The average asset under management of ₹52.89-lakh crore of top five States and Union Territories (UTs) including Maharashtra, New Delhi, Karnataka, Gujarat and West Bengal accounted for 68 per cent of mutual fund industry last month.

However, the share of top-5 States has come down marginally from 69 per cent as new entrants in mutual fund space are making inroads in smaller cities, according toICRA Analytics.

Interestingly, the smaller States and UTs beyond the top 10 States are also witnessing a steady surge in investments into mutual funds.

Top 10 States

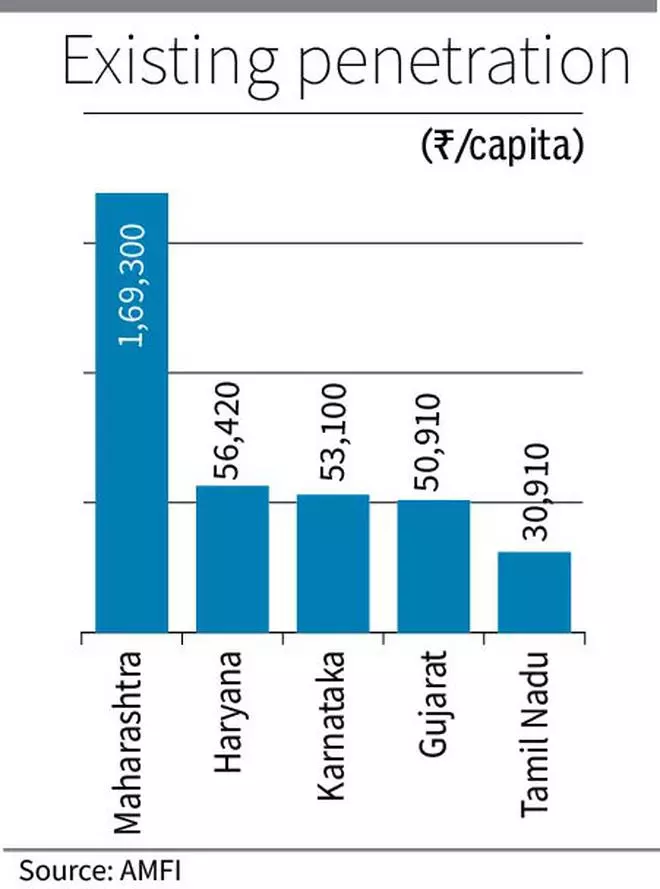

The mutual funds asset in Maharashtra was up 27 per cent last month at ₹21.69-lakh crore against ₹17.14-lakh crore logged in January 2023. The State accounted for 41 per cent of overall average AUM of the industry at ₹52.89-lakh crore last month.

The assets of New Delhi, Karnataka and Gujarat at ₹4.52-lakh crore, ₹3.65-lakh crore and ₹3.61-lakh crore grew 30 per cent each year-on-year, while that of West Bengal at ₹2.74-lakh crore was up 28 per cent.

Interestingly, the top 10 States accounted for nearly 87 per cent of the total average AUM with the remaining States and UTs accounting for around 13 per cent. Among the Top 10, Tamil Nadu witnessed a growth of 34 per cent at ₹2.41-lakh crore; Uttar Pradesh and Rajasthan were up 37 per cent and 38 per cent at ₹2.42-lakh crore and ₹96,619 crore, respectively, while the share of Madhya Pradesh increased by 39 per cent to ₹81,388 crore.

The growth beyond the top 10 States has also been impressive with Pondicherry and Tripura recording 31 per cent and 38 per cent growth at ₹3,193 crore and ₹2,053 crore, respectively, while Manipur witnessed a 4x surge to ₹3,726 crore and that of Lakshadweep was up ten times to ₹169 crore.

Growing retail investors

Ashwini Kumar, Head Market Data, ICRA Analytics, said the surge in asset from smaller States was due to growing interest among retail investors for investing in equities through the mutual fund route and the opening up of branches of asset management companies beyond the top 30 towns.

He emphasized that as the middle class grows, an increasing number of individuals are turning to financial planning, particularly through SIPs, to accumulate savings.

Sanjay Pawar, Managing Director, Smart Financial Planners, said the wealth creation is getting democratised with emergence of many corporates now focusing on regional markets and inflows are increasing despite SEBI withdrawing special incentives given to attract investment from B-30 cities.

The urge for small investors to invest equities always peaks when the markets are its peak, he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.