Broking stocks have been on the rise at the bourses in the last couple of years, thanks to strong financial performance on the back of heavy participation by retail investors. Analysts said the Covid-19 lockdown brought hordes of investors into the equity market and pushed up trading activity. Even after normalcy returned, tradingremains robust, boosting the performance of broking companies.

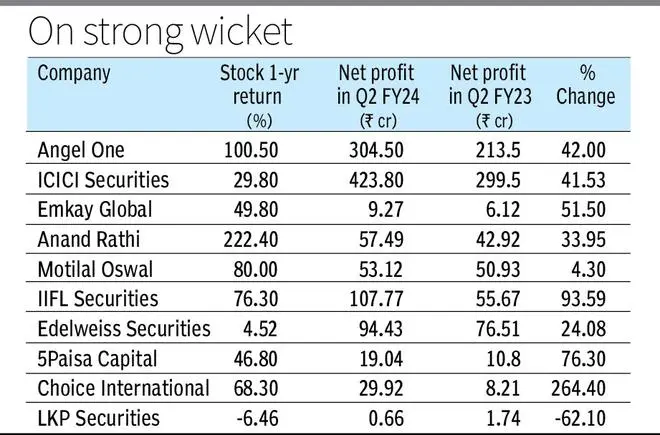

A quick glance at some of the listed brokerages including Angel One, 5paisa Capital, ICICI Securities, Motilal Oswal Financial Services, Geojit Financial Services and Choice International is proof. Sample this: Angel One, which closed at ₹1,598.5 on November 15, 2022, went up 90 per cent to ₹3,042.15 exactly a year later. Similarly, Motilal Oswal Financial Services was up over 77 per cent and ICICI Securities was up 21 per cent during the same timeframe.

“The growth of retail participation has played a significant role in raising the value of listed brokerages and that is reflected in their stock price,” said Bhavik Patel, Sr Research Analyst, Tradebulls Securities.

Demat accounts surge

“The growth in the number of demat accounts, which is set to grow further in the future, is positive for the brokerage industry as it can encash the ongoing opportunities; the brokerage companies can increasingly give services to more clients because of technological advancements,” Vamsi Krishna, CEO, Stoxbox, told businessline.

According to him, the relentless rally in the broader market is catching the investor attention. “With strong investor interest, the funds coming into the market from retail investors, primarily through SIPs, have now started to make an impact.”

With more than 13.22 crore demat accounts as of October 2023, the most in the last 11 months, the growth of retail participants has resulted in not just a strong market rally, but also stellar listings of initial public offerings.

Robust Q2 performance

In fact, during Q2 of FY24, listed brokers experienced several favourable conditions, said Dharmendra Lohar - Head Retail Strategy, m.Stock By Mirae Asset Capital Market. These included indices reaching an all-time high in September 2023, elevated volumes, particularly in high-yield equities, augmented new client acquisition, increased NSE active clients, a flourishing MTF book, and a surge in IPO issuances compared with September 2022.

“Traditional and bank brokers have benefited significantly as their revenue mix is skewed toward equity products, leading to improved yield and brokerage revenue,” he said.

Krishna of StoxBox said, “With the number of demat accounts opened post-Covid increasing substantially, there has been an increase in retail investor interest in the F&O segment, which we believe has helped the brokerage houses generate significant turnover in the last few years.” For instance, Angel One reported a 42 per cent jump in profits during the quarter to ₹304.5 crore on the back of a 29 per cent growth in total income. The listed broker also reported its highest-ever client addition (60 per cent quarter on quarter) in a quarter at 2.1 million.

Emkay Global Financial Services, another listed brokerage, reported a 51.5 per cent increase in profits to ₹9.27 crore (₹6.12 crore), driven by a 25 per cent growth in revenues from operations.

With inflation under control and interest rates peaking, Krishna believes the domestic market will remain stable in the medium term. “However, the markets may experience a pinch of volatility due to the State elections this year and the general election next year.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.