Indian markets have outperformed the world by falling much less in the past couple of months but that has not stopped foreign portfolio investors (FPIs) from withdrawing funds as the rupee saw a sharp slide against the dollar.

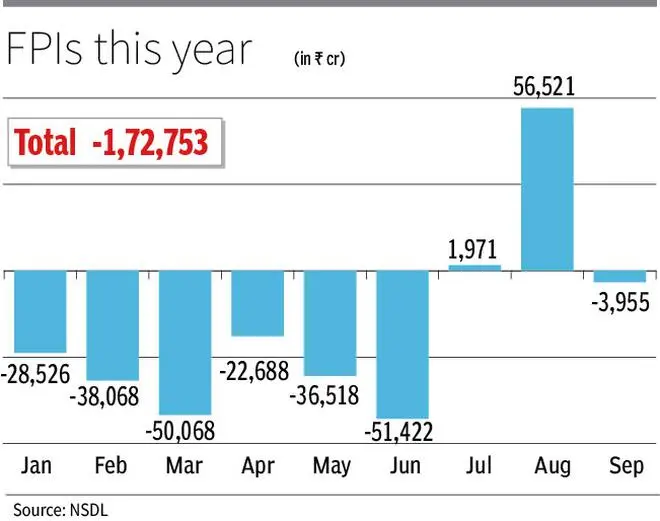

After infusing funds in August, FPIs turned net sellers again in September. According to exchange figures, FPIs net sold stocks worth ₹18,303 crore in the cash markets alone. On a net basis, which includes all buy and sell of equities, derivatives and debt, the FPIs were sellers to the tune of ₹7,600 crore. FPI outflows in India touched ₹1.68-lakh crore in 2022 so far, show data.

Cash market selling by FPIs in September was the highest since June when they had sold stocks worth ₹58,112 crore, according to exchange figures. While FPIs were net sellers in cash markets, domestic institutional investors made net purchases of stocks worth ₹14,119 crore, show data.

Fall from the peak

On Monday, the traders would be eying moves in the US stock futures. The markets are likely to open lower on Monday since Dow Jones, S&P and Nasdaq had closed with declines of around 1.7 per cent on Friday. The US markets are down by around 18-22 per cent from their life-time highs compared to Sensex and Nifty that have fallen less than 8 per cent from the peak.

In September alone, the benchmark indices have fallen nearly 6.6 per cent. Nifty fell to around 16,800 from the highs of around 18,000 during the month as market sentiments remained bearish due to the US Federal Reserve’s aggressive stance on the interest rates. In September, the Fed hiked interest rates by 0.75 per cent and has a roadmap to take the rates to around 5 per cent by December. In India, the swift decline in rupee has forced the Reserve Bank of India to embark on an aggressive rate hike mode, experts said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.