IPO volumes are seen doubling in 2024 from last year with a significant uptick in the average deal size, with $12-13 billion being raised in the primary equity markets, according to V Jayasankar, Managing Director of Kotak Investment Banking.

Talking to the media, he said that large companies in sectors such as manufacturing, healthcare, financial institutions group, consumer and digital are evaluating primary issuances that can hit the market in the current year. Other sectors that are likely to see IPO launches are electric mobility, fintech and consumer technology. The average deal size would also be higher at over $200 million, again doubling from the average deal size of $109.5 million seen last year.

Jayasankar said that overall activity in the equity capital market will be more buoyant compared to last year and forecast inflows of $50 billion. This supply should be met by at least $40 billion worth of fresh paper issuances by Indian companies. “Supply of money will be fairly strong. There is a huge runway of growth for the equity capital markets,” he said.

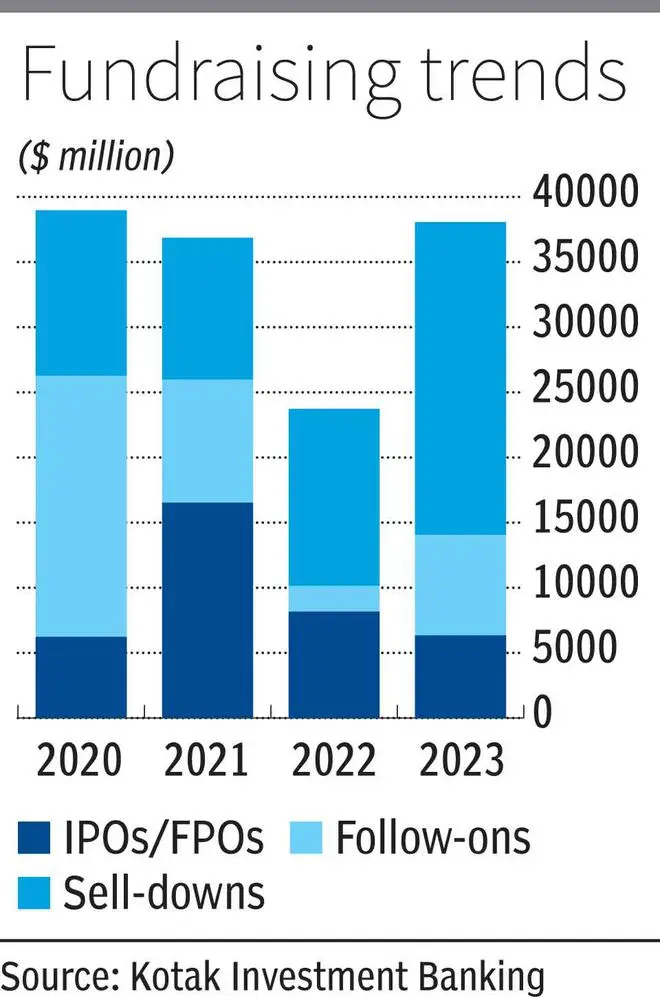

Flows from domestic institutions, contributing around half of the total, should be stable and those from foreign institutions could be a little volatile due to macro factors in their home countries. Overall capital market activity in India in 2023 stood at $38 billion, with a moderation in IPO volumes.

Sell-down momentum to continue

Sell-down activity, where both private equity firms and promoters took the opportunity to exit or sell stakes, peaked last year at $24 billion as equity valuations in the public markets surged. Jayasankar said that the momentum will continue in 2024 as well with PEs and venture funds exiting on the back of strong institutional flows. “Sell-downs rose dramatically in 2023,” said Jayasankar, adding that block deals business will continue to be a mainstay for exits as sell-down activity will keep up its tempo.

The jump in equity markets last year made exits through the public markets more attractive for investors rather than resorting to strategic exits through private deals.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.