The findings of the two-year investigation conducted by Hindenburg Research, presenting evidence that Adani group has engaged in brazen stock manipulation and accounting fraud in the group’s seven key listed companies over the course of decades, led to a bloodbath in Adani group stocks. Of course, the Adani group issued a detailed rebuttal to the allegations of “stock manipulation and accounting malpractices”, dismissing all allegations and terming the report as an “attack on India”.

The report raised questions on the financials of Adani group stating that there is an 85 per cent downside purely on a fundamental basis owing to sky-high valuations. It stated that key listed Adani companies have also taken on substantial debt, including pledging shares of their inflated stock for loans. Another key concern was appointment of Adani family members as top leaders, resulting in placing control of the group’s financials and key decisions in the hands of Adani family members. It also stated that Adani’s seven key listed entities collectively have 578 subsidiaries and engaged in a total of 6,025 separate related-party transactions in fiscal 2022 alone.

Interest of investors

These events have refocused attention on governance issues in the Indian corporate sector. It would be interesting to see how the large block investors like mutual funds voiced their opinion on proposals like related-party transactions, appointment/ reappointment of directors, changes in capital structure, etc., for Adani group companies.

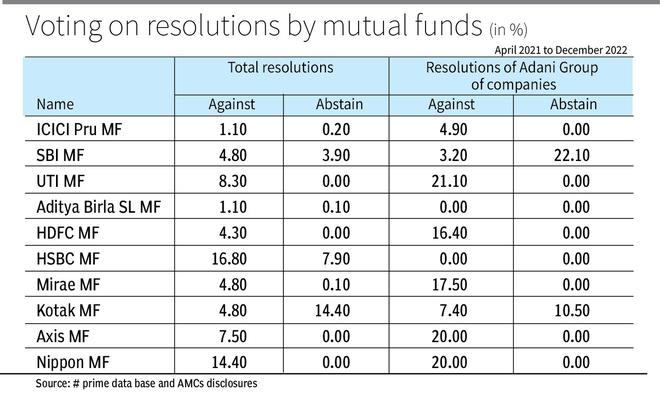

The Table presents how top mutual funds voted on all resolutions versus the ones of Adani group of companies for the period April 2021 until December 2022.

Mutual funds have great potential for active corporate governance compared to other investors. As per the regulations governing mutual funds, each mutual fund has its own board of trustees who are legally bound to represent the interest of the investors/unit-holders. The securities market regulator has specifically emphasised the role of mutual funds in the corporate governance framework.

In the past, SEBI has prescribed guidelines for the votes cast by mutual funds, which require them to disclose their general policies and procedures for exercising the voting rights in respect of shares held by them on their respective website as well as in the annual report distributed to the unit-holders from the financial year 2010-11.

In 2014, another pivotal step was taken, mandating mutual fund companies to disclose their voting patterns every quarter, on resolutions of the companies in which their schemes had invested. This resulted in an increase in the percentage of resolutions in which mutual fund companies voted. During 2014-2022, around 40 mutual funds exercised 4-lakh plus votes. However, at the industry level, most voting appears to be with the management. In around 10 per cent of cases mutual funds preferred to abstain instead of voting the proposals.

Mutual funds were criticised for watching from the fence and not actively voicing their concerns. A significant regulatory development for making mutual funds responsible corporate stakeholders was a circular issued by SEBI in March 2021, making voting on corporate resolutions compulsory for mutual funds.

The quick analysis presented in the Table reveals two things: mutual funds have generally become more active in “voicing than walking”, and when it came to Adani group of companies, some of them did express concerns.

A few of the mutual funds voted against the resolutions for increasing the borrowing limits for the Adani group, citing that the limit sought is high and there is no clarity on the potential usage of funds. However, many voted for it stating that the terms and conditions are not detrimental to company’s long-term business prospects and are in line with requirements. AMCs like Mirae and Nippon stand out for opposing all such resolutions pertaining to borrowing limit extension.

Aditya Birla voted for all related party transaction resolutions regarding the Adani group. In the rationale given by the mutual fund, it has stated that the proposals are in line for growth of the company, while saying that more disclosures are needed. Looks like the benefit of doubt has been given to companies when they provided insufficient information. HDFC MF and Nippon MF stood out for opposing all related-party transaction resolutions with respect to the Adanis, stating that the proposal is open ended and includes providing financial assistance with a promoter group entity.

Appointment of directors

Mutual funds also had different takes on the appointment of directors, especially the family members. ICICI PRU majorly voted for the appointment/ re-appointment of Adani directors citing that the director holds necessary experience and education to add value to the board. HDFC MF opposed quite a few appointments of director including that of Rajesh Adani, stating that it expected directors to take their responsibilities seriously. Rajesh Adani attended just three out of eight board meetings in FY22 and 12 out of 23 board meetings in the last three years.

Aditya Birla MF took the opposite stand stating Rajesh is part of the promoter family of the company and Adani group, provides strategic direction and helps with the long term growth plans of not just the company but also the group. It too noted his lower participation in meetings, and highlighted that it is important for him to remain as part of the company board. Interestingly, Aditya Birla voted for all the resolutions relating to appointments. In the same case, Kotak MF refrained from voting stating that it cannot opine on individual capabilities. Axis too opposed the appointment Rajesh Adani. Nippon opposed all such appointments related resolutions. SBI MF did not vote on many of these resolutions.

Globally, the role of mutual funds in corporate governance is heavily researched, in identifying reasons such as cost-benefit for the mutual fund, conflict of interest and affiliated relationships, . Such studies are needed in the Indian context too.

The writer is Professor & Dean (Academics), School for Securities Education, National Institute of Securities Market. Views are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.