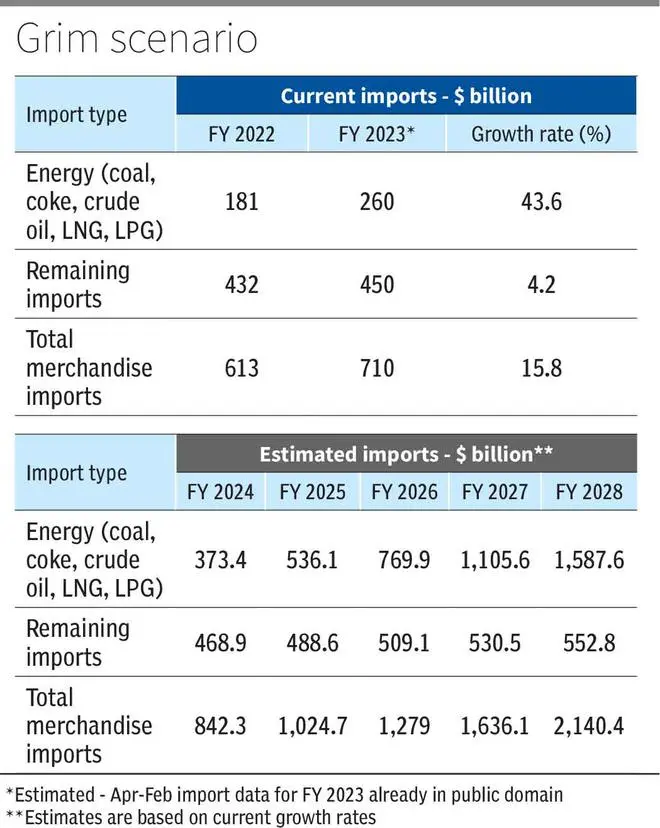

India’s energy imports are estimated to grow 43.6 per cent in FY2023 over the previous year. Energy imports include coal, coke, crude oil, LNG, and LPG.

Energy-related products dominate India’s import basket and account for 36.6 per cent of the total merchandise import bill. India’s energy import bill for FY23 is estimated to be $260 billion.

High growth in energy-related imports is mainly due to the challenging external environment. If the present energy import growth rate continues, the energy import bill will exceed the bill for all remaining merchandise imports in the next two years. And the energy import bill will exceed the $1-trillion mark by December 2026. The situation will look worse if the import value of goods like photovoltaic cells and Lithium Ion batteries required for clean energy is added.

Currently, four factors are leading to a surge in the price of oil, coal, and other energy sources. These are the disruption of oil supply chains due to the US sanctions on Russia post the Russian invasion of Ukraine and the weakening of the US-Saudi Arabia 1970s deal that led to the dollar becoming the world’s reserve currency and leading to the sale of oil and currencies other than the dollar.

The remaining two issues are high inflation in developed countries, including the US, Canada, Germany, and the UK, and the US effort to create alternate supply chains excluding China. As these issues may linger long, the price rise may be here to stay.

Petroleum crude and products: The estimated values of petroleum imports for FY 2023 are $210 billion. This includes crude oil with an import value of $163 billion and LNG and LPG of $17.6 billion and $14 billion, respectively. Crude imports grew by 53 per cent over the last fiscal.

India bought crude from various countries. The top suppliers are Iraq ($36billion), Saudi Arabia ($31billion), Russia ($21billion), UAE ($17billion), the US ($11.9billion). Imports from Russia zoomed by 850 per cent over last year.

India paid prices ranging from $90-92 per barrel for imports from Iraq, Russia, and the US. In comparison, it paid the price ranging from $101-103 per barrel for imports from Saudi Arabia and UAE. One tonne of crude equals 7.35 barrels.

India used its refining capacity to process part of the imported crude oil and exported products worth $96 billion. The key exports were diesel ($45 billion), petrol ($15 billion), and ATF ($16 billion).

Coke, coal: While coal is a significant contributor to CO2 emissions, it remains the critical fuel for electricity generation for most countries. Disruption in oil trade due to sanctions on Russia and the weakening of the US-Saudi Arabia 1970 oil deal put pressure on governments to secure long-term coal supplies.

India’s estimated coke and coal imports for FY2023 are $51 billion. India imports both coking coal and thermal coal. While coking coal is used as raw material for making steel, thermal coal is used to generate electricity.

The coking coal imports may exceed $20.4 billion, an 87 per cent increase over last year.

The most significant addition is a rise in average import price from $250/tonne to $370/tonne. India imports about 60 per cent of coking coal from Australia ($11.8 billion). We also bought coking coal from the US ($2.7 billion) and Singapore ($2.1 billion). Singapore does not mine coal.

Steam coal imports in FY 2023 are estimated to exceed $23.2 billion, a 105 per cent increase over last year. India imports about 59 per cent of steam coal from Indonesia ($13.6 billion). Other significant suppliers are South Africa($3.8 billion), Australia ($1.7 billion), and Russia ($1.6 billion). The most increase in imports is on account of the rise in prices. Country-wise price rise in 2022 over 2021-Indonesia — 22 per cent, South Africa 49 per cent, Australia 35 per cent, Russia 46 per cent.

Reducing imports

India must reenergize the exploration of local oil fields and enhance production through coal mines. Enhanced domestic production will substantially cut the energy import bill and improve the current account. India, in the 1980s, met 85 per cent of its crude oil needs mainly from ONGC’s Bombay High offshore oil field, but now we import 85 per cent of our needs. A renewed focus on exploration in India will help.

India has 26 sedimentary basins divided into the following four categories: Category I (7 Basins) — established commercial production; Category II (3 Basins) — known accumulation of hydrocarbons but no commercial production as yet; Category III (6 Basins) — indicated hydrocarbon reserves considered geologically oil-bearing; Category IV (10 basins) — uncertain potential may be prospective by analogy with similar basins worldwide; and deep-water reserves

Crude oil and natural gas production in India is from category-I basins and deep water areas. Hydrocarbon discoveries have been made in Category-II basins, but commercial production is yet to commence. India must evaluate its options to increase local production.

India must also focus on reducing coal imports. There’s not enough scope for reducing the import of coking coal as India does not have high-quality reserves. But, the import of thermal coal can be managed. Coal imports have increased mainly because of demand from new power plants that use only high-grade imported coal. Several issues favour imports.

These include the low quality (high ash content of 30-40 per cent) of Indian coal, the inability of Coal India Ltd to increase production and use technology to increase the calorific value of coal, and within-country transport restrictions. An early resolution of these issues will reduce the imports substantially.

India’s merchandise imports for the fiscal year ending March 2023 are estimated to touch $710 billion, up from $613 billion in FY2022, an increase of over 15.8 per cent over last year. Containing energy imports will ensure that the overall import bill does not strain the current account.

The writer is is founder, Global Trade Research Initiative

There’s not enough scope for reducing the import of coking coal

as India does not have high-quality reserves.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.