The Adani group is back again drumming up support for its fund-raising plans, but it is on a firmer footing with group companies, that have already reported quarterly and annual results, showing robust performance and growth. Sources indicated that both foreign and Indian institutions have been meeting Adani group officials, interested in investing in the companies.

Another significant development is that Indian banks have also expressed their willingness to increase their exposure to the Adani group. Adani Enterprises and Adani Transmission are planning to raise a combined ₹21,000 crore through qualified institutional placements. People aware of developments, said that domestic mutual funds and even private equity firms have been sending out feelers in recent weeks to participate in the issuance. The placements are expected to take place later in the year after shareholder approval is obtained in June. The group is also waiting for the probe by the Securities and Exchange Board of India (SEBI) to be completed and the initial report to be tabled in August.

At Jefferies India Forum on Thursday, in which several Adani group companies were present , officials are understood to have highlighted the group’s performance and the way forward. After GQG Partners Rajiv Jain recently spoke about increasing his company’s stake in the group, investor interest has increased, sources said.

How group companies performed

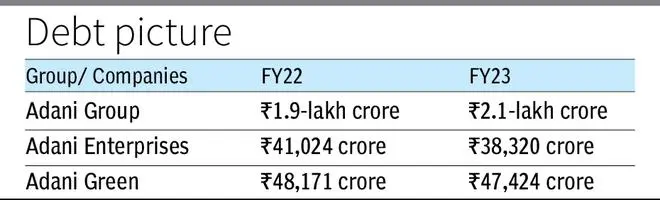

The group’s gross debt as a whole is estimated to have come down to about $21 billion at the end of March, a reduction of $1.6 billion from December-end and net debt at $25 billion.

Adani Enterprises, the flagship and the incubator of new businesses ended FY23 on a high note with a consolidated net profit of ₹2,473 crore versus ₹777 crore a year ago on revenue of ₹1.37 lakh crore compared with ₹69,420 crore a year ago, with all its segments performing well. Its gross debt fell 6.6 per cent on year to ₹38,320 crore at the end of the year. The promoter group’s debt also fell 15.6 per cent year-on-year to ₹10,544 crore.

Another major company in the group, Adani Green Energy saw a 72 per cent rise in net profit at ₹3,192 crore while revenue rose 54 per cent to ₹5,825 crore. The company reduced its gross debt to ₹47,424 crore at the end of March from ₹48,171 crore, year ago. During the year, it had repaid ₹3,850 crore in debt through money received from IHC and internal accruals.

Two other group companies Adani Ports and Special Economic Zone and Adani Transmission are yet to announce results but the operational performance of both companies have been good.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.