Chief economic advisor V Anantha Nageswaran has come up with a document named The Indian Economy: A Review, which takes stock of the state of the Indian economy over the last ten years. As per the document, the Indian economy is overcoming a reluctance towards lending and entering a phase of investment recovery. Here are four charts depicting the investment trends in India.

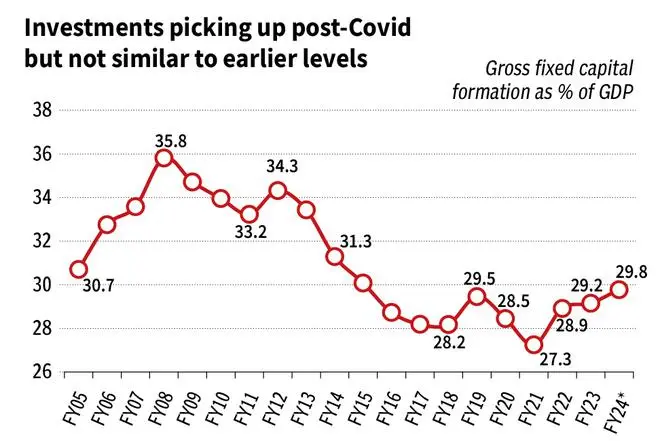

While Gross Fixed Capital Formation (GFCF) as a percentage of GDP has grown from around 27.3 per cent in FY21 to 29.2 per cent in FY23, it is yet to reach the levels seen in 2008 at 35.8 per cent.

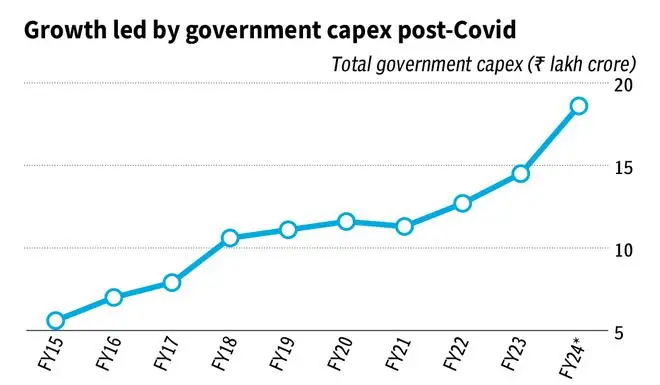

Amidst the balance-sheet retrenchment period in private corporates, the government took on the mantle of leading capex growth, increasing it from ₹5.6 lakh crore to ₹18.6 lakh crore during FY15 to FY24 (budgeted estimates).

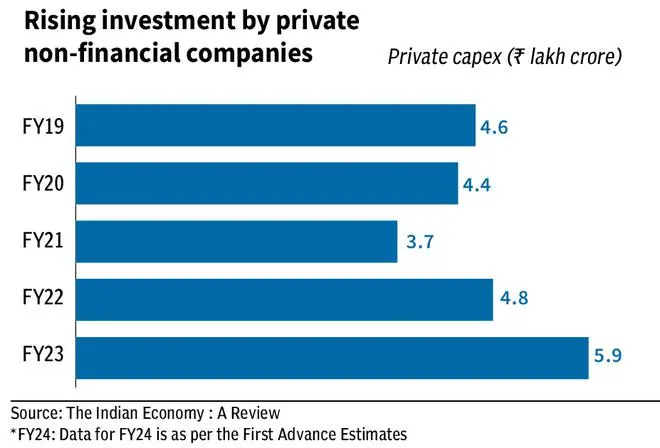

As per Axis Bank Research, capital expenditure by private non-financial companies has grown from ₹4.6 lakh crore to 5.9 lakh crore during FY19-23.

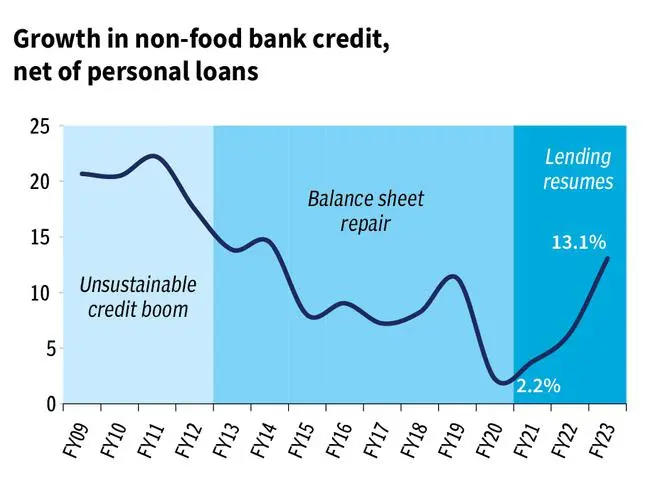

The non-food bank credit growth declined from more than 20 per cent in 2008 to 2.2 per cent in FY21, which, however, rose to 13.1 per cent in FY23.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.