In the post-reform period, private initiatives have been given more importance, making availability of institutional credit as a significant facilitator for entrepreneurs and investors.

The government introduced a variety of initiatives to ensure flow of credit to priority sectors, besides introducing policies relating to infrastructure support to facilitate entrepreneurship and industrialisation of backward areas. Overall credit flow, however, remained skewed in favour of better-off States.

While overall credit disbursed, as revealed from the outstanding credit of the scheduled commercial banks, increased by 16 per cent on an average annually from ₹1,23,020 crore in 1991-92 to ₹10,656,326 crore in 2021-22, higher than the growth of GSDP and Central transfers, significant gains accrued to States like Maharashtra, Telengana, Tamil Nadu, Gujarat and Andhra Pradesh.

Per capita credit flow, which grew from ₹1,469 in 1991-92 to ₹79,936 in 2021-22, for Bihar, Jharkhand, Assam, Uttar Pradesh, Meghalaya, Nagaland and Manipur in 2021-22 was less than 40 per cent of the all-India average, while it was three times the national average for Maharashtra.

Skewed credit flows

The skewness of the institutional credit flow on per-capita basis is also validated by the coefficient variation of inter-State credit, which persisted at above 65 per cent throughout this period.

Credit disbursed as per cent to GSDP for all States averaged 24.81 per cent in 1991-92, which gradually increased to 49.94 per cent in 2011-12, before moderating to 45.93 per cent in 2021-22.

Inter-State variations in credit/GSDP ratio persisted and skewedness remained stable throughout the period.

The coefficient of variation varied between 36 and 48 per cent. Most States witnessed an increase in credit/GSDP ratio with the exception of Goa and Sikkim, the two States at the top of the ladder in terms of per capita income.

Credit/GSDP ratio was significantly higher than the national average for Maharashtra, Telangana, Tamil Nadu, Andhra Pradesh, Kerala and Punjab.

North-East dilemma

For all North-Eastern States, the credit/GSDP ratio remained lower than 25 per cent during 2021-22. The situation in North-East needs all the more to be highlighted as the North East Development Financial Institution was a specific initiative made to increase flow of institutional credit to these States to support private investment initiatives.

Notwithstanding an improvement in credit/GSDP ratio over time, for most of the backward States, the ratio remained below the national average.

The stimulus packages announced under Atmanirbhar Bharat and others post pandemic have a significant component of institutional credit to various enterprises. Low penetration of institutional credit resulted in limited advantages of these initiatives accruing to poor States.

Financial institutions are essentially intermediaries in nature. Their sources of funds are basically deposits raised from the public. Their lending should, therefore, be necessarily for viable projects. The institutions are expected to actively seek clients and help in identifying projects for which lending can take place.

Varied C-D ratio

Generally, one should expect credit-deposit ratio to operate in a range and not vary across States in any significant manner. In our country, public sector banks, which dominate the institutional credit structure, should take the lead in smoothening credit-deposit ratio variance across States.

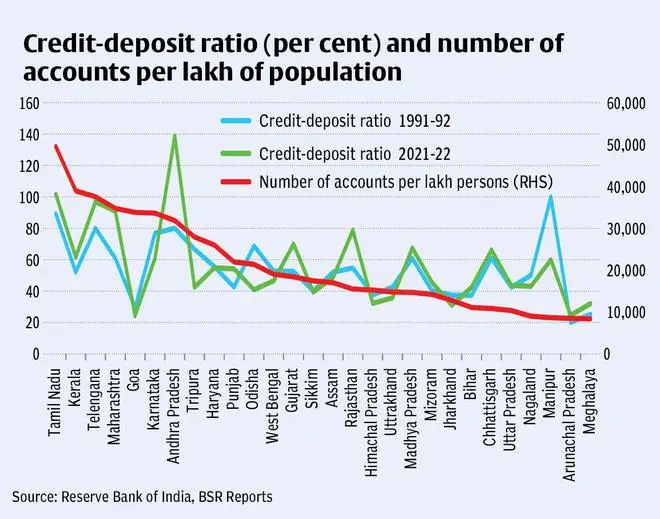

However, there have been significant inter-State variations in credit-deposit ratio. While the average credit-deposit ratio in 1991-92 was 58.2 per cent, North-Eastern States in general and other poor States had a much lower ratio. These virtually emerged as the collection centres of deposits for disbursement of credit to better-off States. It seemed as though, through institutional flows, backwardness and isolation were being reinforced.

The fact that the number of accounts per lakh of population was also very low in these States, reinforces the argument that these States are not getting focussed in institutional finance.

States’ role

The States themselves have a lead role to play in crowding in institutional finance through better law and order management, creating favourable policies to attract investment, creating soft and hard infrastructure and skill development. Their role in the State and district level institutional finance committees needs to be more proactive.

The current approach of achieving some sort of equality in GSDP and services delivery has not met with the desired success. There is need for some alternative out-of-the-box thinking.

Though credit disbursement cannot ignore viability issues, poor States cannot remain just the collection centres for banks.

C-D ratio threshold

To the extent that problem is because of hesitancy or aloofness needs to be tackled and a beginning may be made by stipulating some minimum credit-deposit ratio threshold with inbuilt incentives to reach the threshold.

Resources both at the level of the States and the Union are limited and there are competing claims. It is important these are spent judiciously and sectoral expenditure is appropriately prioritised.

The Twelfth Finance Commission had considered equalising delivery of services in health and education sectors across States. More sectors, particularly civic facilities, may be added for getting a minimum standard of access across the country.

An independent agency for allocation of resources and to oversee their outcomes would be a right institutional arrangement. Achieving a reasonable level of equality in income and aggregate consumption should remain at the top of the agenda.

(Concluded)

Gopalan is a former Finance Secretary, and Singhi is a former Senior Economic Adviser, Ministry of Finance

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.