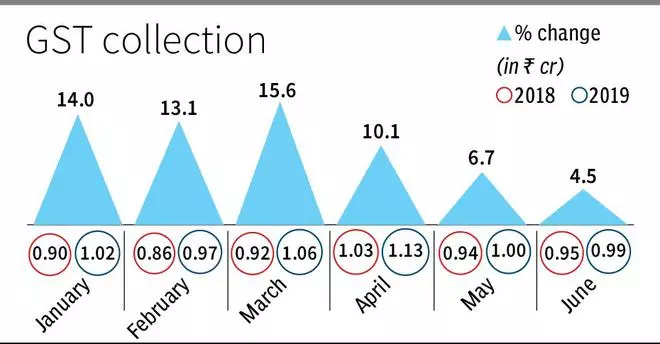

General elections are set to boost collection from Goods & Services Tax (GST) during first three months – April to June – of next fiscal year 2024-25 starting April 1. Impact of election was observed in 2019, first general election after introduction of GST.

Collection number of April, May and June will be made public on May 1, June 1 and July 1, respectively.

Growth factors

Number of factors can be attributed to possible rise in GST collection. First is increase in candidate’s expenses limit. During the forthcoming election per candidate limit would be ₹95 lakh for all States expect Arunachal Pradesh, Goa and Sikkim. For these three States, the limit would be ₹75 lakh. In 2019 general elections, limits were ₹70 lakh and ₹54 lakh. Similarly for all Union Territories, except Delhi, the limit has been enhanced to ₹75 lakh from ₹54 lakhs. For NCT of Delhi, the limit is ₹95 lakh as against ₹70 lakh.

Along with general elections, there are polls for legislative assemblies in four States – Andra Pradesh, Odisha, Arunachal Pradesh and Sikkim. Also, there are bye-election to 26 Assembly Constituencies of Bihar, Haryana, Gujarat, Jharkhand, Maharashtra, Telangana, Tripura, Uttar Pradesh and West Bengal. Per candidate expenditure limit for Assembly seats have also been enhanced to ₹40 lakh from ₹28 lakh in bigger States and NTC of Delhi and ₹28 lakh from ₹20 lakh in Goa, Arunachal Pradesh, Manipur, Mehgahlaya, Mizoram, Nagaland, Sikkim and Tripura.

Second factor would be government expenditure for conducting election. The overall expenditure on conduct of elections to Lok Sabha is borne by the Centre and for Legislature Assemblies, States bear the cost. If elections to Lok Sabha and State Legislative Assembly are held together, the expenditure is shared by the Central and respective State Governments.

According to information available on Election Commission’s website, 2014 election saw Centre spending over ₹3,870 crore. While data for 2019 is not there, but it is estimated be between ₹4,200 crore and ₹4,500 crore. For 2024 election, over ₹5,300 crore has already been allocated. These expenditures include cost of procuring new EVM and maintenance of existing ones, travel, accommodation and food of poll officials, setting up polling booth beside others.

Long duration

Third factor would be longer duration of poll process, 44 days which would also necessitate higher expenditure and thus more tax during April, May and June. Fourth factor would be higher expenditure by political parties. Reports suggest, expenditure could go up ₹1-lakh crore from ₹60,000 crore of 2019. More expenditure is likely to be done on services such as travel, food and accommodation, where GST ranges between 5-18 per cent. Expense on star campaigners will further boost GST kitty. Officials say since GST is end consumer-based taxation, so even if a candidate or a political party spend outside, Election Commission mandated expenditure mechanism, GST will need to be paid.

The average monthly gross collection for FY 2023-24 has been ₹1.67-lakh crore, exceeding the ₹1.5-lakh crore collected in the previous year’s corresponding period.