UPI or Unified Payments Interface has been one of the major driving factors in recent years of India’s economy.

As per reports in 2021, India accounted for 40 per cent of the total digital transactions globally.

UPI has made it easy and universal to go cashless anywhere with just a smartphone and a mobile number linked to their bank accounts.

UPI transactions can be made through credit and debit cards via QR code scanning, or through single-click app transfer. One can easily link their cards to the in-house UPI app, Bharat Interface for Money (BHIM).

Link your credit card to BHIM UPI app

- Set up your BHIM UPI account with the registered bank account linked mobile number.

- Set up a 4-digit passcode (in order to secure all your transactions).

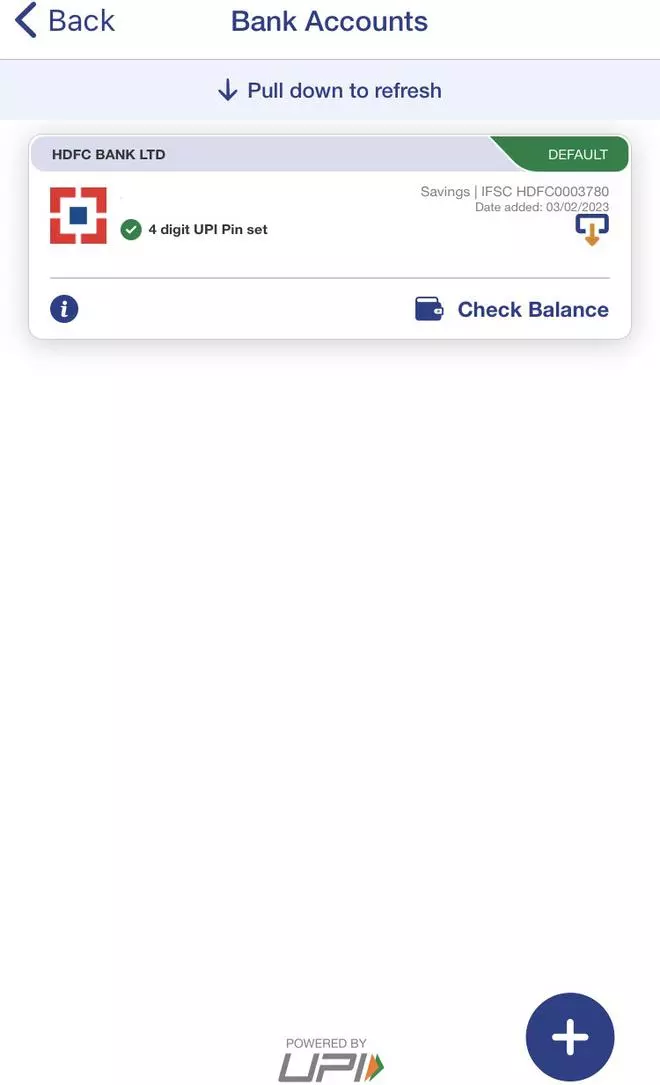

- Launch the BHIM UPI app, and tap on the ‘Bank Account’ at the top left of the page.

- Tap on the + icon at the bottom-right corner of the page.

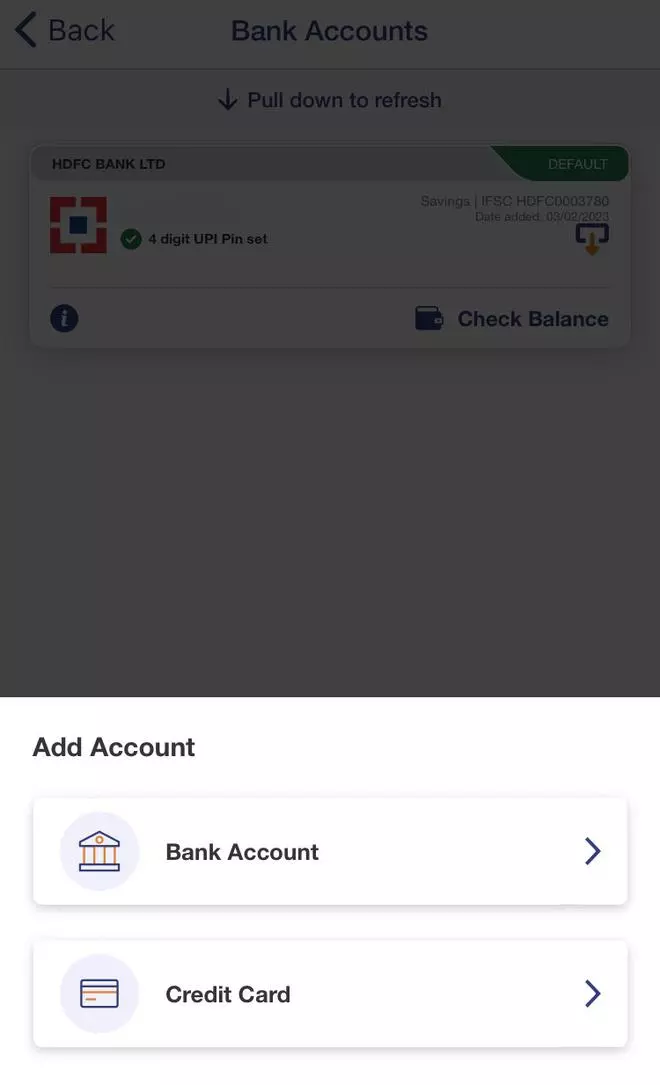

- Select ‘Credit Card’ option to add.

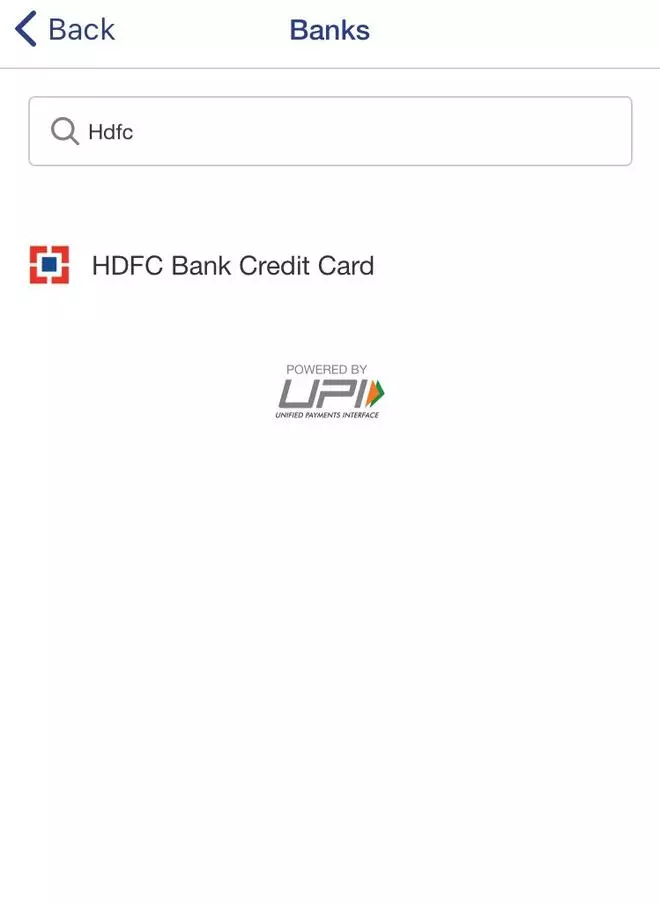

- Continue to type the preferred credit card bank account, and follow the rest of the steps.

- Finally, one will receive an OTP on the linked number, continue with the verification. With the next step, you are all set.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.