At the start of May, the central government released yet another statement exuding optimism about the progress of India’s Goods and Services Tax regime, based on the previous month’s collections. The statement said that monthly goods and services tax (GST) collections in April had risen by 12 per cent year-on-year to a record high of ₹1.87 trillion. This compared with ₹1.60 trillion collected in March, and ₹1.68 trillion in April 2022.

It is worth noting that simple growth in total collections is being presented as evidence of good performance, even if that growth had been preceded by a decline between April 2022 and March 2023 in this case. This has been the rhetoric used by the government to hype performance with respect to the GST regime. Interestingly, most commentators and the financial media have backed this hype.

Having declared at the time of its launch that the GST regime would be a game changer for India’s indirect taxation framework, these commentators were complicit in the hasty adoption of the regime.

Since nominal growth in tax receipts is to be expected in any growing economy experiencing some inflation, the GST record thus far needs a closer look. Not least because, the end of June would mark the completion of a year since the practice of compensating the States for any shortfall in receipts from GST, relative to a 14 per cent growth in revenues from taxes subsumed under the new regime, came to an end.

State governments cannot in principle unilaterally adjust tax rates that are harmonised across the country by a GST Council dominated by a centralising union government. Therefore they are — and will henceforth remain — hostage to revenue performance under the GST regime.

IT factor

It was claimed by proponents of GST that the information technology-assisted ‘efficiency’ of and the systemically embedded tendency to greater compliance under the new regime would result in a significant increase in revenues from Goods and Services taxes. This has not been realised. Even ignoring the prolonged period of poor functioning of the IT software and network supporting the new regime, the evidence contradicting such claims is striking.

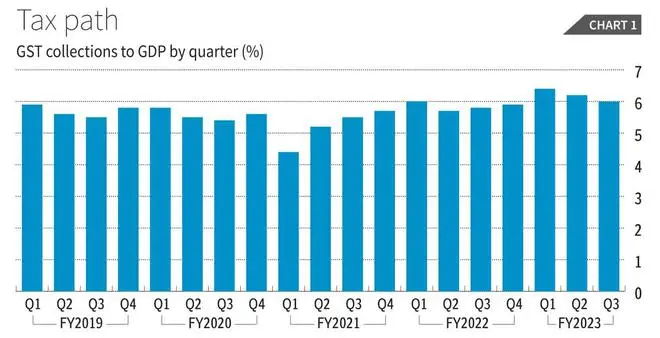

As Chart 1 shows, from the start of 2018-19, which was the first full financial year when the GST regime was in operation, until the first quarter of financial year 2020-21, when the force of the Covid pandemic was felt, there was not a single quarter in which the gross GST collections to GDP ratio equalled the early peak of April-June 2019.

That is, relative to GDP, GST revenues were worse than stagnant in those years. It was only after the pandemic quarter April-June 2021, that the ratio recovered and then rose to touch a peak value of 6.4 per cent in April-June 2022. But part of that gain was lost in the subsequent two quarters with the ratio placed at 6 per cent during October-December 2022. Overall, the picture is one of stagnation of GST collections relative to GDP.

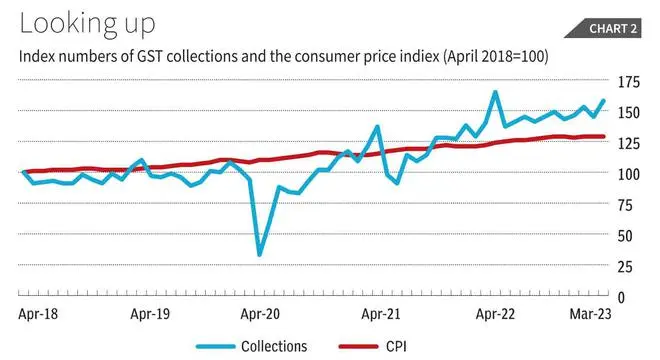

The evidence also suggests that only recently have GST collections risen faster than inflation. Chart 2 uses indices with base April 2018 (equal to 100) for both consumer prices and monthly gross GST collections. As the Chart shows, from April 2018 to September 2021 the index for GST collections was lower than that for consumer prices in all months except one, indicating that the real value of GST revenues in the aggregate was falling since prices were rising faster that those revenues.

It is only after September 2021, that the index for collections moved above the consumer price index and the gap between the two subsequently increased. But this positive tendency in the real value of collections has to be seen in the light of the absence of any significant buoyancy in GST collections relative to GDP.

Compensating States

Finally, the promised increase in revenues to the States to be delivered by the Centre, in return for the States ceding their original Constitutionally guaranteed right to impose indirect taxes, has not been realised. The promise was that, until the GST regime stabilised, States would be compensated for any shortfall compared to a 14 per cent annual growth in GST revenues, relative to the base value of the taxes subsumed under the new regime. Presuming that stability and growth would be ensured within five years, the compensation arrangement was put in place for that limited period.

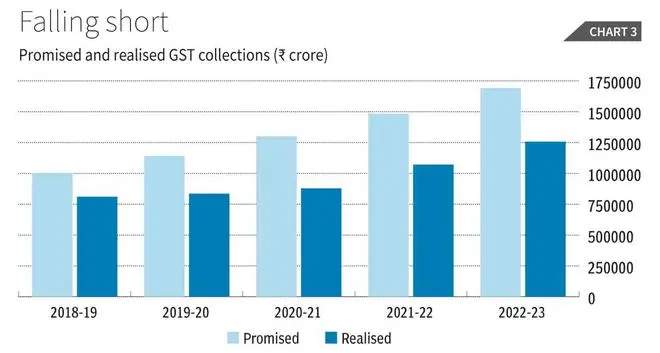

One estimate by Sacchidananda Mukherjee of the National Institute of Public Finance and Policy places the annual average revenues realised from taxes subsumed under GST during 2012-13 to 2016-17 at ₹7.70-lakh crore. If we take this as the base value from which the annual 14 per cent growth was expected to be realised and compare it with actual receipts from GST collections during the period 2018-19 to 2022-23 (Chart 3), the shortfall relative to ‘promised’ revenues varies between 19 and 33 per cent, with the shortfall in the most recent full year (2022-23) being around 26 per cent.

Not surprisingly, compensation for the shortfall financed with the compensation cess and additional borrowing by the Centre post-Covid was crucial for the States. It follows that the end of the practice of providing compensation after five years, even though the promised stabilisation and growth of revenues under the regime has not been realised, is bound to lead to significant fiscal stress in most States, except the most developed ones. The States are nevertheless trapped, since they have ceded their right to taxation across a broad range of taxes.

Not surprisingly, most States have demanded extension of the compensation arrangement. The central government’s refusal to accede to that demand has led to a serious crisis in federal fiscal relations. This should lead to a serious rethink of the regime rather than a resort to hype based on positive nominal growth figures, with the aim of whitewashing the real situation.

It is of course true that two sets of taxes on goods, which could make a significant difference to buoyancy, are still outside the GST regime: those on petrol and petroleum products; and those of alcohol. The former is an area which is being exploited both by the Centre and the States for revenue, especially the former. And many States have become excessively reliant on taxes on alcohol.

Whatever the external benefits that higher taxation of these goods are seen to deliver, an overwhelming reliance on them is hardly a rational indirect tax framework.

As States cannot unilaterally adjust tax rates that are harmonised across the country by a GST Council dominated by the Centre, they are bound by revenue performance under the GST regime

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.