The stock of Amara Raja Batteries jumped nearly 18 per cent post results, after the company’s strong Q2 show.

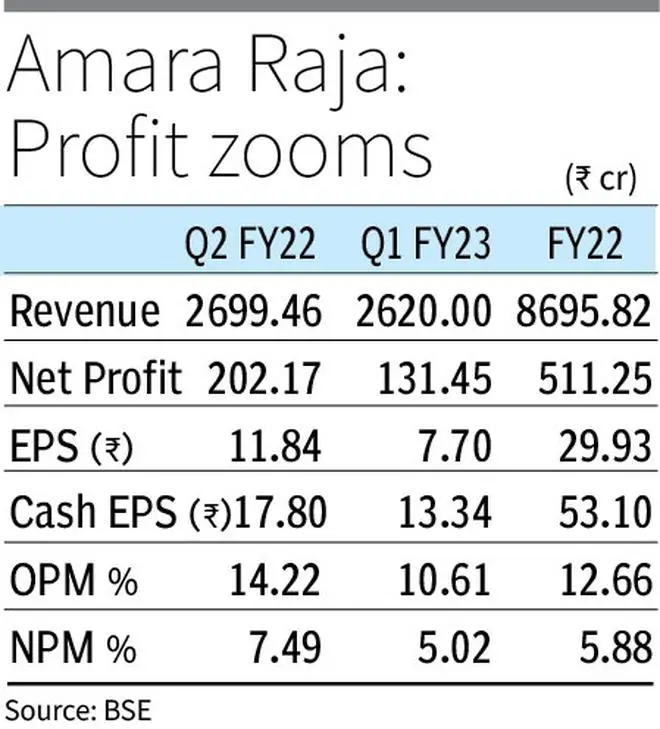

The Andhra Pradesh-based firm said that its consolidated net profit jumped 39 per cent to ₹201.22 crore for the September quarter, against ₹144.32 crore in the year-ago quarter. Amara Raja said its consolidated revenue from operations stood at ₹2,700.47 crore (₹2,264.15 crore).

While the Street celebrates the stock post earnings, analysts give a mixed view.

The stock on Wednesday closed at ₹615.20, up 2.31 per cent, on the BSE, over the previous day’s close. On November 3 (ahead of results), the shares of the company were hovering around ₹520.

Competition to hurt

Motilal Oswal Financial, which reiterated its Neutral rating with a target price of ₹590 (12x September 2024E EPS), said the expectation of better earnings growth balances out the increasing threat of lithium chemistry to the Auto and Industrial businesses.

Amara Raja’s Q2-FY23 earnings were led by softening of raw material costs coupled with volume growth across segments, it said. “The recent moderation in lead prices will aid margin recovery. Volumes should see an upward trajectory in both automotive and industrial segment,” added Motilal Oswal.

Lithium project

However, Geojit Financial said investment for technological upgradation in the lithium ion project for two-wheeler/three-wheeler batteries are progressing as per schedule and have started supplying lithium battery pack to three-wheeler applications. “We believe, respite in the lead price to limit margin dilution and which is expected to expand from current level, owing to pick up in the auto sector.”

The company’s strategy to incorporate lithium ion project and expansion as a wholly-owned subsidiary would support long-term visibility, Geojit, which maintained its Accumulate rating, said.

Anand Rathi Share and Stock Brokers was the most bullish among domestic brokerages. While reiterating its Buy on the stock, it hiked the target to price to ₹750 from ₹733, as it expects replacement and OEM demand to be robust in the near term.

Key risks

Emkay Global remained cautious on the stock, as it does not see any near-term triggers, while retaining a Hold rating on the stock with a target price of ₹550.

Key downside risks, according to Emkay Global, are lower-than-expected demand in key geographies, increased competitive intensity, and adverse movement in commodity prices/currency rates.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.