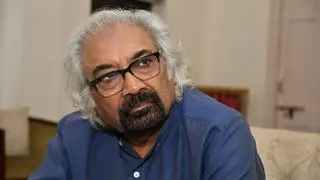

India must enact a comprehensive national law on ‘public private partnerships’ to enhance the confidence level of players in infrastructure, protect stakeholders and make available the concept of PPPs across all sectors, PR Jaishankar, Managing Director, India Infrastructure Finance Company Ltd (IIFCL) has said.

“Ideally it should be a law. This can be a structural process and reform. If we are going to bring more large investments into infrastructure development, we need to build more confidence among foreign investors and domestic investors. Today that confidence is lacking in the PPP environment. Confidence building of stakeholders will be achieved by a national law on PPPs”, he told BusinessLine .

He pointed out that having tasted the high growth benefits of PPP over the last two decades, it has become subdued now. The entire PPP model is now entering a phase of maturity, which calls for standardisation across sectors and extending this model to all sectors of the economy. Having a law will give ab-initio clarity for stakeholders, which would ensure that most of the disputes do not arise. More investments will flow into PPPs if investor protection is enhanced.

“Whenever an activity is growing mega scale, you need to standardise it and have uniform application across sectors. When we are looking at scaling up infrastructure development to huge mega projects, it will all be enabled if we have a national law for PPP for the protection of stakeholders participating in PPPs”, he said.

This will give clarity on the roles of both public sector, concessioning authorities, legislative bodies as also the implementing private sector agencies.

The law should specify how the public sector and the private sector should conduct themselves and the various uniformly applicable guidelines that must be followed. This would serve as an important benchmark for various agencies and give clarity on the execution of PPPs.

“Today, disputes are arising because there is no clarity and people are not sure about the standards. That is the problem that arose in termination payments issue of NHAI. These are things that can be easily addressed if there is a law. We need a comprehensive law that delineates roles, guidelines and has necessary standards”, he said.

Jaishankar said that the recent budget has focused on ushering in investments to kick start many projects to revive economy and to ensure that government funding on infrastructure projects is enabled in a big way.

Today foreign investors are wary of investing in greenfield projects because most of them are interested in revenue generating assets. A national law will facilitate widespread participation from both foreign and domestic investors, he said..

“In today’s environment, investments in PPPs are sluggish. But going forward I don’t think we have any major alternative other than depending on PPPs for faster and better development”, he said.

On an overall basis, IIFCL, which is entirely government-owned, has sanctioned over 670 projects so far, of which about 450 are PPPs. IIFCL has participated in financing of nearly 25 per cent of India’s PPP projects. India offers the largest PPP market in the world. Jaishankar said that private investments are now trickling in few areas under PPP, but certainly not at the level seen three to five years ago. “We now need to bring back the animal spirits on PPPs”, he said.

In the context of post Covid-19 world, Jaishankar noted that investors are getting back and projects are reaching the pre-Covid level revenues to a great extent. Today in the absence of a law, one has to rely on concession agreements, which are non uniform, he pointed out.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.