Small and mid-cap shares saw a sharp selloff on Tuesday, amid signs of a froth building up in the space. The BSE SmallCap crashed 1,550.66 or 4 per cent at 36,982.74 and the BSE MidCap slumped 980 points or 2.96 per cent at 32,084.93.

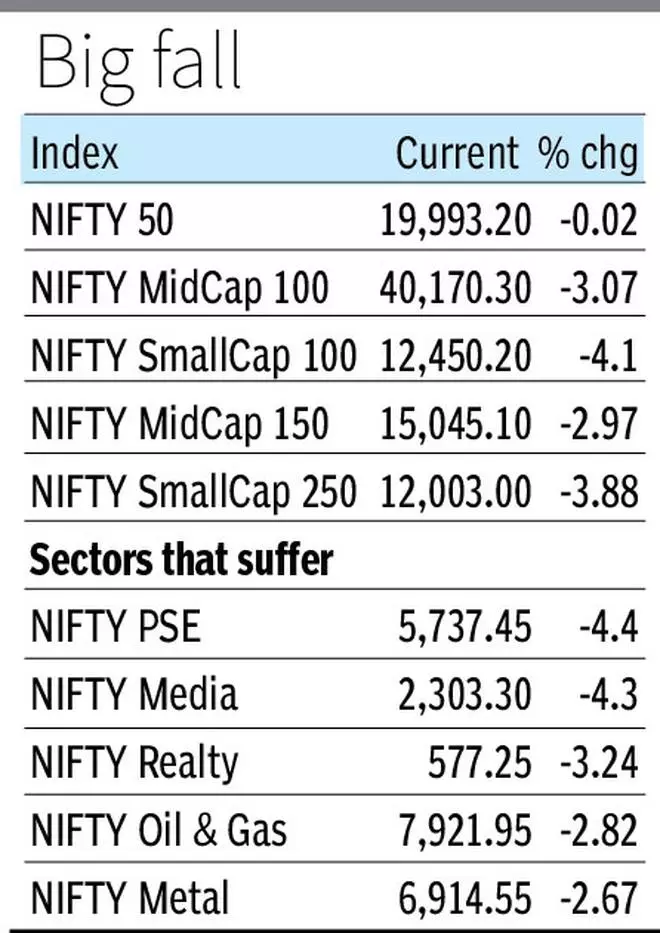

Nifty Midcap 100 and Nifty Smallcap 100 fell 3.1 per cent and 4.1 per cent, while the Nifty Smallcap 250 posted its biggest single day fall this year, slipping 3.9 per cent. On the other hand, the NSE Nifty and BSE Sensex closed flat.

The indices have been showing strength in the past few sessions hitting fresh highs, backed by rising volumes indicating broader market participation. Nifty Midcap 100 and Nifty Smallcap 100 have gained 6.2 per cent and 6 per cent, respectively in the past month.

“Three to four days of 1000-point correction on the Nifty Midcap 100 Index will go a long way in clearing out the froth and pushing out punters who don’t know what and why they are buying and just riding the momentum,” Sandip Sabharwal, a former fund manager, said in a post on X.

Shift of focus

Market pundits expect the focus to shift from mid- and small-caps to large-caps in the near term, as investors turn cautious on the broader market. According to a recent report by Motilal Oswal Financial Services, Nifty 50 (19.6) and Nifty Midcap 100 (23.7) indices were trading at a premium, while the Nifty Smallcap 100 index (15.2) was trading at a discount to the long-period average on a 12-month forward P/E basis.

Kotak Institutional Investors on Monday had dropped recommendation on the mid-cap space, saying it could not see too many options beyond the BFSI space that offered decent potential upside from their fair value.

“There is no meaningful change in the fundamentals of most companies; in fact, they have worsened in many cases. The primary driver of the rally appears to be irrational exuberance among investors, with high return expectations (and purchase decisions) being driven by the high returns of the past few months,” the report said.

ICICI Securities expects the broader market to continue with its relative outperformance amid overbought conditions. “Although, in the short-term index may undergo breather after sharp rally, small cap space is expected to relatively outperform over next couple of quarters,” the brokerage said.

Shares of public sector enterprises were among the major losers on Tuesday, with the Nifty PSE index slipping 4.4 per cent. Some of the top PSE losers include BHEL (10.1 per cent), REC (8.2 per cent), Power Finance (7.6 per cent), NHPC (7.3 per cent) and Bharat Electronics (7.3 per cent).

Asian markets were mostly down Tuesday amid lingering concerns about China’s economy. European stocks traded mixed as investors awaited release of US inflation data along with the ECB policy meeting this week.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.