Call it the slip between the cup and lip. Investors in mutual funds realise less return than the fund in which they invest across all asset classes due to variety of reasons.

The gap could be due to investors’ urge to time the market, stop investment when markets are down, buying a particular fund based on its recent performance and chasing investment fads.

The return gap exists even if the investors diligently follow a SIP approach over the long term. However, following a disciplined SIP approach would lead to the investor return gap being far lesser, according to Morningstar India’s Mind the Gap-India, a study on fund returns versus investors return.

Returns reported by individual funds are time-weighted, meaning they assume a lump-sum investment made at the beginning of the period under review and assumes that it is held till the end of the period.

Investor returns will almost always differ from the reported total returns unless there are no inflows or outflows from the fund in the given period. For instance, if an investor puts ₹1,000 into a specific fund at the beginning of each year and the fund delivers total returns of 10 per cent each in the first two years and negative 10 per cent in the third year, the annualised return of the fund works out to 2.9 per cent. But for the investor, the return is negative 0.4 per cent, because there was less money invested in the fund during the first two years of positive returns and more money exposed to the loss during the third year.

Difference in returns

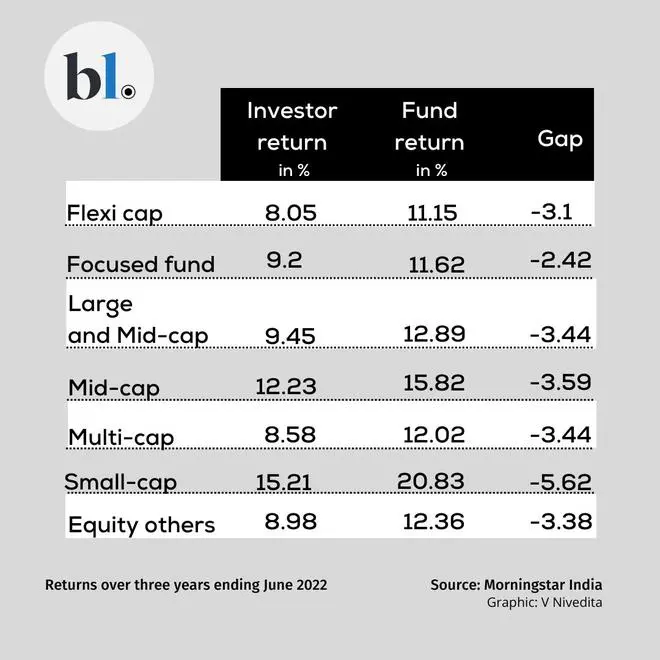

Kaustubh Belapurkar, Director, Morningstar India, said investors earned about 7.8 per cent, 6.3 per cent and 6.5 per cent per year from mutual funds across categories over the last three, five and 10 years ended June 30. However, funds registered a return of 10.47 per cent, 8.79 per cent and 12.33 per cent in the same period, he said.

Among equities, the technology and global funds reported a return of 27 per cent and 9 per cent over 3 years, but for investors it was 3 per cent and 2 per cent, resulting in a gap of 24 per cent and 7 per cent. Similarly, the gap in healthcare and small-cap funds were 7 per cent and 6 per cent each in the same period.

Incidentally, SEBI early this year restricted overseas investments by mutual funds, leading to many global funds not having inflows during that period, which, in turn, has also led to the gap being large.

The gap between fund and investors’ return was lowest in large cap and focused funds at 2 per cent each. Over five-years, equity returns moderated and reduced the gap between investors and funds return.

For allocation categories, the conservative category experienced the smallest investor return gap both over a three-year and five-year period. The highest investor return gap was witnessed by the multi-asset category and aggressive category for the three-year and five-year period respectively.

For the fixed-income categories, the investor gap over a three-year period was least for the medium to long-duration categories and highest for the dynamic bond category. On the other hand, over a five-year period, the least investor return gap belonged to the medium duration while the highest gap belonged again to the dynamic bond category.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.