There is a rush among the foreign portfolio investors (FPIs) to unwind bearish bets on India’s stock market since they were caught on the wrong foot. Up to last Friday, the latest available derivative data show the FPIs had cut their short positions in the index segment, consisting mainly of Nifty and Bank Nifty, by more than 30,000 contracts.

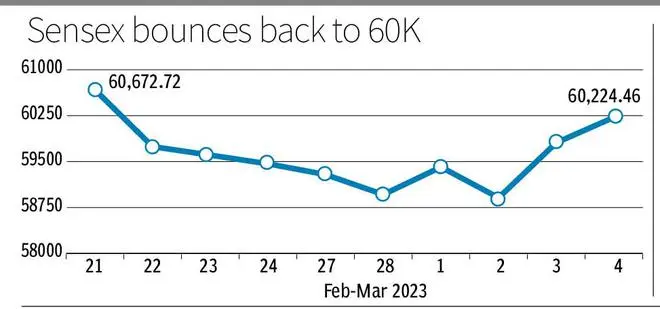

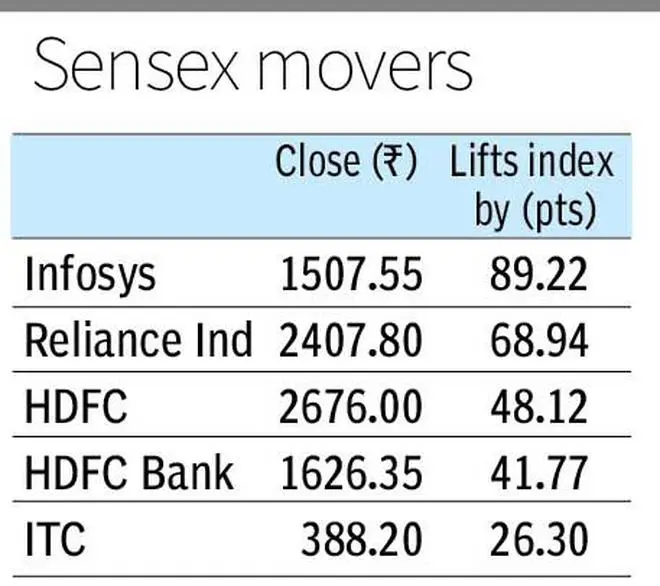

On Monday, FPIs were again on a spree to cut their short bets, analysts said. Sensex gained 0.69 per cent or 415 points to close at 60,224. The index has seen more than 1,200 points rally since February 27. The Nifty index rose by 117 points or 0.67 per cent at 17,711.

In the coming days, markets will be looking at the commentary from the US Federal Reserve for further cues, analysts said.

On March 2, FPI short positions in index futures had crossed 1,31,000 — the highest since June 2022. On March 3, the same declined to 88,000 contracts. The positions were cut further, which will be reflected in the data on Tuesday, analysts said. In just five trading sessions of March so far, FPIs bought shares worth ₹13,313 crore in the cash segment. In the index futures segment, FPIs were net buyers for ₹4,044 crore up to last Friday. In the stock futures segment, FPIs were net buyers for ₹870 crore. The domestic institutional investors were net buyers for ₹6,474 crore.

“The short-term trend of Nifty continues to be positive. Having placed at the crucial overhead resistance of 17,800 levels, there is a possibility of further consolidation or minor downward correction in the short-term, before showing further up move. Immediate support is placed at 17,600 levels,” said Nagaraj Shetti, Technical Research Analyst, HDFC Securities.

Back on the black

Adani Group shares witnessed a rally for the second consecutive day and four Adani group stocks hit the upper circuit price band on Monday. Adani Enterprises closed in 1982 with gains of 5.5 percent. Adani Power, Adani Transmission, Adani Green Energy and Adani Total Gas were locked in 5 percent upper circuit. Adani Ports, ACC and Ambuja, the group’s port and cement companies, gained between 0.9 percent to 2 percent.

Friday’s gains in the US markets were also a reason for the improvement in market sentiment. All the benchmark equity indices in the US markets gained between 1.5 and 2.5 per cent on Friday.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.