The agricultural commodity futures market has had a chequered history. It has faced setbacks due to government control, intermittent as well as extended suspension. While this derivative instrument appears to have lost sheen for the farm sector, options can gain ground in agri-commodities.

As instrumental in price discovery and risk management, options are beneficial to small agro-enterprises since they need not maintain a margin account, unlike the futures. Options are like price insurance akin to Minimum Guaranteed Price bought or sold by paying only a one-time option premium.

Farmer producer organisations (FPOs) can buy a put option to sell their commodities, by paying a put premium. In contrast, solvent extractors or processors, market agencies, and bulk buyers can buy a call to procure underlying commodities by paying a call premium.

Non-agri options traded on a leading commodity exchange in India have recorded 44 per cent (notional) turnover with a CAGR of 277 per cent between 2017 and 2022 (November 24).

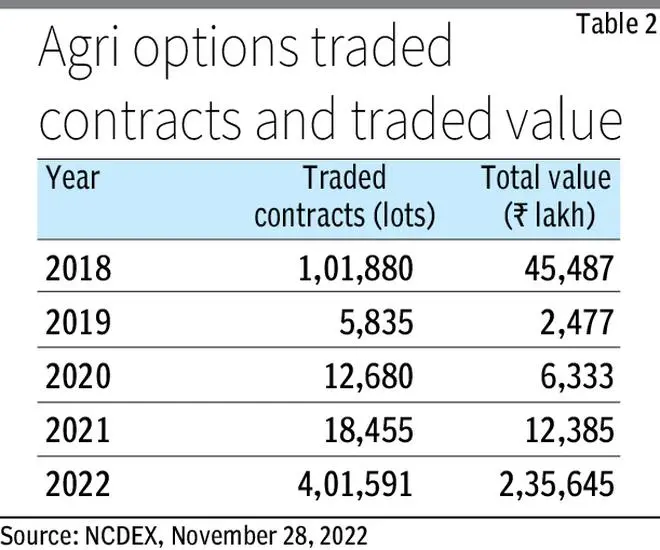

While non-agri options have gained traction (see Table 1), it is not the case for agri. For instance, agri-options traded value reported an insignificant 1.14 per cent of the total trade value on the NCDEX. However, the average daily turnover touched ₹1,094 lakh in 2022 (November 25) from ₹194 lakh in 2018 (see Table 2) with a CAGR of 52 per cent. Therefore, agri-options present a silver lining amid a gloomy outlook.

What are changes needed on options contracts to increase trade volume, open interest, liquidity, and increase participation?

Slew of concerns

First, agri-options follow the compulsory delivery logic embedded in the contract design. Therefore, in-the-money (ITM) [for the call, the underlying price is higher than the call strike price, and for put, the put strike is higher than the underlying price] and close-to-the-money (CTM) option strikes have to be settled with the compulsory delivery option if the option holder exercises the right (which is not an obligation for the holder).

Second, the right to exercise comes with an obligation to maintain margin amounts equivalent to the futures contract held with the exchange members.

This defeats the purpose of options where the buyer pays a limited premium for hedging the price risk. In CDO, CTM and ITM holders are levied with the futures contract equivalent margin if the option contract approaches expiry, known as pre-expiry margins ranging between 20-30 per cent. But the exchange members make the clients pay 100 per cent equivalent margin before the option approaches the expiry. As a risk management practice, the option holders pay a premium plus a 100 per cent margin even if they want to opt for not executing the right at the expiry.

Third, the problem with compulsory delivery logic gets further expounded when the options strike price appears as a borderline case that is out-of-the-money (OTM) but remains near CTM. It can ascend to ITM once the underlying futures final settlement price (FPS) is declared.

Fourth, one can square off when one has an opposite position in the exposure underlying the futures. Most participants avail of this by avoiding physical delivery. But there are no spread margin benefits accrued to the participants.

However, there is uncertainty about whether the strike will approach the CTM/ITM. This further complicates the option writer’s situation during the expiry. For example, a call writer strike reaches deep ITM, which implies that if the holder calls for execution, the writer must deliver goods.

Fifth, the writer needs to procure goods from the market and dematerialise them in the exchange-accredited warehouse. The writer should be ready before expiry to tender against the holder’s call.

But what will the writer do with goods if the call holder opts not to exercise the right? Similarly, the put writer needs to keep funds ready before the expiry of ITM puts, but the situation of the put writer worsens if the put holder does not exercise the right.

Way forward

First, agri-value chain participants need derivatives that are less complex and efficient for market entry and exit. Making options efficient would help agri-value chain participants manage and hedge their exposure in the physical market.

Converging options to futures before the expiry is as good as the underlying futures settling for physical delivery.

Commodity Derivatives Advisory Committee (CDAC) should consider this and help the exchanges introduce changes to the agri-options contract design specifications: margining system, position limits, membership fees, and delivery logic.

Second, indicators such as put-call ratio, delta, max pain, etc., can provide an ex-ante view to the market participants and help them chart trading strategies. Broad-based multiple options contracts need to be launched by the exchanges using the liquidity enhancement scheme.

Third, agri-options cannot mimic the trader’s view of equities. Therefore, exchanges need to develop a robust microstructure and drive the financialisation of agri-derivatives by adopting benchmarked practices followed by global bourses.

To sum up, the agri-commodity exchange can offset 60-70 per cent volume loss due to the extension of futures suspension on seven active contracts by redesigning agri-options and buoying up the option market mechanics in agri-commodities.

Dey is faculty member of Agribusiness Management group of IIM Lucknow. Jagdeep is an entrepreneur. Views expressed are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.