Post the Shriram group’s restructuring and the HDFC-HDFC Bank merger, the spotlight is on the Bajaj group. Will Bajaj Finserv get a bank licence?

This is the question doing the rounds. In fact, on Tuesday, WhatsApp groups were abuzz with a text message that three-four bank licences were likely to be awarded the next day. Candidates were Bajaj Finserv, M&M Financial Services and Poonawala Fincorp.

With the rationale for the HDFC-HDFC Bank merger squarely placed on tightening regulatory norms on non-banking finance companies (NBFCs), expect these heard-on-the-street messages to do more rounds in the coming months. But the question is whether the corporate developments at Shriram or HDFC groups should be seen as signs of change that will engulf NBFCs?

RBI Governor Shaktikanta Das dropped a subtle hint during the question-and-answer session following the Monetary Policy Committee meeting last Friday. He said NBFCs willing to restructure themselves can aspire for a bank licence.

Strong message

This sends out two strong messages.

First, he is implying that don’t look at a conversion from an NBFC to a bank in anticipation of grandfathering or hand-holding by the regulator. If a non-bank is keen on elevating itself to a bank, it better be prepared to stomach the unavoidable regulatory costs such as setting aside statutory reserve ratio, cash reserve ratio and meeting the priority sector norms.

In fact, even in the proposed merger of HDFC Ltd with HDFC Bank, the hope is that considering the size of the merger the RBI will accommodate HDFC group’s request on the regulatory dispensations. But there is no commitment or word from the regulator on this and finer details will emerge only as the two entities move closer with the merger.

The second, and a more interesting point, Das made is that if a non-bank wants to become a bank, it should go through the necessary corporate restructuring.

While Shriram group’s octogenarian boss, R Thyagarajan, may deny plans about seeking a bank licence, ongoing restructuring at the group — three-way merger of Shriram Capital, Shriram Transport Finance and Shriram City Union — makes it difficult not to believe that a bank licence is the logical next step for the group.

The broader point here is if becoming a bank depends on the two aforesaid points, are there enough candidates that will walk the path?

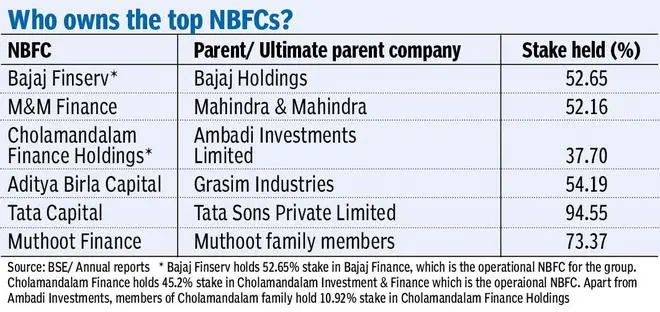

Leaving aside HDFC and Shriram groups, the list of leading NBFCs include Bajaj Finserv, Mahindra & Mahindra Financial Services, Cholamandalam group, L&T Finance, Tata Capital, Aditya Birla Capital and Muthoot.

The key advantage of Shriram and HDFC groups is that they don’t have an identifiable promoter. That’s not the case with the rest. Barring Muthoot, the other names form part of India’s largest conglomerates.

Until now, the RBI has been vocally against business houses entering the banking space. Even in the West, countries such as the US, the UK, Australia and Germany have separated the banking business from their conglomerates and now they function as standalone banking outfits.

Will Indian promoters be ready to give up their prized possessions, given that most of these names have well transformed themselves from captive NBFCs to what they are today.

What’s more, in cases such as Tata Capital, Bajaj Finserv, Cholamandalam group and Aditya Birla Capital, there is intermingled cross-holding of shares between the holding company and the financial services entities and between the NBFC arm and other non-financial entities of the group. Not that unwinding these shareholding positions is impossible. But it could be time consuming, tedious, highly cost ineffective (from a tax perspective) and, more importantly, will put the group in the spotlight bringing to the fore its otherwise private businesses or transactions. Plus, there is the cost of higher regulatory oversight and supervision that the groups were shielded from in the past.

The banking sector is getting crowded with the advent of small finance banks and fintechs. Cut-throat competition and the cost overhang could place the banking business at a disadvantage vis-à-vis NBFCs, more so for the well-established NBFCs, as they would be given a newcomers’ treatment, despite their pedigree.

To top it, will the promoters of NBFCs be willing to pare the stake to 26 per cent in order to be a bank (see table)?

This will be another critical question. Therefore, organically, to convert from an NBFC to banks isn’t easy, even if regulations may be nudging them to function like banks.

Acquisition route

The next option is going the acquisition way. But this is far from a cakewalk. Shriram group’s proposed acquisition of IDFC Bank in 2017 or IndiaBulls Housing’s deal with Lakshmi Vilas Bank didn’t cut ice with the RBI.

This despite they seeming perfect merger candidates on paper. The deals had to be called off. Passing through the regulator’s fit-and-proper criteria is a crystal maze that few have been able to crack.

In sum, the way NBFCs are owned and operated in India leaves little room for them to nurture their banking aspirations, unless they are willing to entirely cede control over the business.

More importantly, players such Bajaj Finance (arm of Bajaj Finserv), Mahindra Finance, Cholamandalam group and Muthoot operate in product segments and/or with customers where banks may remain hesitant to compete in the long-term. For instance, consumer finance is a space where banks, despite repeated efforts, haven’t been able to match Bajaj Finance.

Likewise, though banks have a presence in vehicle financing, barring IndusInd Bank (which has the advantage of Ashok Leyland Finance’s portfolio acquired in 2004) very few have been able to get a toehold in the space. These NBFCs hence hold immense relevance and importance.

If converted into a bank, they may just be a ‘me-too player’ losing their grip on the current business and product niche. This is something that the companies and the regulator may not be comfortable with, as it can have implications for economic growth, essentially because it would result in fewer lenders catering to such segments. Therefore, while on the one hand, the regulatory framework for large NBFCs is prompting them to function like a bank without a formal licence, the dynamics of their respective businesses and ownership structure do not incentivise them to become a bank.

Therefore, unlike what’s being speculated now that there could be more NBFCs converting to banks, the HDFC-HDFC Bank merger may just be a one-off deal.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.