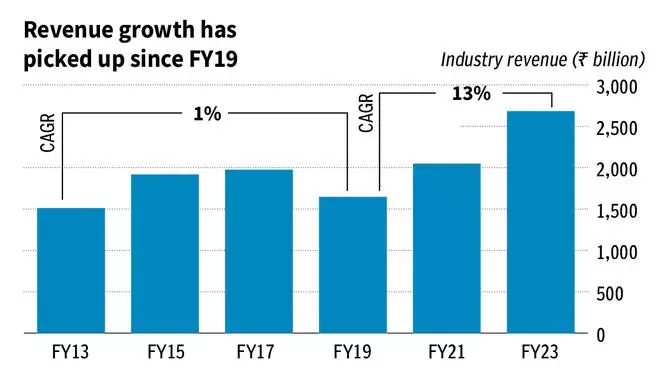

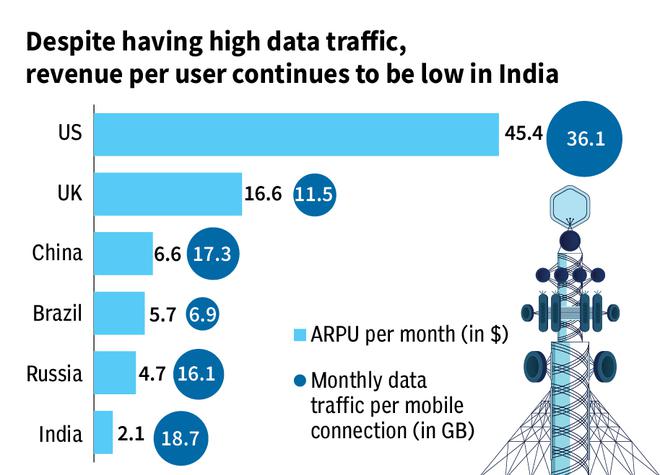

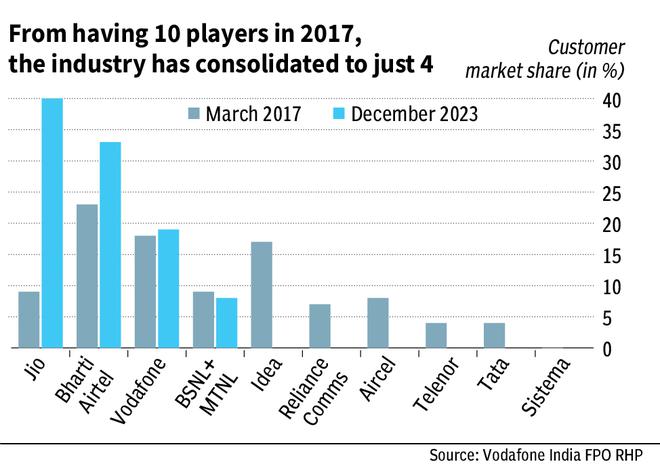

The Indian telecom industry with one of the world’s highest data traffic per connection offers immense growth potential. The Average Revenue Per User (ARPU) continues to be low which provides headroom for future growth. Industry revenue growth has accelerated after FY19 with CAGR of 13 per cent (FY19-23), compared to just 1.4 per cent during FY13-19. Industry consolidation (number of service providers has dropped from 10 in 2017 to just 4 in 2023) augurs well for future pricing growth.

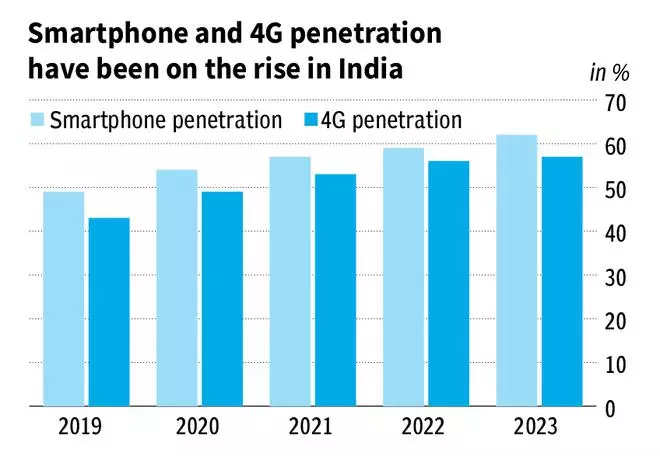

Growing availability of affordable smartphones, gradual reduction in data tariffs and rising income levels have contributed to the increasing penetration of smartphones and 4G in India

The industry’s revenue witnessed a decline of negative six per cent CAGR during FY16-19 due to heightened competitiveness and pricing pressure. Since FY19, revenue has been on a steady rise with revenue CAGR of 13 per cent during FY19-23.

India’s data traffic per mobile connection is higher than that of China despite the ARPU being less than one-third. This disparity provides headroom for future price growth benefitting the industry.

The industry has consolidated from having ten players in 2017 to just four in 2023. Jio and Bharti Airtel lead the way with 40 per cent and 33 per cent market share respectively.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.