As bank lending to Adani Group entities is now under regulatory scanner, banks say they became wary of increasing their exposure limits to the multi-billionaire-backed Adani Group companies by early 2022. By around July or August last year, most banks, especially those in the private sector, decided that they would not increase their exposure to the group any further, according to highly placed banking sector sources.

“When Adani Airport Holdings took control of the Chhatrapati Shivaji Maharaj International Airport in Mumbai and sought for an additional line of credit from banks, we saw merits in the proposal, whether with respect to the overall leverage levels of the conglomerate, its financial position or the overall balance sheet strength. However, the situation started changing by early 2022 when it came to a point where most of the banks had to take stock of their positions, including non-fund based exposures to the group,” said a CEO of a private bank. Adding that “merely noteworthy rating isn’t making a case for banks to increase or exposure, especially to some of its infrastructure projects”, he emphasised that his bank resisted from the temptation of increasing exposure to the group.

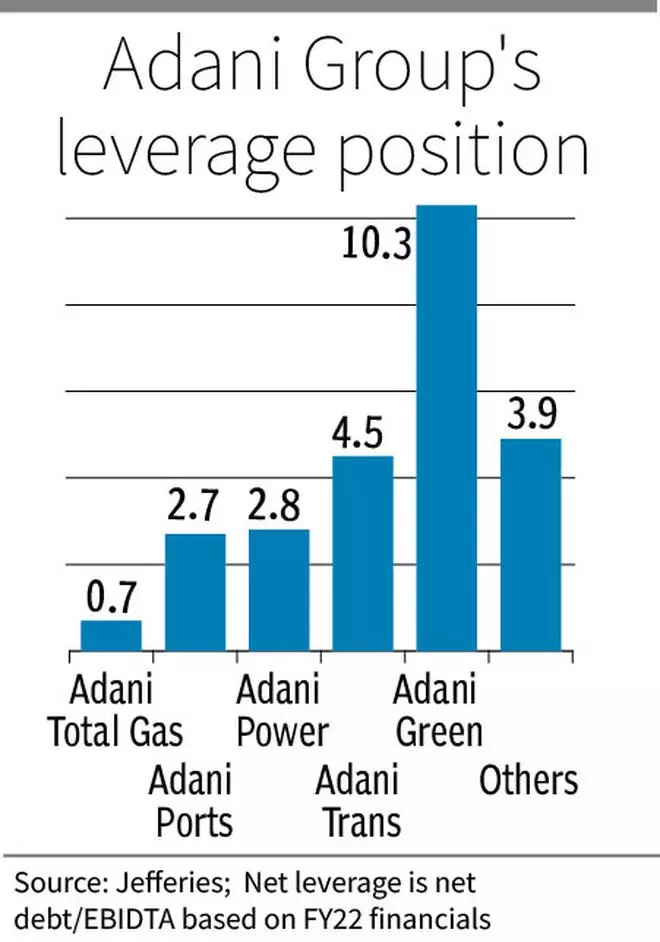

According to a report by Jefferies, total banking sector debt to Adani Group is at 0.5 per cent of total loans. Exposure of public sector banks is estimated at 0.7 per cent, while that of private banks at 0.3 per cent.

In August 2022, Fitch’s CreditSight report first pointed out the overleverage in Adani Group. “This was a validation to some banks, which started turning cautious about the group ahead of the report,” said another banker. There was a bit of pressure on a few banks to lend to the group, according to another highly placed source. “We had categorically turned down these requests, even though it came from some important corners. But we had to take tough calls to ensure that the bank does not faces jeopardy in future,” said another senior official of a bank.

At present, most banks, especially private players, are said to be declining fresh proposals from Adani Group, though the group can drawdown to sanctioned credit limits. It is understood that the total exposure to Adani Group as a percentage of net worth across leading banks is less than five per cent and, hence, not at alarming levels. On Wednesday, IndusInd Bank clarified that its total loan outstanding to Adani Group was 0.49 per cent of its total loans and non-fund-based outstanding was 0.85 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.