The Government of India’s Economic Survey 2022-23 is a bizarre document. It uses cherry-picked time series data to suggest that the performance of the Indian economy has been commendable only during the current Modi government’s tenure and the previous NDA government led by AB Vajpayee.

The conversion of all trends — including macroeconomic processes — into vehicles for promoting political agendas, is unfortunate, because if official policies are really to operate for the benefit of the Indian people, it is important to recognise the realities, rather than see everything as a vehicle for propaganda.

That actual trends are being ignored is apparent, as the Economic Survey glosses over the glaring fact that all the standard macroeconomic indicators like average GDP growth, employment, investment and savings rates show substantial deterioration over the past eight years, compared to the previous decade. (Indeed, the only indicator that has performed better is that of the stock market, which zoomed especially in the last few years, led by the very same Adani group stocks that have now imploded in spectacular fashion.)

As with the domestic economy, the Economic Survey is also Pollyannaish — as in, unwarrantedly optimistic — about India’s external sector performance and current prospects. It claims that India is well able to weather any global storms, since “its economic resilience can be seen in the domestic stimulus to growth seamlessly replacing the external stimuli” (page 13). In any case, apparently India has also managed the past year very well in external terms, actually increasing its share of world exports.

Hype vs reality

How much of this self-congratulation and optimism is actually warranted? It is worth looking at the recent tendencies on the external front in a little more detail, if we are to get a clear and realistic view of the Indian economy’s strengths and challenges.

Figure 1 describes quarterly movements in the shares of India in world merchandise exports and imports since the beginning of 2019. Two features are immediately obvious. First, India’s share of global exports has hovered at slightly below the average rate of 1.8-2.0 per cent of the previous decade, without any noticeable increase.

The share rose to 1.96 per cent in the first quarter of 2022. But this was really driven by oil exports, as India (and more precisely, one particular oil company) benefited from the G7 sanctions against Russia to import oil and natural gas from Russia and export processed fuel to European economies.

As a result, the share of oil products in total exports, which was 17 per cent in November 2021, had increased to 23 per cent by August 2022. Non-oil exports, by contrast, have shown stagnation and even decline in the months to November 2022.

Import surge

Meanwhile, India’s imports have been rising rapidly as a share of global exports. By the third quarter of 2022, they had reached the historically high share of 3 per cent (even as the share of global exports fell to 1.78 per cent). More worryingly, non-oil imports showed the sharpest increase.

As share of total imports, non-oil imports went up from 45 per cent in 2021-22 to more than 70 per cent by the second and third quarters of 2022.

This is clearly bad news in terms of the external trade balance. In addition, rising non-oil imports suggest that more domestic production may be substituted by imports, which obviously affects domestic economic activity and employment. So, this is not just a concern for the balance of payments, but also for internal economic trends and the possibilities for economic diversification. This is certainly a trend that must be watched, if the slogan “Atmanirbhar Bharat” is to have any real meaning.

The merchandise trade balance has been negative, but data indicate that the balance on services trade, which was earlier a major source of net foreign exchange, increased only modestly in the year to June 2022, and has been mostly stagnant since then. Therefore, it has been unable to counter the downward trend in the overall goods and services trade balance.

