When the Narendra Modi-led NDA government came to power in 2014, the advantage of low oil prices gave it an opportunity to bring in the desired reforms in the sector.

Reforms were implemented but instead of facilitating ease of doing business, the industry feels it has created an atmosphere of “unease” due to bureaucratic hurdles and frequent policy shifts.

It is a common knowledge that fuel price is a dominant factor when political parties seek vote — promises of subsidies or cheap fuel price always make it to the debates and discussions through the years.

In his inaugural speech at Urja Sangam 2015, Modi highlighted the nation’s dependence on imports and emphasised on working together to achieve energy security.

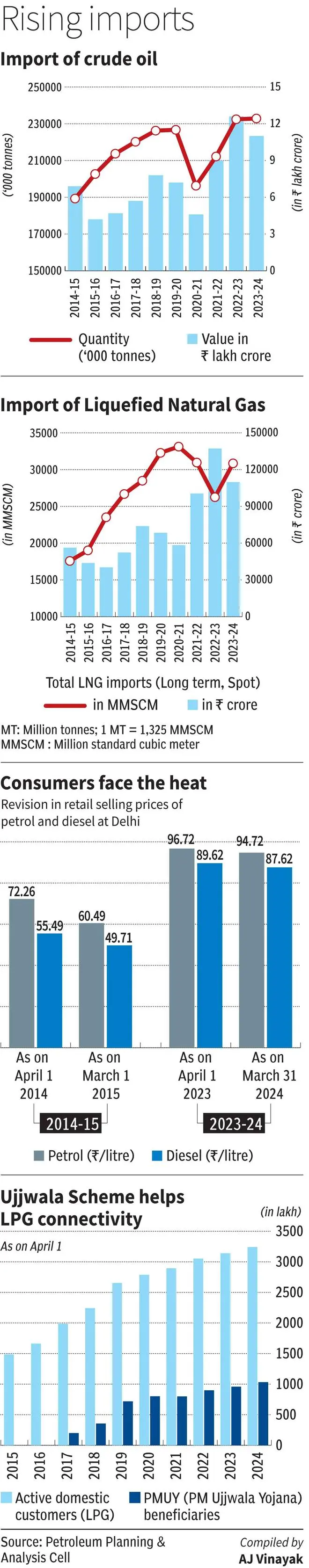

He urged all stakeholders to increase domestic production of oil and gas to reduce import dependence from 77 per cent to 67 per cent by 2022. He further said import dependence should be brought down to 50 per cent by 2030.

But the reality today is that more than 80 per cent of the oil demand and more than 50 per cent of gas demand is met through imports.

At the valedictory session of the same summit, the then Finance Minister Arun Jaitley had said the focus should be on oil and gas exploration. He also added that the government was trying to explore long-term financing mechanism for infrastructure projects.

Before debating further let us see what has happened in the 10 years of the NDA:

Marketing

Cooking gas price in India is one of the lowest globally, even lower than producing nations, according to the Ministry of Petroleum and Natural Gas. On auto fuel side there was a major shift to BS-VI — reducing sulphur emissions by 80 per cent vis-à-vis BS-IV levels. There has also been a growing number of States and UTs which are becoming kerosene-free.

Natural Gas

The focus is on city gas distribution networks — both piped natural gas and compressed natural gas.

Revised guidelines were issued in April 2023 for pricing of domestically produced natural gas, but it is still not fully decontrolled.

Exploration

Adopted in 2016, the Hydrocarbon Exploration and Licensing Policy (HELP) is an exploration and production policy that replaced the New Exploration Licensing Policy (NELP).

Refinery expansion

India is the fourth largest refiner in the world. From a capacity of 215.07 mmtpa in 2014 today it has a capacity of 256.8 mmtpa.

Going green

National biofuel policy, focus on ethanol blended petrol programme, biodiesel blending programme and bio-ATF, green hydrogen.

on global stage

An area where the NDA regime in its second term excelled was how it navigated through the geo-political tension and managed to get cheap Russian oil. India has diversified its crude oil sources from 27 countries in 2006-07 to 39 countries in 2022-23.

At the inauguration of India Energy Week 2024 in February, Modi said India is the world’s third largest energy, oil and LPG consumer. He said India is the fourth largest LNG importer and refiner and the fourth largest automobile market. He also underlined the rising demand for electric vehicles in the country and estimated doubling of the nation’s energy demand by 2045.

Modi highlighted the increase in production of domestic gas due to the government’s reforms and said efforts are being made to take the percentage of gas in the primary energy mix from 6 to 15 per cent. This will see an investment of about $67 billion in the next 5-6 years.

Despite all these measures, India is still not in a comfortable position.

This is mainly because the sector is largely influenced by politics, particularly the retailing business. For example, though on paper retail price of petrol and diesel is deregulated — to be revised daily in sync with global price shifts — when elections come, the price remains flat. Thus, when the revision happens it makes a dent in the pocket of the consumer and the fiscal math of those in the business goes for a toss.

On the exploration side, although a conducive fiscal regime was created, investors are cautious as there has been instance of government interventions which has not been favourable for the players to venture into this high risk space.

A deterrent has also been the non-inclusion of oil, gas and key petroleum products HSD, MS and ATF under GST.

Windfall tax levy on domestic producers is another eye sore, as it impacts long-term investment plans. It is rightly said, always expect the unexpected in the oil and gas industry and always have a backup plan.

To ensure energy security, strategic oil storage capacities are need of the hour. Despite its good intentions, the NDA regime, in its two terms, has moved at a slow pace in this area. India has strategic oil reserves of about 8-9 days which is dismal when compared with its growing demand.

The NDA, which in its first term enjoyed soft oil prices, now faces volatile oil and gas market.

It is important for India to take full advantage of any opportunities adopting a holistic approach – integrated energy policy. Today, it is a situation where all efforts to energise the sector has fallen between the cracks.