Foreign portfolio investors (FPIs) returned to stock markets with a bang in August. After a selling spree worth more than $33 billion in nine months, between October 2021 and June 2022, FPIs have made net purchases in stocks and bonds worth around $5.5 billion in the past three to four weeks, a majority of the money coming in during August.

Although this buying led the Nifty and Sensex to recover nearly 18 per cent from the lows of 2022 and even aided the rupee in recovering from its lifetime low, experts have now advised caution in investments and trading as there could be a little upside from the current levels.

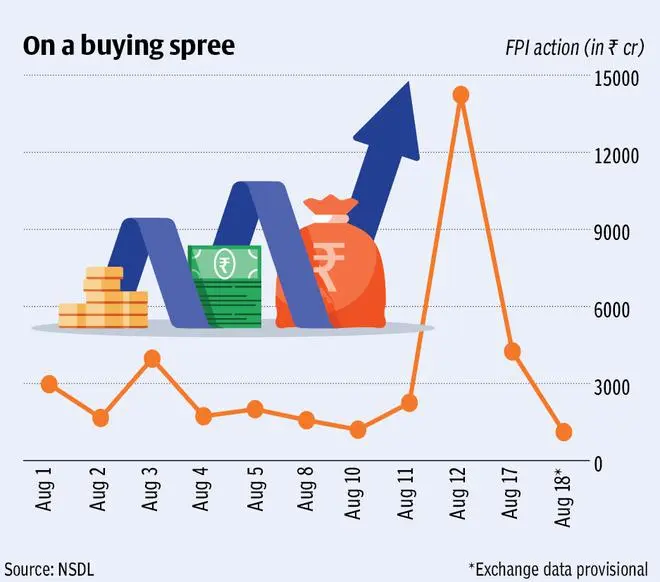

In August alone, the FPI buying in Indian markets stood at ₹44,500 crore, including the primary market purchases. They bought equities worth ₹44,481 crore between August 1 and 19, showed data from National Securities Depository Limited (NSDL). This is the highest buying so far this year. In July, the figure stood at ₹4,989 crore, of which only ₹1,674 crore was invested in the debt market.

Will the rally continue?

Equity markets got support in the wake of falling global crude and other commodity prices. But, experts believe the rally has gone on far too long amid the tight monetary slowdown in the US and Europe. According to Rishi Kohli, Managing Partner & CIO Hedge Fund Strategies at InCred Alternatives, there are a lot of local and global factors lining up for potential market declines and volatility over the next few weeks.

“Derivatives data suggest that FPIs once again started selling in cash and single stock futures in the past two trading sessions. A slew of other technical data points indicate the markets could reverse. Bearish engulfing candle was formed on the Nifty and Bank Nifty technical charts on Friday. This similar formation in the past has mostly led to 10-15 per cent corrections and this time since it happened at the critical trendline resistance, it is time to be cautious in the near future. Also, India’s market cap as a percentage of world market cap is near its peak last seen in 2010 — so that is another sort of resistance,” said Kohli.

What to watch for

In the coming days, markets will be focused on the Jackson Hole economic symposium where the Federal Reserve Chairman Jerome Powell will be speaking on August 25.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.