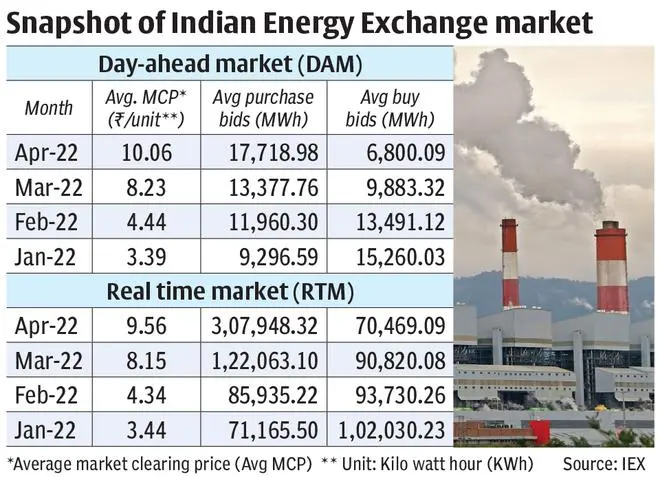

The average market clearing price (MCP) in the real time (RTM) and day-ahead markets (DAM) has skyrocketed by almost 200 per cent, or nearly three times, between January and April this year to ₹9.56 per unit and ₹10.06 a unit, respectively.

The high spot prices in the country’s largest energy exchange IEX are not only a record high, but also reflective of the growing power demand amid low coal supplies forcing States to buy electricity even at high rates.

Experts attributed the surging prices to idle imported coal-based (ICB) and gas-based power plants due to high global prices of the two commodities. Besides, with ICB plants dependent on domestic coal, the supply lines are stretched further increasing pressure on plants to secure coal. DAM and RTM account for a majority of the trade on IEX.

Surging spot prices

During April, the average MCP in the DAM grew by 197 per cent compared to ₹3.39 a unit in January 2022. On a month-on-month (M-o-M) basis, the MCP rose 22 per cent from ₹8.23 a unit in March 2022. Compared to April 2021, the prices are up by 172 per cent.

For perspective, the MCP during March 2022 was the highest in over two years, even higher than the MCP in October 2021 (₹8.01 a unit), when India faced a major electricity crisis with States facing hours of power cuts.

Related Stories

Why wind developers are surrendering capacities won in auctions

Ultra-low tariffs are cited as the prime reasonSimilarly, the average MCP in the RTM grew by 178 per cent in April 2022 from ₹3.44 a unit. On a M-o-M basis, the MCP rose by 17 per cent from ₹8.15 a unit. On an annual basis, prices were up 173 per cent from April last year.

On high prices, IEX said, “The power supply side constraints reflected across the market segments on the exchange. In the day-ahead and real-time market combined, the total buy bids at 21,996 million units (MU) almost 3X of the sell bids at 7,010 MU while the cleared volume was at 5818 MU.”

Growing power demand

Power demand has been growing consistently since January this year. The consumption surged further due to earlier-than-expected summers accompanied by heat waves in several parts of the country. However, so far in May, the power demand has come down following rains which cooled down the mercury from a record 46 degrees.

For perspective, energy consumption rose by 2.43 per cent Y-o-Y to 112.67 billion units (BU) in January 2022, while the national peak demand at 192.07 gigawatts (GW) was up 1.09 per cent from January 2021.

Compared to January, the energy consumption in April grew by 11 per cent Y-o-Y to 133 BU. The national peak demand met during the day was at an all time high of 207.11 gigawatts (GW), up 13 per cent on an annual basis.

Energy consumption between January and April 2022 was higher by 18 per cent.

Stretched coal supplies

As on May 3, domestic coal-based (DCB) power plants had reserve stocks for 7.9 days and ICB plants for 7.2 days. The actual stocks at 147 non-pithead plants was 25 per cent of their normative requirement. Also 87 DCB plants and 11 ICB plants have stocks lower than 25 per cent of their normative requirement.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.