Mutual fund schemes investing overseas have turned out to be the biggest wealth destructor leading to an erosion of 21-40 per cent of investors’ wealth from their peak and 24-38 per cent in last one year.

With easy money fast disappearing, global markets are crashing on concerns over economic growth, leaving investors in the lurch. Brave-heart investors, who want to average out their investments by buying more into these funds at a lower valuation, could not even attempt it as the Association of Mutual Funds in India has capped individual mutual funds investment limit at February level.

Funds lose heavily

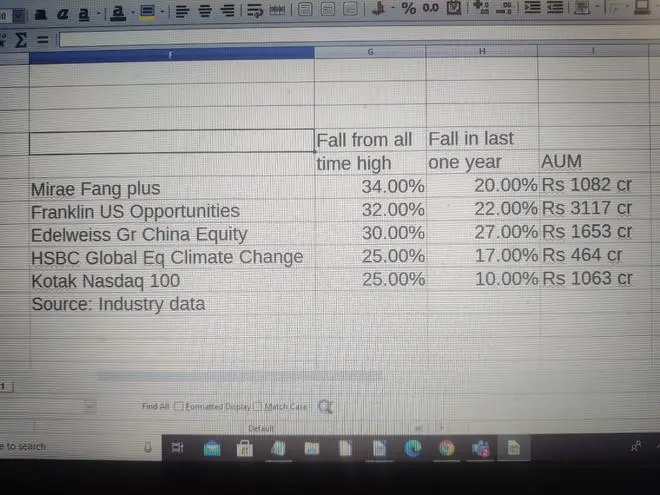

Invesco Global Consumer Trends and PGIM Emerging Market Equity have crashed 42 per cent and 34 per cent in the last one year. Both these funds have assets under management (AUM) of ₹463 crore and ₹150 crore as of Monday.

Edelweiss US Technology Equity, with AUM of ₹1,582 crore, was down 25 per cent, while Kotak Global Innovation Fund dipped 35 per cent in the last one year.

The S&P 500 fell four per cent to 3,750 points on Monday, marking its lowest level since last March and bringing its losses since January to over 22 per cent.

The Dow Jones Industrial Average dropped 876.05 points, or three per cent to settle at 30,517, about 17 per cent off its record-high. The Nasdaq Composite tumbled 5 per cent to close at 10,809, recording a loss of over 33 per cent from its peak.

The way forward

Pankaj Shreshta, Head - Investment Advisory Division, Prabhudas Lilladher, said volatility is part of equity investments and in the current scenario investors should consider staggered equity investment over the next six-nine months.

The RBI and SEBI should consider increasing the overall global investment cap of mutual fund industry as global markets such as US equity market has corrected significantly and mutual fund investors should have the opportunity to buy or average their US equity investments at a lower price, he said.

Atanuu Agarrwal, co-founder, Upside AI, said since the option to invest in the US through mutual fund is not available due to threshold limits, investors would be better-placed buying into an index ETF or a professionally-managed fund through the LRS route.

Dr Esha Khanna, Assistant Professor, NMIMS Sarla Anil Modi School of Economics, said the US Federal Reserve could take a more hawkish tone on June 15 amid rising inflation numbers and given that the dollar being a safer haven, diversification of stocks will provide an opportunity of steady risk-adjusted returns in the long term.

Though the RBI has massive foreign exchange reserves, it may stick to the current investment limit of MF due to the depreciating rupee and current volatility, said Khanna.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.