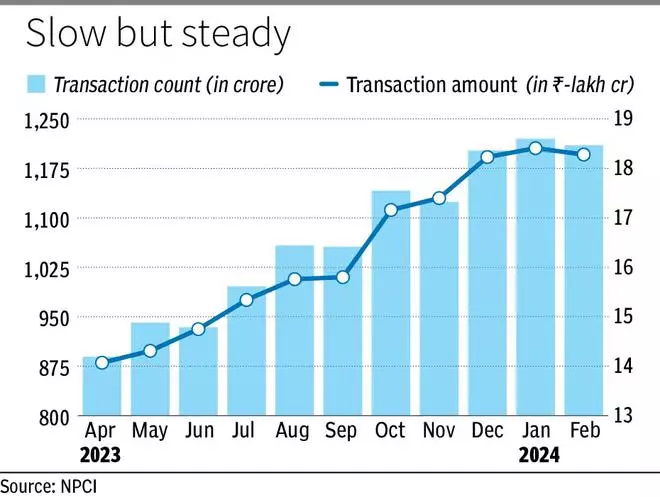

After starting 2024 on a strong note, the Unified Payments Interface (UPI) saw transactions dip slightly in February but remain above December 2023 levels.

Transactions worth ₹18.28-lakh crore were processed during February, nearly 1 per cent lower than the peak of ₹18.41 lakh crore in January 2024. The value of transactions was 48 per cent higher year-on-year, as per data by the National Payments Corporation of India (NPCI).

The number of transactions on the UPI network too fell by 0.8 per cent to 1,210 crore from the January level of 1,220 crore transactions. On year, the volume of transactions was 61 per cent higher.

Typically, transaction volumes and the transaction amount is lower in February due to the fewer number of days in the month.

Factors responsible

“A lot of factors might have caused this decline, one of which could be the technical breakdown at multiple banks earlier in the month which led to downtime of servers and failed UPI transactions. The other reason could also be that February is comparatively a shorter month with lesser days,” said Akshay Mehrotra, Co-Founder and CEO, Fibe.

Y-o-y growth in UPI transactions has consistently remained over 40 per cent for the value of transactions and above 50 per cent for volume of UPI trades in 2023 and FY24 so far. In FY23, the UPI platform processed 8,376 crore transactions aggregating ₹139-lakh crore.

A shift in consumer behavior of moving away from traditional cash transactions, increased convenience through value-added features, digital adoption by merchants through third-party payment applications, and rising share of P2M (person-to-merchant) transactions is driving UPI growth, according market participants.

“This is not a comparable metric since February has lesser days. A better metric is transactions per day and February is higher with 417 million transactions a day compared to 393 million transactions a day in January 2024. Given the trajectory of growth, we stand by our previous estimate that UPI monthly transactions, in all likelihood, will touch 20 billion by the end of FY25,” said Sunil Rongala, Senior Vice President, Head – Strategy, Innovation & Analytics, Worldline India.

UPI transactions are expected to breach 100 crore transactions per day by FY27, as per a report by PwC India, which projects UPI to dominate the retail digital payments landscape, accounting for 90 per cent of total transaction volumes over the next five years.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.