The benchmark indices hit fresh highs on Friday, notching up gains for the seventh straight week amid positive cues on both domestic and global fronts.

The ease in US bond yields and the US Federal Reserve’s dovish commentary on Wednesday hinting at multiple rate cuts next year have fuelled a rally in global stocks. The dollar headed for its biggest weekly drop in five months on Friday.

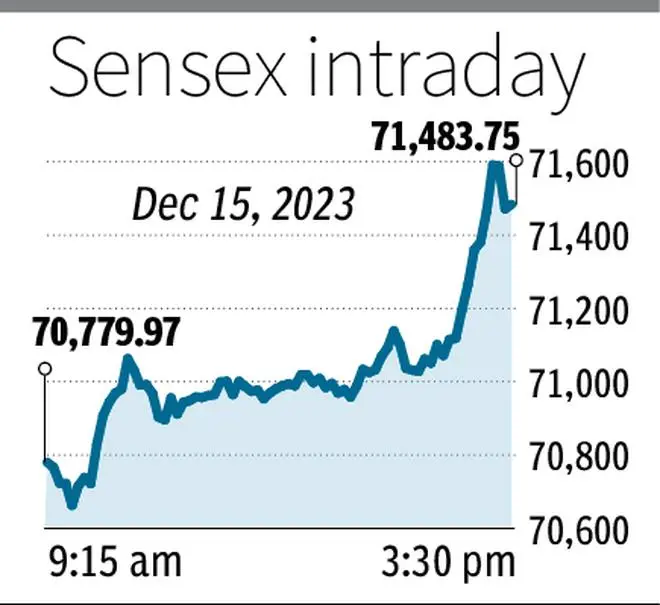

The Sensex nudged past the 71,000 mark to close higher by 969 points, or 1.37 per cent, at 71,483. The Nifty rose 3 per cent to 21,456. The combined market value of all BSE-listed companies surged by ₹2.76-lakh crore on Friday, marking an overall increase of ₹8.55- lakh crore for the week, reaching ₹357.8-lakh crore.

Foreign portfolio investors bought shares worth ₹9,239 crore on Friday, even as domestic institutions sold shares worth ₹3,077 crore, provisional data showed. FPIs have shopped for equities worth over $5 billion this month.

IT stocks

IT stocks continued their outperformance for a second day, with HCL Tech, TCS, and Infosys seeing gains of over 5 per cent each. The IT sector has rallied 7.6 per cent this week on expectations of a rise in demand from the US, optimism about AI-based opportunities, and hope of interest rate cuts next year.

Metal stocks traded higher after China reported mixed economic data and the country’s central bank pumped cash into the money market through reverse repos and the medium-term lending facility. PSU Bank stocks extended gains for the eleventh consecutive trading session.

Also read: Gold rally ₹915 per 10 grams in a week on US Fed rate cut hopes

“Robust domestic industrial production and manufacturing PMI, coupled with the RBI’s positive remarks on India’s GDP forecast, contributed to the bullish trend. Investors expressed confidence that clouds over US economic growth would dissipate in H2CY24, anticipating a soft landing facilitated by normalisation in monetary policy,” said Vinod Nair, Head of Research at Geojit Financial Services.

India’s trade deficit narrowed in November from a record high the previous month as imports fell after demand slowed following the festive season.

‘Santa rally’

“Markets are witnessing a Santa rally globally post the dovish outlook by the US Fed and the fall in the dollar index. This, along with strong FII buying and healthy macros, supported the positivity in Indian markets. Nifty has surged ~3% in the last two days, and we expect this optimism to continue next week on the back of a liquidity-driven rally,” said Siddhartha Khemka, Head of Retail Research, Motilal Oswal Financial Services.

Most Asian indices ended in green on Friday, with the Hang Seng leading the pack with gains of 2.4 per cent. CAC and DAX were also trading in green.

Also read: Will IREDA stock be a redux of IRCTC at the bourses?

Nair expects a near-term consolidation in the market due to elevated valuations, concerns over El Nino, and a slowdown in world GDP.

“Technically, the bulls remain in control. Further upsides are likely once the immediate resistance of 21,492 is taken out. Caution is, however, warranted for the near term, as the 14-day RSI at 84.93 is in overbought territory. 14-week RSI is at 75.87, which implies that it is not extremely overbought and there is scope for more upsides in the intermediate term,” said Subash Gangadharan, Senior Technical and Derivative Analyst, HDFC Securities.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.