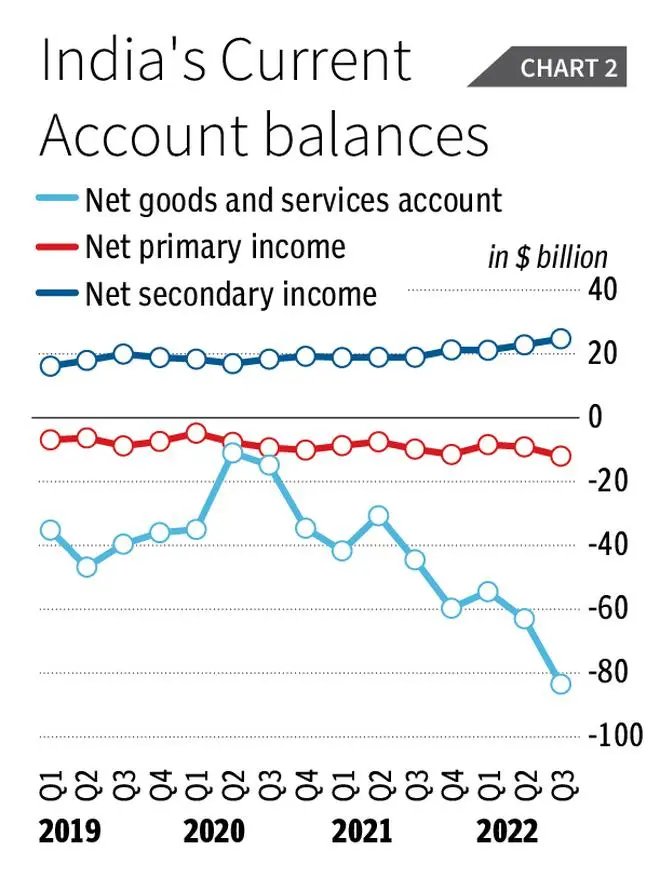

As a result, as Figure 2 shows, the net goods and services account has deteriorated sharply after the second quarter of 2020. The deficit on that account increased from $11 billion in the second quarter of 2020 to as much as $83.5 billion in the third quarter of 2022.

Matters have been made worse by the increasing outward payments on the “primary income” account — that is, the net payments made on capital income such as profit remittances and interest payments. Once again, outflows on this account have been worsening since early 2020, increasing from less than $5 billion in the first quarter of 2020 to as much as $12 billion in the third quarter of 2022.

In the past, India’s current account has really been rescued from large deficits by the steady flow of remittances from Indian workers abroad, shown in Figure 2 as the major part of secondary income. These have indeed remained steady, and increased from $17 billion in the second quarter of 2020 to almost $25 billion in the third quarter of 2022. But this has not been enough to counter the growing deficits on the other two elements.

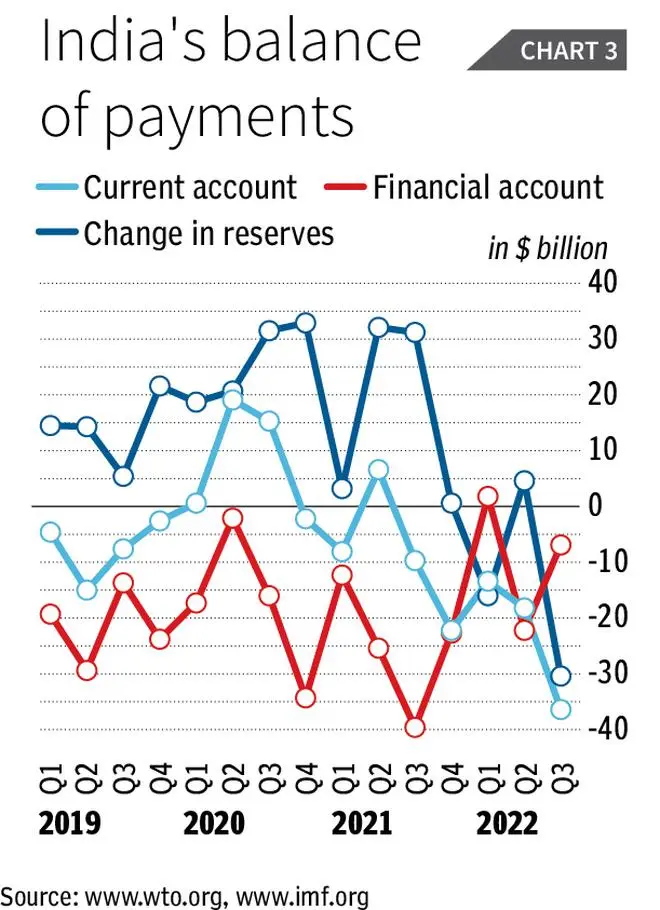

The result is that the total current account — displayed in Figure 3 — has worsened almost continuously since the second quarter of 2020, when it was briefly in surplus. By the third quarter of 2022, the current account deficit had crossed $36 billion.

Unstable flows

Meanwhile, capital flows of all kinds, here shown as the net financial account flows, have been extremely unstable and have turned negative after the first quarter of 2021. The outflows increased in the third quarter of 2022, and all the indications are that the outward movement of cross-border capital (which is notoriously fickle) is likely to have accelerated since January 2023.

Certainly, the current turmoil in Indian stock markets, and specifically the concerns about Adani group enterprises, will not be helpful in attracting or retaining footloose foreign capital at least in the short term.

All this suggests that there are many reasons to be concerned about the fragility of the Indian balance of payments, and there is clear need for active policy consideration on this front. The complacency expressed by the Economic Survey is therefore misplaced, perhaps even counterproductive.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.