Three developments over the past couple of months have put the global rice market in focus. First, the India curbed rice exports by banning shipments of fully broken rice and imposing a 20 per cent duty on white rice exports.

Second, Union Minister of Agriculture and Farmers Welfare Narendra Singh Tomar told the Rajya Sabha last week that due to deficient rainfall in some rice-growing States such as Uttar Pradesh, Bihar, Jharkhand and West Bengal, the cereal’s production may decline this season (July 2022-June 2023). In its first advance estimate, the Agriculture Ministry pegged kharif rice production at 104.99 million tonnes (mt) this season against 111.76 mt last season.

Third, Bangladesh has approached India for 0.5 mt of parboiled rice on a government-to-government basis to build stocks for its public distribution system. The move comes after Dhaka had scouted for supplies in Thailand, Vietnam and Cambodia. Another reason for the Sheikh Hasina Wajed government to turn to New Delhi is the price competitiveness of Indian rice.

Trade analysts are of the view that these are signs of a bull run in the rice market in early 2023. According to the International Grains Council (IGC), the rice sub-index has increased 15 per cent over the past year.

Lower estimates

Though Indian production has been pegged about 7 mt lower than last year, there are fears that the output could be even less. Though kharif rice procurement is 13 per cent higher till the week-ended December 10, analysts say this is because procurement in Chhattisgarh began a month early. The trade says a clear picture will emerge only by the middle of January.

The problem in rice production is not confined to India alone. Pakistan is among the worst affected with much of its paddy crop washed away in floods during July, the worst since 1961. The US Department of Agriculture (USDA) has projected Pakistan’s rice production at a 10-year low of 6.6 mt this season against a record 9.1 mt last year. Analysts peg the crop loss at 4 mt.

The scenario in China is not clear, particularly since it faced its severest drought in 61 years for nearly 70 days from July to September in the Yangtze region. Seven of the 13 major producing regions affected by the drought accounted for 48 per cent of the nation’s rice production in 2020. Research agency Fitch Solutions Country Risk and Industry Research has cautioned the trade saying China might provide a false sense of slackness in the market. The USDA has projected a 2 mt drop in China’s production, though fears are that the loss might be higher.

There have been problems with the paddy crop in Myanmar, Vietnam, Cambodia and Thailand which could result in supplies being affected in the global market. Drought in parts of Europe and the US will affect the rice crop in those countries with production dropping by 0.5 mt.

In Bangladesh, two of its three paddy crops have been affected. While the Aush crop was affected due to lower rainfall, the Boro crop was earlier damaged by flash floods. Dhaka fears the third crop — Aman — might also be hit and the Hasina Government is looking to import to ensure the neighbouring nation has ample stocks.

FAO projections

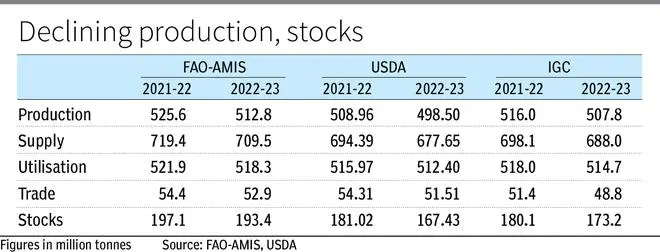

The Food and Agriculture Organisation’s Agricultural Market Information System has estimated global rice production to drop by over 12 mt, while the International Grains Council and the USDA project the output 9-10 mt lower. Trade analysts, however, say there could be a nearly 14 mt drop in production.

The three agencies have estimated the carryover stocks lower ranging from 3mt to 13 mt, which could trigger a bull run in the global rice market.

A major reason why the rice market will likely soar over the next few months is that the trade is one-tenth of the global production. In such a limited trade, any variation in production or supply could trigger volatility.

Rice prices have increased by 5-8 per cent since India imposed curbs on the cereal’s exports. Analysts say prices have more headroom to move up and there should be no surprise if they surge by another 15-20 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.