A string of concerning developments in the US banking sector this week has rattled the global financial markets.

On Friday, fears of contagion spread like wildfire weighing on stock market sentiments from Japan to Australia, India and Europe leading to a global sell-off in the banking sector. This was after US equity benchmark’s cracked on Thursday on the news of huge losses to Silicon Valley Bank (SVB), a prominent lender to US tech companies.

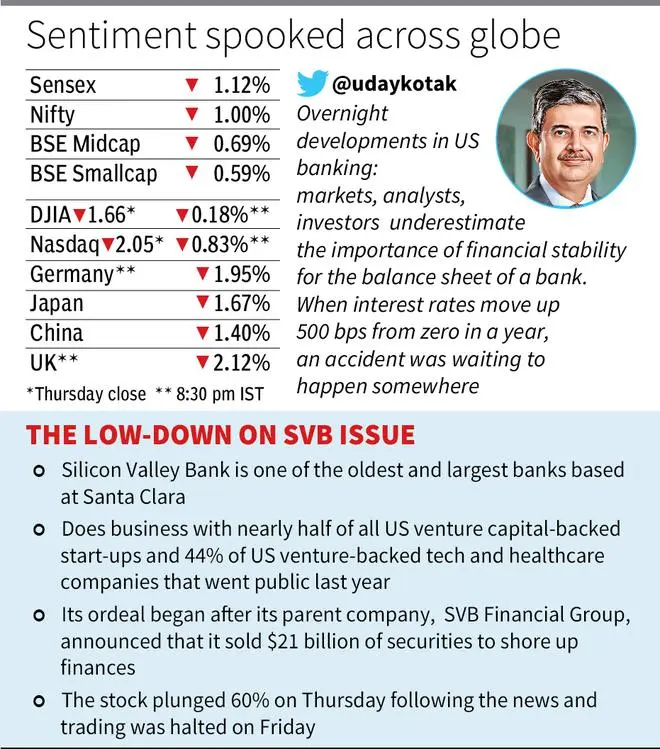

Following the sharp decline in the US markets, India’s Sensex and Nifty were trading more than 1.5 per cent lower on Friday. On the closing, Nifty was down 176 points or 1 per cent at 17,412. Bank Nifty index fell by 1.87 per cent or 771 points at 40,485. The Sensex declined by 671 points or 1.12 per cent at 59,135. HDFC Bank, Bank of Baroda, IndusInd Bank, SBI and Axis Bank fell between 2 per cent and 2.61 per cent.

SVB crisis

SVB is the biggest bank in Silicon Valley but got hit by high deposit outflows at the bank due to a broader downturn in the tech startup industry. After liquidating $21 billion securities portfolio, SVB announced a hasty $2.25 billion fundraising to shore up its finances in the wake of $1.8 billion loss on bonds.

Moody’s immediately downgraded the bank’s credit rating to Baa1 negative outlook from A3.

Panic started in the US since Tuesday after KeyCorp, which sells retail and commercial loans through subsidiaries, warned of elevated risks due to tightening US interest rates and lowered its full year guidance. This was followed by crypto focused bank Silvergate announcing liquidation due to the collapse of crypto exchange FTX in the US. SVB’s fund raising news on Friday was the final nail for market sentiments.

Read also: Silicon Valley Bank races to prevent bank run as Funds advise pulling out cash

“This is certainly not 2008 crisis. There is no dearth of money in the system and massive fund raising by Adani group is a prime example. More, the large US banks and even Indian banks are all well capitalised. When an ecosystem collapses, like the crypto, start-ups and PEs, some casualties are bound to happen. The meltdown could be in its final leg and collateral damage has hit market sentiments. But this will not last long. We may be closer to a panic bottom in the markets,” said Deven Choksey, MD, KR Choksey Holdings.

FPIs on selling spree

On Friday, India’s market saw largest single day selling by the foreign portfolio investors (FPIs) in the cash segment so far in March on Friday. Data showed FPIs were net sellers for stocks worth ₹2,061 crore in cash market. FPI selling in the stock futures stood at ₹2,400 crore and ₹1,603 crore in the index futures segment. FPI short positions in the index futures segment rose to more than 100,000 contracts compared to 88,000 contracts on Wednesday. Domestic institutions were net buyers for ₹1,350 crore on Friday.

Uday Kotak, Chairman of Kotak Mahindra Bank wrote in a Tweet: “Overnight developments in US banking: markets, analysts, investors underestimate the importance of financial stability for the balance sheet of a bank. When interest rates moved up 500 bps from zero in a year, an accident was waiting to happen somewhere.”

Investors will be looking for commentary from the US Federal Reserve chief in the coming days since he has been maintaining his hawkish stance for more than a year now. Fed chief Powell, in his latest testimony at the Capitol Hill, had said that the March rate hike decision would be based on totality of data.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.