The Indian stock market ended the week on a negative note, with the Nifty 50 and the Sensex ending about a per cent down as bears prevailed over bulls. Even in this market, select stocks from the Nifty 500 bucked the trend.

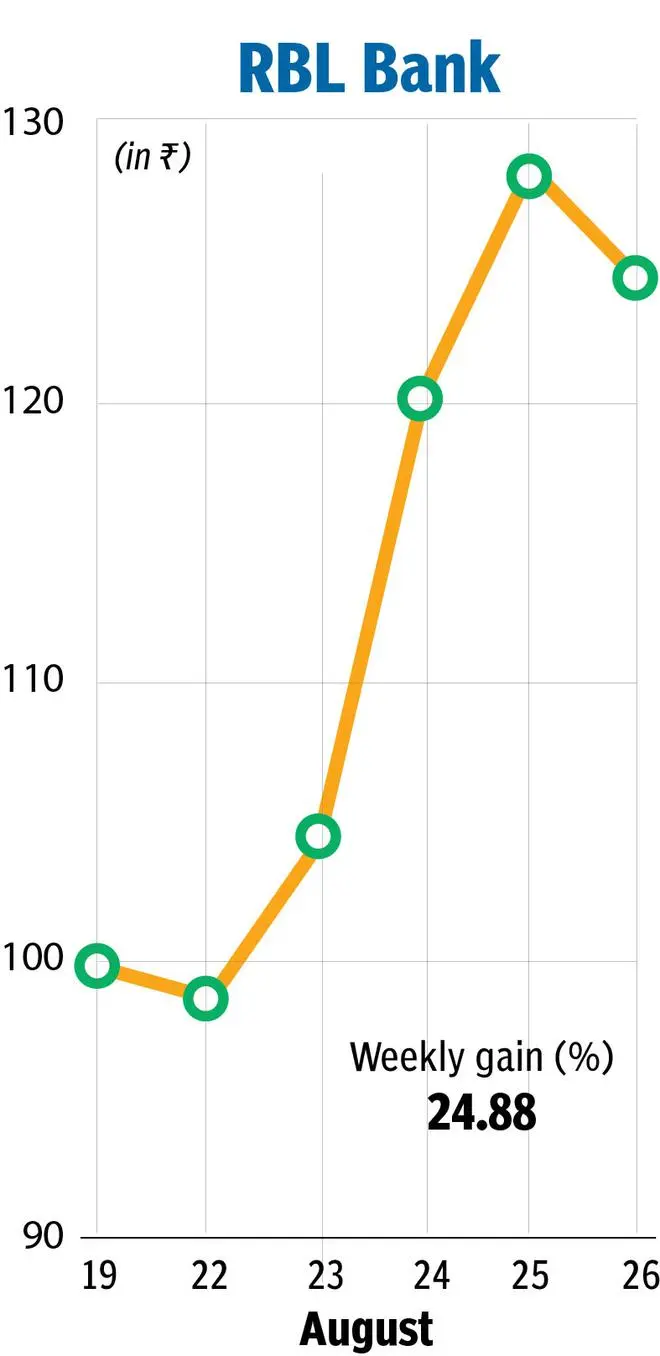

The stock of RBL Bank, one of India’s leading private sector lenders, gained a whopping 24.8 per cent this week. The stock hit the upper circuit on Wednesday and closed at ₹124.45 on Friday. The reason for this sharp rise was the retirement fund, College Retirement Equity Fund (CREF) buying an additional stake in the bank, through a bulk deal executed on August 24. Prior to this, the fund held a 1.16 per cent stake in the company. CREF operates as a non-profit organization offering investment options such as investment, insurance, and annuity products and serving communities in the United States.

RBL Bank, formerly known as Ratnakar Bank, is back in black, reporting a net profit of ₹201 crores in Q1FY23 vis-à-vis a net loss of ₹459 crores in Q1FY22. Net interest income stood at ₹1027.1 crores, up by 6 per cent from ₹969.5 crores in the same period last fiscal. Its net interest margin stood at 4.36 per cent.

