Kashish Shah

A big move for India’s road to ‘net-zero’ carbon emissions is currently being contemplated by the government. Reportedly, an expert committee appointed by the Union Power Ministry has tabled a plan to stop new coal-fired capacity additions. This follows India’s pledge at COP 26 to have net zero emissions by 2070.

The committee, headed by former Central Electricity Authority (CEA) chairman Gireesh Pradhan, found the addition of low-cost renewable energy capacity would handle the expected growth in electricity demand. It also found the overall coal fleet was underutilised, averaging 55 per cent capacity utilisation. The growth in demand would improve the utilisation of the existing coal fleet.

With the emphasis on accelerating the decarbonisation of India’s power system, the committee recommends replacing retired capacity with technologies that could operate flexibly to support integration of 450GW of variable renewables (VRE) by 2030.

As solar generation is available only during the day and wind patterns are highly seasonal and intermittent, the power system needs to evolve and modernise to respond to grid stability challenges with a growing share of VRE.

Power storage such as batteries and pumped hydro, aligned with conventional thermal (gas and coal) and hydro units could operate as peakers to provide energy to the grid.

Flexible generation

How do flexible generation sources integrate?

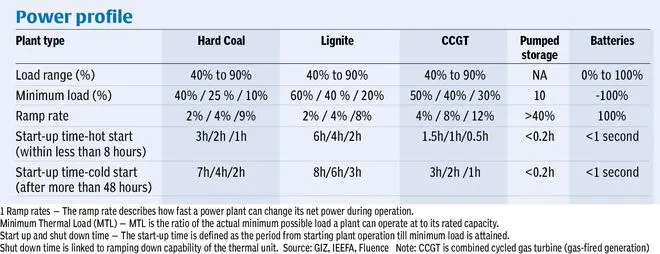

Flexible generation is characterised by the ability to quickly start up, rapidly ramp up and ramp down the generation, then just as quickly shut down. The accompanying table compares the flexibility of flexible generation sources.

Gas-fired power plants (CCGT) in general rate better on flexibility parameters with quicker ramp up and ramp down rates and minimum generation levels.

As shown in the table, the CCGT plants have greater ramp rates and shorter start up times but for higher minimum loads. CCGT plants can ramp up net generation at 12 per cent per minute compared to coal and lignite, 9 per cent and 8 per cent for respectively. CCGT plants can operate at a minimum load of 30 per cent (coal and lignite, 10 per cent and 20 per cent).

In recent years, economic constraints -- primarily the lack of a domestic gas supply -- have limited the 25GW of gas-fired capacity to extremely low utilisation, below 20 per cent.

In terms of flexibility, battery storage is the most proven technology to provide fast ramp-up and ramp-down energy dispatch and fast frequency service. Batteries ramp-up to full load in a minute and can also absorb excess power from the grid.

Battery market charging up

In our view, recent market and regulatory developments indicate India’s battery storage market could boom in no time. Continuing a decade-long deflation in costs, solar plus batteries are cost competitive with new coal-fired plants in markets such as the US and Australia, where battery storage development is burgeoning.

In India, there is a similar prospect for a surge in uptake of battery storage as the learning-by-doing experience deepens as new projects, backed by tenders from government-owned entities such as NTPC and Solar Energy Corporation of India (SECI), are executed.

ReNew Power, one of the biggest renewable energy developers in India, and Fluence Energy, a leading battery technology provider, have announced a joint venture to develop a 150MWh storage facility in Karnataka. ReNew Power has won numerous RE plus storage tenders and the battery project will play a key role in delivering firmed RE capacity.

The cost of batteries could reduce further with local manufacture.

The government is striving to support the localisation of batteries’ value-chain with a Production Linked Incentive (PLI) scheme worth ₹18,100 crore ($2.47 billion) for 50GWh of battery storage for electric vehicles (EVs) and stationary battery storage. The tender has been oversubscribed 2.6 times with bids received for 130GWh of battery manufacturing capacity.

The interested parties are Reliance New Energy Solar, Hyundai Global Motors, Ola Electric Mobility, Lucas-TVS, Mahindra & Mahindra, Amara Raja Batteries, Exide Industries, Rajesh Exports, Larsen & Toubro, and India Power Corporation.

Optimal use of power assets

CEA estimates 27GW/108GWh of battery storage capacity will be required to integrate 450GW of VRE by March 2030. Optimised power assets, both energy and grid services, is key for transitioning to a modern and cost-effective power economy.

Coal and gas-fired power with favourable cost economics could be retrofitted to operate flexibly, enabling a diversified pool of assets to compete to provide energy and grid ancillary services.

A recent report from Wartsila recommends regionally co-optimising energy and ancillary services, simultaneously creating two different value (revenue) streams, bringing down system level cost and potentially driving investment into the assets that could provide flexibility.

The writer is with IEEFA India

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.