Even as Indian equities have delivered stellar returns post Covid, with several stocks seeing their price rise several fold over the last four years, there are still pockets of opportunity for investors eyeing a medium-term horizon. One such opportunity in the agri business space is Godrej Agrovet, which is part of the over $4-billion Godrej Group.

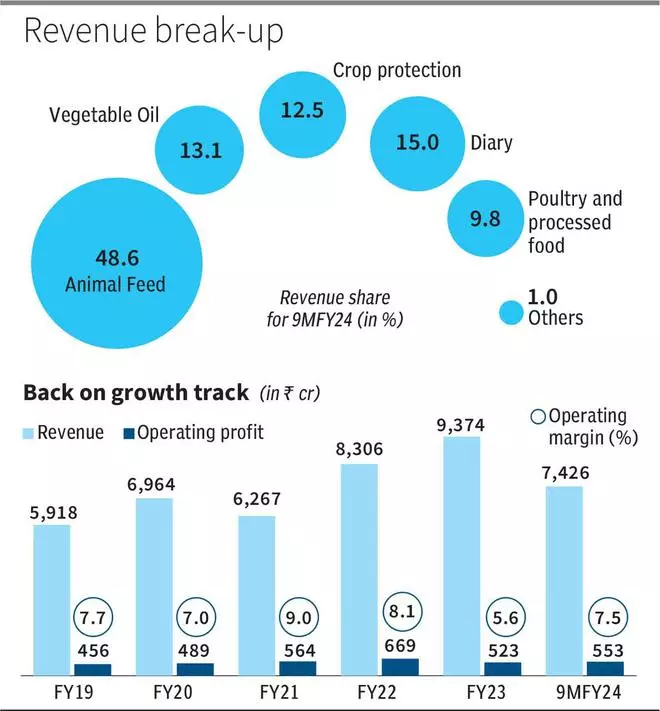

The company’s business can broadly be segmented into five key divisions: Animal feed business (accounting for nearly half the company’s revenue as of 9MFY24), dairy (15 per cent), vegetable oil (13 per cent), crop protection (12.5 per cent) and poultry processed food (10 per cent).

The company’s expansion initiatives in the crop protection segment, vegetable oil and dairy business will drive healthy growth in the medium term. At the current price of ₹485, the stock trades 28 times its trailing twelve-month earnings as compared to five year average of 30 times. We believe that the stock holds good potential over the next 2-3 years, as management is now consolidating the business with a clear vision to focus on businesses with strong growth potential, improve operational efficiencies and focus on bottom line improvement.

On a relative basis, the stock may appear fairly priced compared to industry. However, the reason for the same is the earnings compression witnessed over the last two years. With the profit growth expected to sustain at a healthy pace over the next couple of years, the stock makes for a good investment for those with a medium-term horizon.

Business

The group’s consumer foray started way back in 1897, through products such as swadeshi soaps. The group has since organised all its businesses and Godrej Agrovet is the agribusiness company from the Godrej stable.

Currently, animal feed business, which includes poultry, cattle and aqua feed, is the largest segment within Godrej Agrovet, accounting for over 48 per cent of the revenue (9M FY24). With over 30 manufacturing units and presence not only in India, but also in Bangladesh through its JV ACI Godrej Agrovet, the company is the largest compound feed player in the Indian market. Strong growth in fish feed segment and the commissioning of a new facility in Uttar Pradesh last year to cater to the North and East markets should support growth.

However, the challenge remains by way of regulatory moves such as allowing soymeal imports, which can risk short-term growth. Last year, the company invested ₹20 crore in Godrej Maxximilk Private Limited, which is into development of high-quality cattle embryo, post which the company announced that it had achieved new milestones in R&D and production.

The third largest segment — vegetable oil, wherein the company manufactures and sells Crude Palm oil and Palm Kernel Oil, accounts for 13 per cent of Godrej Agrovet’s revenue. The company is the largest manufacturer of oil palm and has a share of over 30 per cent in the Indian market. Interestingly, India imports over 97 per cent of its oil palm need.

Godrej, with partnerships with over 9,000 farmers across the country and a potential cultivation area exceeding 2 lakh hectares, is well-placed to capitalise on the huge local demand. The new refinery with a capacity of 400 MTPD and Solvent Extraction plant with capacity of 200 MTPD, and the commercial MoUs with various State governments — Assam, Manipur, Tripura, Nagaland and Odisha for palm plantation — will drive growth in this segment.

Plant protection chemicals segment contributes about 12 per cent to the company’s revenue. This includes Astec business which is the institutional business wherein the company does contract research and development (CRDO) for other large players. Besides this, the company also has a domestic formulations segment wherein it sells generic branded fungicides, herbicides and insecticides to end customers.

The portfolio also includes a wide range of products that cater to the entire lifecycle, such as plant growth regulators and organic manures. It is the world’s largest producer and marketer of Homobrassinolides, a plant hormone used to stimulate growth and increase yield. The company has started capital expansion projects worth ₹300 crore for expansion in Astec Lifesciences and is confident of strong revenue growth every year.

The dairy business under Creamline Dairy Products accounts for 15 per cent of the revenue currently. Sold under “jersey” brand name, the company is focussing on value added dairy products. The company has an aggregate processing capacity of 1.36 million tonnes per day and has strong presence in the South — Tamil Nadu, Andhra Pradesh, Telangana, Karnataka and Maharashtra. Last year, it expanded its packaging capacity, adding a new line, with which its capacity today stands at 70,000 litres per day. Value added products and capacity expansion should drive the growth in this segment.

Poultry and processed foods sold under Real Good Chicken and Yummiez brand account for 10 per cent of revenue. This division is a JV between Godrej and Tyson Foods, US.

Performance

In FY23, the company reported weak performance due to a few one-off reasons, such as adverse regulatory move to allow imports of soymeal, input price fluctuations as a result of which the operating profit margin took a hit. While revenue grew by about 13 per cent as compared to the previous year to ₹9,374 crore, operating profit declined by 22 per cent largely on account of raw material price increase.

However, in the 9MFY24, though the revenue growth was flat, the company has managed to grow operating profit by 21 per cent, thanks to healthy performance in the domestic plant protection chemicals business, dairy segment. Over the next two-three years, benefit from operating leverage and expansion in CRDO, dairy and animal feed should support sustainable growth in revenue and profits.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.