Recently, Rajasthan and Chhattisgarh announced a reversion to the Old Pension Scheme (OPS) for their staff in lieu of the New Pension Scheme (NPS, now called the National Pension System), because NPS is felt to be uncertain and inadequate. OPS has a higher fiscal cost, wherefore the idea of NPS originated. But how costly is the shift back to OPS?

First, a brief introduction. OPS is a “defined benefit” scheme, where the first pension is 50 per cent of the employee’s final salary, followed by indexed dearness relief. This was OPS in its original form, but court interventions and policy changes like One Rank One Pension added various enhancements. Unlike many global defined benefit schemes, there are no contributions for the government’s OPS and the whole cost is borne by the employer. Also, it is a “pay as you go” or unfunded scheme since the government pays the pension when due without making any provision while it accrues.

Related Stories

OPS, NPS and the AP alternative

The old pension system is fiscally onerous and the NPS niggardly. The AP govt’s formula is worth looking atOPS with its modifications was felt to be fiscally unsustainable in the long run. So, a new scheme was devised by the Vajpayee Government for new government recruits since 2004. The Central government and most State governments had adopted it.

NPS is a “defined contribution” scheme. Throughout the career of the employee, a monthly contribution (partly by the government and partly deducted from the salary of a working employee) is made. This accumulates with investment returns to fund pension payouts after retirement. Ten per cent of salary plus dearness allowance (DA) is deducted as employee’s contribution, along with a government contribution of 14 per cent (till recently/still in some States, 10 per cent) of salary plus DA.

The total amount contributed each month accumulates with investment returns based on market conditions (hence the uncertainty). At the time of retirement, the corpus (total of every year’s contributions plus the investment returns) is used to purchase a fixed annuity, with an option to withdraw a portion as lumpsum.

An illustration

For a theoretical salary including DA of ₹100, the government deducts ₹10 from the employee’s salary, adds ₹14 as government’s share and pays ₹24 to the pension fund. For the government, this is equivalent to an outflow of ₹114 with the ₹14 being its contribution to the scheme; for the employee, this is equivalent to accruing an inflow of ₹114, though the employee receives only ₹90 now; ₹10 of salary is employee’s contribution to the pension scheme.

When asked about the fiscal cost of reverting to OPS, the PFRDA said that OPS and NPS are not comparable and that “you can compare apples with apples only.” True. But, if NPS is a basket of apples and OPS is a basket of oranges, how big should a basket of apples be such that it is equivalent to a basket of oranges? This article attempts to estimate how much the contribution in NPS should increase such that it would be sufficient to pay for an OPS.

Mathematically, the terminal value of the corpus is the sum of a geometric progression, based on salary growth, duration of employment and investment return. Post retirement, the present value at retirement of the pension payments under OPS is calculated using a geometric progression with step increases at various points; length of the progression varies with life expectancy. The mathematical equations were programmed into a statistical model to assess the fiscal cost of reverting to OPS from NPS.

To begin, a few parameters are assumed.

Pre-retirement:

Salary grows at a random sample value between 12-16 per cent per annum throughout the career. This growth comes through DA, increments, promotions, and periodic increases. (This was arrived at by looking at the actual salary growth of the lowest paid government employee and an IAS entrant under the Fourth Pay Commission to the salary of the lowest paid government employee and a Secretary Rank IAS officer under the Seventh Pay Commission, which was 11.2 per cent and 16.7 per cent, respectively.)

Length of a career varies from 27 to 35 years.

Career investment return is a random sample value between 8-11 per cent per annum (returns on NPS since inception for States is 9.6 per cent per annum: PFRDA Pensions Bulletin March 2022).

Government contribution, 10 per cent (Rajasthan/Chhattisgarh), 14 per cent (Centre) throughout.

Employee contribution, 10 per cent.

Post-retirement:

Government’s cost of capital is 7 per cent.

Mean expected life span from age 60 is 18.6 (Rajasthan), 15.4 (Chhattisgarh), 18.2 (India) [SRS Life Table (2014-2018), Census of India].

Entire corpus used for pension with no lumpsum withdrawal.

For OPS: Dearness relief of 5 per cent per annum., periodic increases of pension of 15 per cent every decade; first pay revision assumed in the 5th year after retirement; second pay revision in the 15th year.

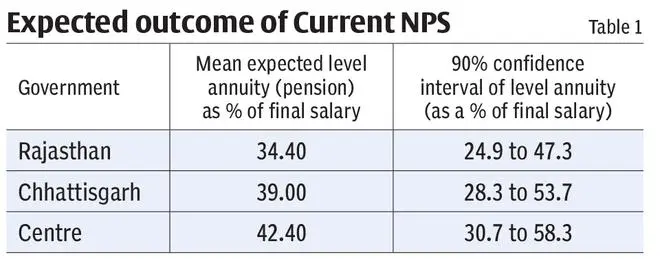

Running 1,00,000 Monte Carlo simulations for a single employee on R statistical software, produces the results in Table 1.

Variation between Rajasthan and Chhattisgarh is due to different life expectancy. The mean expected pension for the Central Government is significantly higher because of the higher government contribution, though the life expectancy is more than Chhattisgarh and similar to Rajasthan.

NPS as it stands gives a mean level pension of 34 per cent (Rajasthan) to 42 per cent (Centre) of final salary and has a 90 per cent probability of being between 25-54 per cent (government contribution, 10 per cent) and 31-58 per cent (government contribution, 14 per cent) of final salary.

In contrast, OPS gives an increasing pension, starting at 50 per cent of final salary. OPS will definitely have a bigger present value of pension payouts. The question is, to meet this higher amount of pension, how much extra government contribution would be needed? This will be discussed in the next part of this article.

To be concluded

The writer is an economist and student of the Institute & Faculty of Actuaries, London

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.