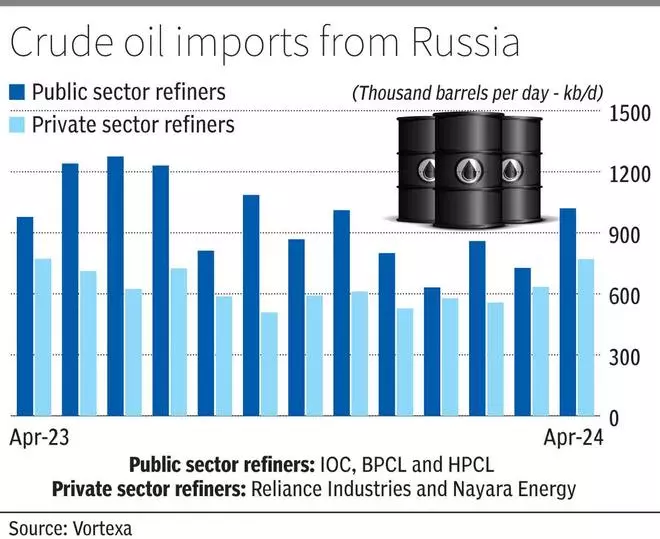

Private refiners, Reliance Industries (RIL) and Rosneft-backed Nayara Energy, imported around 770,000 barrels per day (b/d) of crude oil from Russia in April 2024, the highest in a year.

Analysts and trade sources attribute the higher numbers to more export volumes being shipped out of Russia and lifting of lower cargoes by Chinese refiners.

Sensing the opportunity to procure more barrels, public refiners such as Indian Oil Corporation (IOC), Bharat Petroleum Corporation (BPCL) and Hindustan Petroleum Corporation (HPCL) too imported 1.02 million barrel per day (mb/d) last month, which is a 7-month high.

According to energy intelligence firm Vortexa, India imported more than 1.72 mb/d crude oil from Russia in April, which is also the highest in the last nine months. Imports last month were 26 per cent higher M-o-M and almost flat on an annual basis (April 2023: 1.74 mb/d).

More Russian barrels

Vortexa’s Head of APAC Analysis, Serena Huang told businessline: “Higher Russian crude exports in February and March as well as lower imports by Chinese refiners have made available more volumes for Indian refiners. Given that Russian crude cargoes are likely to be more discounted than Middle East grades, Indian refiners are likely to opt for the former.”

When asked about the impact of sanctions, she explained that the biggest impact of western sanctions on selected shipping companies and vessels carrying Russian crude to India has been the disruption on Russian Sokol deliveries. But it had minimal impact on India’s overall imports of Russian crude.

Vortexa’s Senior Oil Risk Analyst Armen Azizian, in an April 16 commentary, said, “Russian crude STS (ship-to-ship) activity (excluding CPC Blend & KEBCO) reached 310,000 b/d in April (days 1-15), a 120,000 b/d increase M-o-M and a 10-month high. Russian Urals is the sole grade transferred via STS in April so far, which has reached a 12-month high.”

In 2024 so far, Vortexa observed nine very large crude carriers (VLCCs) transferred Russian crude via STS. All nine VLCCs were previously involved in Iranian and/ or Venezuelan trade.

VLCCs have been the driving force behind Russian Urals STS activity moving upwards in recent months, especially in April. More than 60 per cent of Urals transferred in April were because of VLCCs loading via STS from Aframaxes, which increased STS volumes (three Aframaxes feed one VLCC), he added.

“This return of VLCCs to the Russian trade, specifically these tankers involved in the sanctioned trade, suggests there is surplus tonnage in the VLCC segment of the opaque fleet,” Azizian said.

Middle East volumes drop

Vortexa data show that crude oil imports from India’s traditional suppliers in the Middle East fell in April.

India imported 776,000 b/d from its second largest supplier Iraq last month, compared to 1.09 mb/d in March 2024. Imports from Saudi Arabia were down for the second month in April at 680,000 b/d (March 2024: 768,000 b/d).

In-bound shipments to India from the UAE fell to 260,000 b/d last month from 442,000 b/d in March.

“The move to import more Middle Eastern crude has been a backstop for potential disruption in purchasing Russian crude. But prices of Middle East grades have been rising amidst limited export volumes and robust demand from Asian refiners, which is likely to cap Indian refiners’ appetite if they are able to secure sufficient discounted Russian volumes,” Huang said.