Return and volatility correlations of Bitcoin and the Indian stock markets have increased many folds, a blog by International Monetary Fund (IMF) stated. These strongly advocate the need for regulation.

A recent United Nations report placed India at the seventh spot in a list of top 20 economies in terms of people holding digital currency. It says 7.3 per cent of the Indian population owns digital currency.

Asia focus

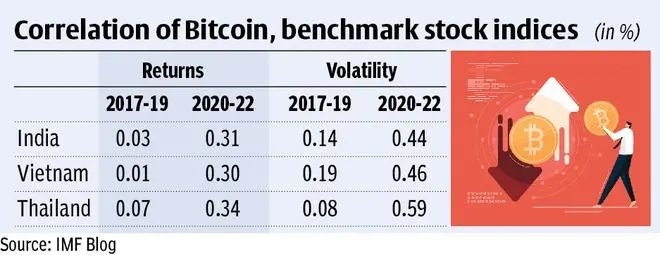

According to a blog titled ‘Crypto is More in Step with Asian Equities, Highlighting Need for Regulation’, and authored by Nada Choueiri, Anne-Marie Gulde-Wolf and Tara Iyer, as Asian investors piled into crypto, the correlation between the performance of the region’s equity markets and crypto assets such as Bitcoin and Ethereum has increased. While the returns and volatility correlations between Bitcoin and Asian equity markets were low before the pandemic, these have increased significantly since 2020.

“The return correlations of Bitcoin and Indian stock markets have increased by 10-fold over the pandemic, suggesting limited risk diversification benefits of crypto. The volatility correlations have increased by three-fold suggesting possible spillovers of risk sentiment among the crypto and equity markets,” it said.

In its previous blog, published in January this year, IMF had said crypto assets showed little correlation with major stock indices before the pandemic. They were thought to help diversify risk and act as hedge against swings in other asset classes. But this changed after the extraordinary central bank crisis responses of early 2020.

Embracing cryptos

The latest blog also said crypto trading volume and co-movement with equity markets have surged. Few parts of the world have embraced crypto assets like Asia, where top adopters include individual and institutional investors from India to Vietnam and Thailand. This raises the important issue of the extent of integration of crypto into the financial system in Asia. “While digitalisation can aid in the transition to an environmentally-conscious payment system and also foster financial inclusion, crypto can pose financial stability risks,” it said.

Further, it highlighted that before the pandemic, crypto seemed insulated from the financial system. Crypto trading, however, soared as millions stayed home and received government aid, while low interest rates and easy financing conditions also played a role. “The total market value of the world’s crypto assets surged 20-fold in just a year and a half to $3 trillion in December. Then it plunged to less than $1 trillion in June as central banks’ interest rate increases ended easy access to cheap borrowing,” the blog said.

Choueiri is the Mission Chief for India at the International Monetary Fund; Gulde-Wolf is Deputy Director of the Asia and Pacific Department with the Fund; and Iyer is an economist in the Global Financial Stability Analysis Division of the IMF’s Monetary and Financial Markets Department.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.