Overseas investors were net sellers of India’s banking and financial services sector in eight out of 12 months in the previous calendar year pulling out ₹55,415 crore in net investments. While the outflow saw foreign portfolio investors’ (FPIs) stake in large private banks come down, they increased their stake in small private lenders during this period.

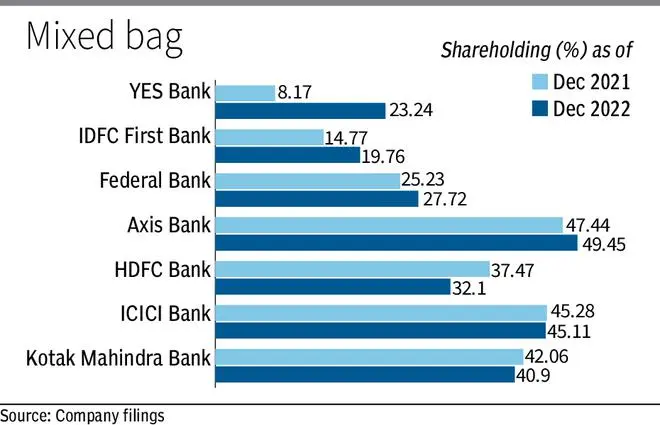

As per latest shareholding data, FPI stake in Yes bank saw the highest increase on a year-on-year (y-o-y) basis as of December. From 8.17 per cent in December 2021, FPI holding in Yes Bank went upto to 23.24 per cent as of December 2022. The spike in holding in Yes Bank is on account of private equity majors Carlyle and Advent picking up 9.99 per cent stake in Yes Bank for about ₹8,896 crore.

In December, Yes Bank announced that it has allotted a total of 369.61 crore shares of face value ₹2 each and 255.97 share warrants convertible into equity shares of face value ₹2 each on a preferential basis to CA Basque Investments, a Carlyle Group entity, and Verventa Holdings Ltd , an Advent group entity.

FPIs also increased their stake in IDFC First Bank to 19.76 per cent as of December 2022 from 14.77 per cent at the end of the same quarter in 2021. Foreign investor’s stake in Federal bank also went up by 2 per cent during this period.

“There is some kind of revival in the mid and small cap banks and that is why FPIs are increasing their position in these stocks,” said Kranthi Bathini, Director, Equity Strategy, WealthMills Securities.

Large private banks

On the other hand, FPI’s stake in large private banks remained unchanged or reduced. HDFC Bank saw 5 per cent decline in FPI holding on a y-o-y basis as of December 2022. Foreign investor holdings in the bank fell to 32.1 per cent (37.47 per cent) during this period.

Foreign investors reduced their stake by one per cent in Kotak Mahindra Bank while their holding in ICICI Bank remained unchanged at 45 per cent. In Axis Bank, they increased their stake by 200 basis points to 49.45 per cent.

Bathini attributes the FPI stake reduction in HDFC Bank to the merger overhang of the bank with the Housing Development Finance Corporation (HDFC Ltd). He, however, added that the combined entity will see more allocation by foreign investors since the weightage of HDFC Bank will increase sharply in the MSCI global index post the merger.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.