TPG India Investments II Inc sold its entire 2.65 per cent stake, or 99.2 lakh shares, in Shriram Finance via multiple block deals on the BSE on Monday, as per exchange data.

The shares were traded at ₹1,401.00 against Friday’s close of ₹1,401.15. Following the block deals, the stock surged to touch a one-month high of ₹1,500 intraday but later pared some gains to end 5 per cent higher at ₹1,469.60 on the BSE. As per the transaction price, the deal value stands at around ₹1,390 crore.

US-based private equity firm, TPG, had first invested in the Shriram Group via Shriram Transport Finance 18 years ago. It was looking to exit the lending business of the group following the three-way merger of Shriram City Union Finance and Shriram Capital with Shriram Transport Finance in December 2022 to set up Shriram Finance. However, TPG continues to hold stake in the group’s insurance business.

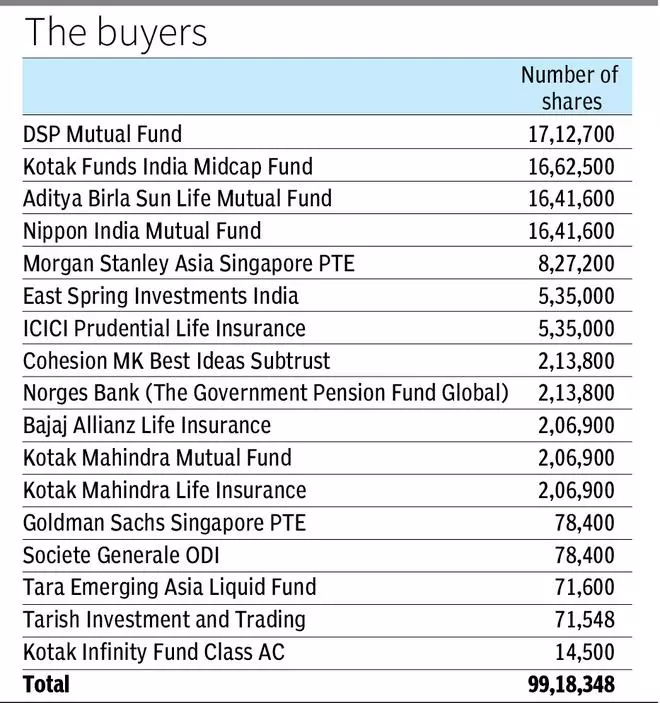

Kotak Funds - India Midcap Fund, which bought the largest number of shares at 16.6 lakh shares, was the single largest buyer. Other buyers included Nippon Mutual Fund, DSP Mutual Fund, Aditya Birla Sun Life Mutual Fund, East Spring Investments, Morgan Stanley Asia Singapore, Goldman Sachs Singapore PTE and Norges Bank on behalf of Government Pension Fund Global, among others, which picked up stake through various schemes and funds.

Norway-based Government Pension Fund Global already holds 2.13 per cent stake in Shriram Finance as of March 2023.

Earlier sale

Prior to this, in January 2023, PE firm Apax Partners, through its arm Dynasty Acquisition, had sold 80 lakh shares or 2.95 per cent stake in Shriram Finance at ₹1,300 per share. Dynasty Acquisition, which held 1.73 crore shares of Shriram Finance, had acquired the stake in Shriram City Union Finance from TPG Capital in 2015.

FID Funds Mauritius Ltd, part of the US-based Fidelity Investments, had then bought 66.28 lakh shares or 2.45 per cent stake. The remaining shares were bought by ICICI Prudential Life Insurance, Norges Bank — on behalf of Norwegian Government Pension Fund Global, Societe Generale, BNP Paribas Arbitrage Fund and Aditya Birla Sun Life Insurance.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.