As of 30th June 2022, the Bank has 502 bank branches and 1,302 business correspondent branches, out of which 289 are banking outlets.

RBL has been involved in a number of controversies in recent years. The bank’s troubles started when there was a change of guard at the helm, with then CEO Vishwavir Ahuja quitting unexpectedly in December 2021 and the RBI appointing an additional director, Yogesh Dayal, for the period of two years. Some analysts viewed this as an intervention by the government to save the private bank.

Even after a stellar week, the stock is still down 2.12 per cent year to date and 23.4 per cent for the last year.

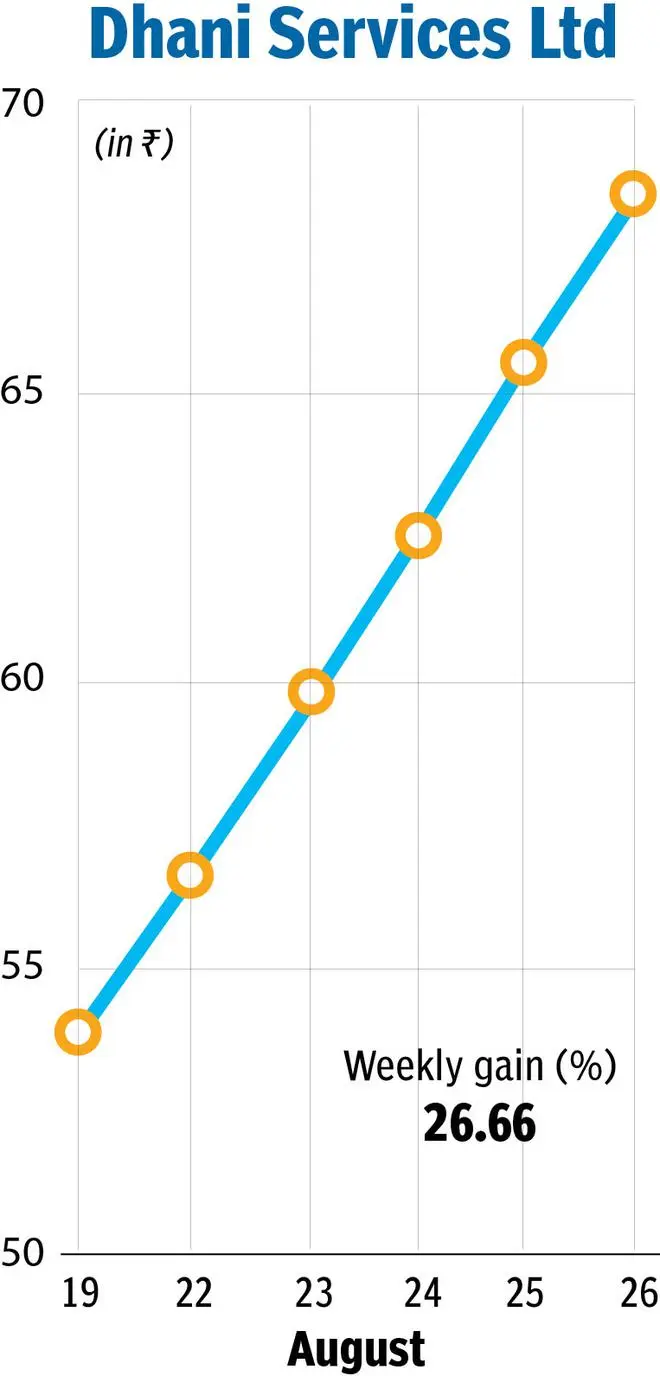

Another stock that fared better than the market this week is Dhani Services Ltd, a provider of healthcare and transactional finance offerings through its application ‘Dhani’. The stock rallied 26.67 per cent over the course of last week at settled at ₹68.40 on Friday. This was on the back of solid performance by the company in the June quarter. Standalone net sales were ₹25.90 crores in Q1FY23, witnessing a 151.7 per cent y-o-y increase from ₹10.29 crores in the corresponding period last year. Dhani Services swung to a net profit of ₹11.7 crores in Q1FY23, from a ₹0.57 crore net loss in Q1FY22.

