Even as the Union Budget 2023-24 has been termed capital-intensive, the absence of allocation for recapitalisation of the Public Sector Banks (PSBs) is conspicuous.

Bank recapitalisation refers to the infusion of capital into banks to enable them meet the mandatory capital adequacy norms set by Reserve Bank of India from time to time.

Bank recapitalisation has been a regular feature in the Union Budget since 2016-17. The higher non-performing assets (NPAs), provisioning and write-offs, warranted capital support for banks. Between FY17 and FY21, the Centre has infused about ₹3.31-lakh crore into banks.

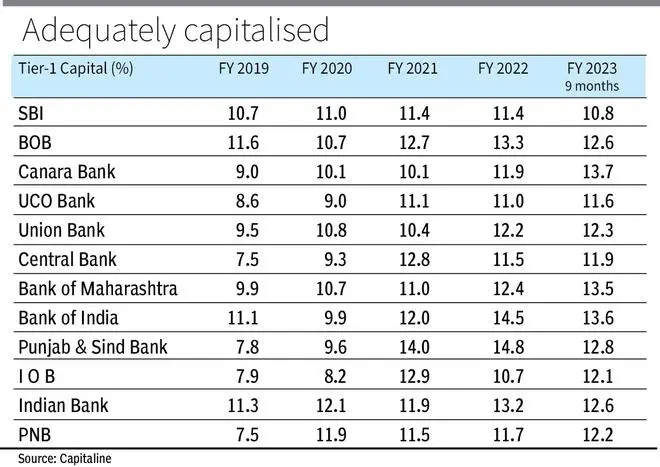

However, things have changed now. With the roll out of recapitalisation package for public sector banks and improving trend in profitability, all PSBs have, as of December 31, 2022, more than 100 bps cushion over and above the regulatory Tier I capital requirement.

Even from an overall capital adequacy perspective, the average capital adequacy ratio for PSBs is at about 15 per cent, which is among the highest we have seen in the last decade. Apparently, the Finance Ministry appears to have done a lot of homework on this before taking a decision on recapitalisation of PSBs, which have been faring well on macro stress tests.

According to the findings of the stress tests, which are also taken by the RBI, SCBs are well-capitalised and capable of absorbing macroeconomic shocks, even in the absence of any further capital infusion by stakeholders. Under the baseline scenario, the aggregate CRAR of 46 major banks has been projected to slip from 15.8 per cent in September 2022 to 14.9 per cent by September 2023. It may go down to 14.0 per cent in the medium stress scenario and to 13.1 per cent under the severe stress scenario by September 2023, but it stays well above the minimum capital requirement, including capital conservation buffer (CCB) requirements (11.5 per cent).

“None of the 46 SCBs would breach the regulatory minimum capital requirement of 9 per cent in the next one year, even in a severely stressed situation,” the RBI observed recently. According to Bibekananda Panda, an economist with SBI, recapitalisation of PSBs was not opted as all banks are have capital level well above the regulatory requirement.

“The robust credit growth is to be supported by drawing down the SLR investment, which has been in excess of the basic requirement,” he said.

On the basis of RBI data updated on January 27, 2023, the system has an excess SLR of 9.45 per cent, which amounts to ₹17.9 trillion. Further, banks are already in competition to raise deposits via higher rates. Deposit growth is also keeping pace and is expected to be robust, going forward, as banks pass on the last 25 bps rate hike in its policy review last week. The incremental deposits in the last 10 months of the current fiscal is ₹12.53 trillion against ₹9.2 trillion in FY22.

“The focus has shifted to raising long-term capital raising through green infrastructure bonds,” Paanda added. While SBI and EXIM Bank have already raised capital on green bonds, some other banks, too, have similar plans.

In this backdrop, banks are confident of their ability to self-fund their capital needs. For instance, Bank of Baroda, according to its MD and CEO Sanjiv Chadha, might end up the year with a capital adequacy ratio north of 16 per cent, and higher than what it was at the beginning of the year.

“Which means you are completely self-funded in terms of capital. Now, think of the next year whether it’s likely that loan growth might be a little bit more moderate. So, therefore, for the moment, you don’t even need to access the markets, forget whether you want to go again to the government or not,” he added.

“Again, the return ratios of banks improve. I think their ability to fund themselves from the market is much better,’’ he added.

According to Somasekhar Vemuri, Senior Director & Head, Ratings Criteria, Regulatory Affairs and Operations, CRISIL Ratings, banks are well poised to grow at approximately 15 per cent over this fiscal and next, with limited need for incremental capital to maintain regulatory levels.

“However, in case growth were to come in higher than estimates over the medium term, the requirement for capital could increase commensurately, though it is expected to remain well below what was seen in the past,” said Vemuri.

So, can it be said that recapitalisation has become a thing of the past? Not necessarily. The performance of banks and their health are always connected to the macro economic environment, and the likely need for recapitalisation cannot be ruled out in future.

But for now, in the medium term, it appears that banks have moved beyond the need for capitalisation, thanks to a host of measures taken to reign in NPAs and the general buoyancy seen the economy.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.