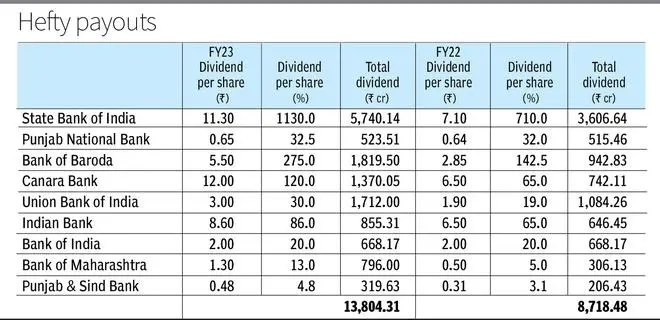

The Government will rake in the moolah as it will receive dividend income aggregating ₹13,804 crore from public sector banks (PSBs). This is about 58 per cent higher than the ₹8,718 crore paid out in the previous financial year.

The handsome dividend declaration by State-owned banks comes in the backdrop of healthy profitability and comfortable capital position.

Among the 12 PSBs, three declared dividends of over three digits in percentage terms for financial year ended March 31, 2023 — State Bank of India (SBI) declared the highest dividend of 1130 per cent (on equity share of face value ₹1), followed by Bank of Baroda (275 per cent on equity share of FV ₹2), and Canara Bank (120 per cent on equity share of FV ₹10).

The dividend income for FY23 will form part of the current year’s non-tax revenue of the Government.

SBI, which reported an all-time high standalone net profit of ₹50,232 crore in FY23, will handover a dividend cheque of about ₹5,740 crore to the Government. This is about 42 per cent of the total dividend that will accrue to the Government from PSBs. The country’s largest bank had declared a dividend of 710 per cent in FY22, with the Government’s share of the dividend being ₹3,607 crore.

Six PSBs declared dividends ranging from 4.8 per cent to 86 per cent. However, Central Bank of India, which was brought out of Prompt Corrective Action Framework (PCAF) by RBI in September 2022, Indian Overseas Bank, and UCO Bank (both banks were brought out of PCAF in September 2021), did not declare dividend.

Positive outlook

Karthik Srinivasan, Senior Vice-President, Financial Sector Ratings, ICRA, said: “The very fact that banks have been making more money and their capital position is also much better than what it was two-three years back, to that extent they are able to declare higher dividend. And the outlook for the current year is also good. Net-net, it should be a fairly strong year in terms of financial performance for banks.”

Emkay Global Financial Services said in a report that most banks under its coverage reported a healthy earnings beat in the fourth quarter, mainly led by continued strong credit growth, healthy margins, higher recoveries from written-off accounts (for PSBs) and lower lower loan loss provisioning, as asset quality continues to improve.

Also read: RBI to pay ₹87,416 crore as dividend to Centre for FY23

PSBs logged their historically-best quarter, with net profit growth of 98 per cent Year-on-Year/19 per cent Quarter-on-Quarter, it added.

“For FY24, in our view, credit growth/ margins will moderate, as will Pre-Provisioning Operating Profit growth. However, treasury gains for PSBs and continued lower loan loss provisions for most banks should keep net-earnings growth healthy,” opined Emkay analysts.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.