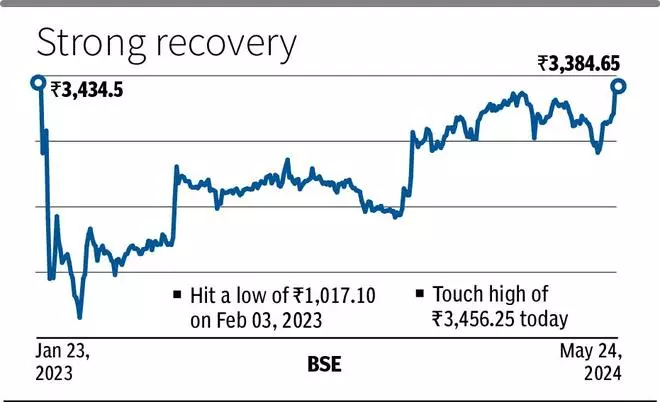

Adani Enterprises’ shares have reclaimed the levels seen in January last year, prior to the damaging allegations levelled by short-seller hedge fund Hindenburg Research against the group triggering a sell-off in group stocks that wiped off billions of dollars of investor wealth.

- Also read: Adani Ports & SEZ to replace Wipro in Sensex

On Friday, Adani Enterprises stock rose 2.1 per cent to an intra-day high of ₹3,457.85 on the NSE, overhauling the closing price of ₹3,442 on January 24, 2023, a day before the Hindenburg report came out. It fell to a low of ₹1,194.20 on February 27. Since then, the stock has nearly trebled.

Though the shares ended flat with a negative bias at ₹3381, the stock has appreciated over 22 per cent in the last 11 trading sessions, with an unbroken 5-day rally in between till Thursday, when it rose 8.3 per cent. Sentiment in the stock got a boost with the prospect of it being included in the BSE’s Sensex which is expected to fetch inflows of $118 million in the stock from passive index funds.

Shares of Adani Ports, Adani Total Gas and Adani Power have already crossed their pre-Hindenburg levels, but those of Adani Green Energy, Adani Energy Solutions and Adani Wilmar still have to get back to those levels. On Thursday, the total market capitalisation of the group was at ₹17.23 trillion ($207.6 billion), but still about $22 billion short of what it was before the Hindenburg report.

Along the way, the company and others in the group have been helped by periodic infusions of funds by Rajiv Jain’s boutique investment firm GQG Partners, supplemented by contributions from sovereign funds of UAE and Qatar.

GQG Partners’ investments in the Adani group have appreciated around 150 per cent in little more than a year.

Adani Enterprises, the Gautam Adani flagship, is the chief incubator of new enterprises in the conglomerate. Its board is scheduled to meet on May 27 to consider a proposal to raise funds through the issue of equity or other eligible securities. In February 2023, a follow-on public offer to raise ₹20,000 crore had to be abandoned in the aftermath of the allegations.

According to media reports, the company is planning to raise around $1 billion to fund its airports and new energy businesses.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.