Deposit growth for the banking system is expected to moderate to 12-13 per cent in FY25 from 13.8 per cent in FY24, further intensifying the competition for deposit accretion, especially for low-cost current account savings account (CASA) deposits.

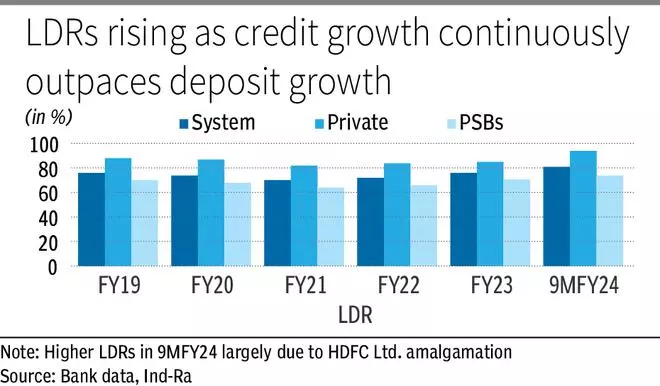

While deposit growth improved to 12.5 per cent in Q3 FY24 from 9.6 per cent in FY23, it continues to lag system credit growth, which is around 16.1 per cent. System loan to deposit ratio (LDR) is at 81 per cent, the highest in the last five years. This is also seen increasing lenders’ reliance on bulk deposits if growth in granular deposits remains constrained, according to India Ratings.

Sector outlook

The rating agency has maintained a ‘neutral’ outlook on the banking sector for FY25. It increased the credit growth forecast for FY24 to 20.5 per cent (inclusive of impact of HDFC merger), driven by continued growth in retail, NBFC, other services and government/public sector units.

Credit growth for FY25 is seen at 15 per cent, albeit with a change in portfolio mix due to slowdown in lending to NBFCs and retail sector, which is likely to be offset by a revival in private capex benefitting corporate credit growth.

“With the increase in policy rates and banks increasing the rates on term deposits, the mix of deposits has changed. This has led to a decline in the CASA ratio for the system (excluding the HDFC amalgamation) by around 300 bps between Q4 FY22 and Q1 FY24, owing to the movement of funds from CASA to better-yielding products.”

However, some of these funds could return to CASA balances once the interest rate cycle starts to reverse in H2 FY25, thus supporting CASA ratios to an extent, it said.

PSU banks are better placed in terms of deposits, with average LDR of around 65 per cent, significantly lower than 82-83 per cent for private banks. As a result, select private banks are already paying much higher interest for savings deposits. On the other hand, PSU banks could drive significant loan growth and profitability without the need to grow deposits commensurately.

“However, with most PSBs operating at the higher end of their normal LDR range (around 75 per cent), PSBs will have to start focusing on growing its deposits to meet the strong systemic loan growth,” it said.

FY25 inflection point

In addition, the rapid improvement in banks’ financial metrics, seen over FY21-FY24, is likely to reach an inflection point in FY25, given that net slippages continued to decline and credit costs trended lower in FY24.

However, the level of net slippages of 44 bps and 72 bps credit cost in FY24, are not sustainable and likely to move up going into FY25.

“The improving return on assets over FY21-FY24 is likely to reach an inflection point with some pressure on margins and credit costs reaching multi-year lows”, said Karan Gupta, Head and Director Financial Institutions, India Ratings.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.