The stock is still down 58.7 per cent year to date.

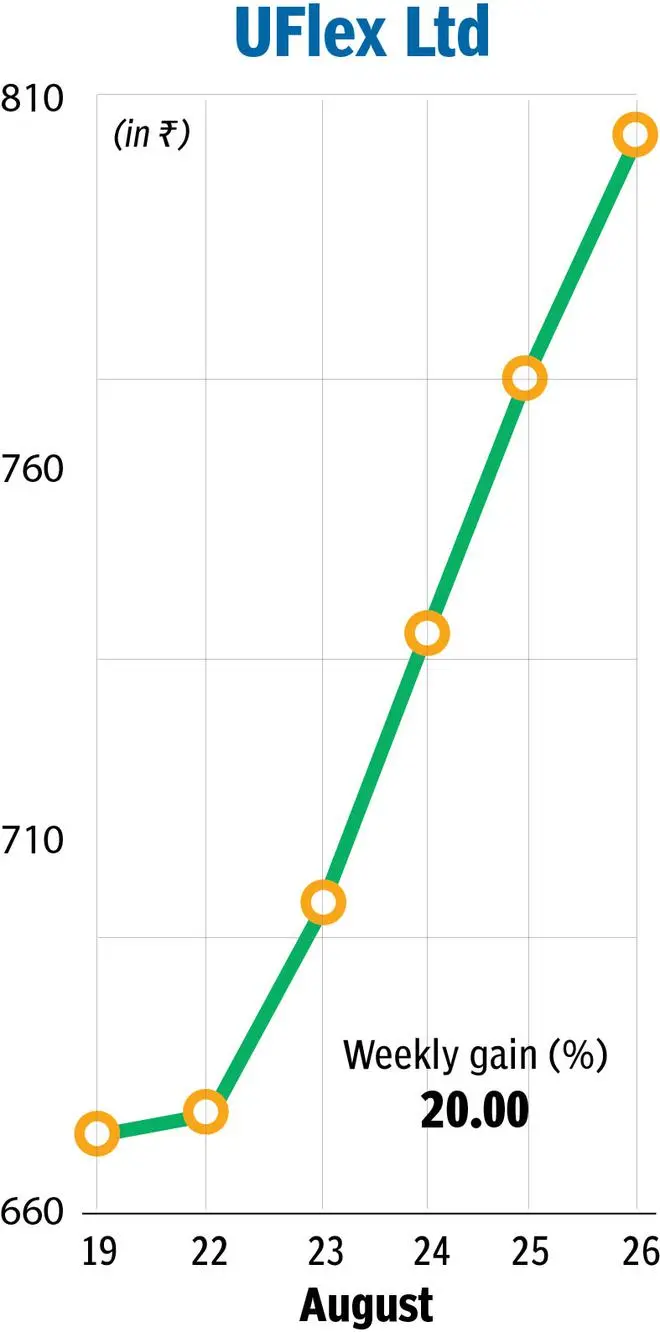

The other winner this week is UFlex Ltd. The stock of India’s largest flexible packaging company has gone up 20 per cent, and currently trades at ₹804.90. The stock is near its 52 week high of ₹811. The founder of UFlex Ltd, Ashok Chaturvedi, is known as the father of the flexible packaging industry in India and the company is also a global leader in polymer sciences. Revenues for the quarter experienced robust growth, standing at ₹4046 crores, up 46.5 per cent from ₹2761 crores reported in the same quarter last year.

During Q1FY23, EBIDTA rose by 44.3 per cent y-o-y to ₹725 crores. Net profit witnessed a 41.9 per cent y-oy increase from 264 crores in Q1FY22 to 374 crores in Q1FY23. The company also reported a 14.8 per cent y-o-y increase in total production output reaching 1,59,793 MT and Total Sales volume stood at 1,54,811 MT growing 15.7% y-o-y. It also estimated additional volumes to come from its new capacities in Dubai and Karnataka. The stock trades at 0.74 and 0.64 times its estimated FY23 and FY24 book values, respectively.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.