Stress in the banking sector is often tagged to public sector banks. While that’s not wrong, those in the private space have been equally vulnerable. Here, the spotlight is on five such names — Bandhan Bank, IndusInd Bank, RBL Bank, Ujjivan Small Finance Bank and YES Bank. These banks were once the market darlings and investors were willing to lap them up at any valuation, drawing support from their asset quality, reckoned best in class until FY19.

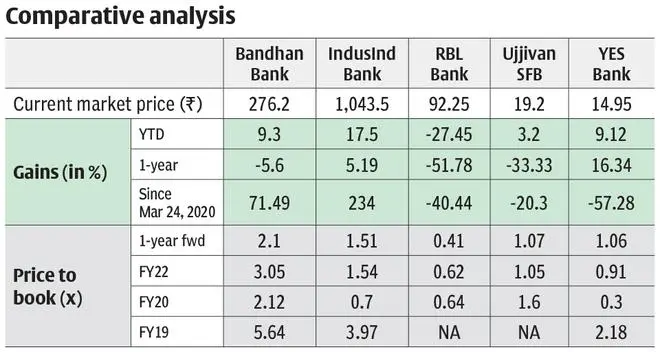

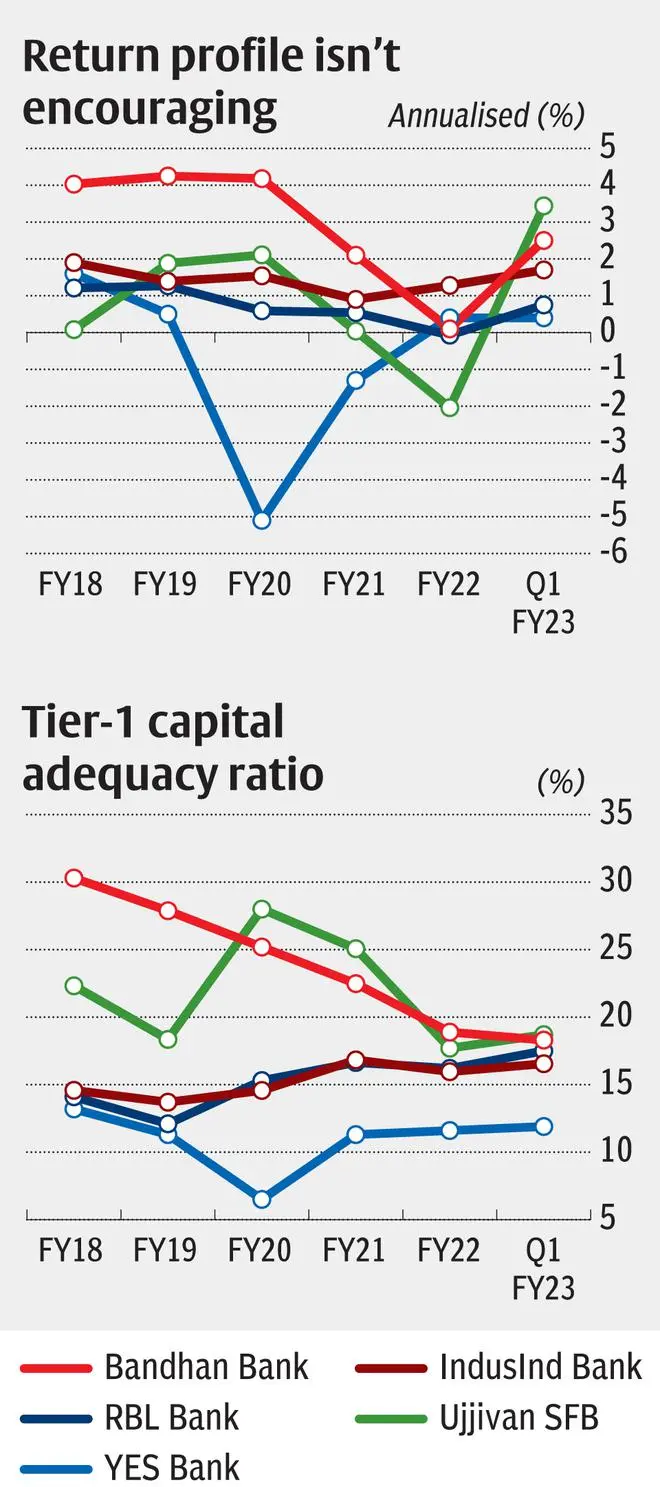

In March 2020, when YES Bank went belly up and the pandemic hit the system, it accentuated the pain. What’s more, IndusInd and RBL faced a temporary run of deposits, too, in early-2020 and within months the list of trouble across these banks started to get bigger. Barring YES Bank, the other banks have yet another common thread – their exposure to the microfinance (MFI) sector. With two back-to-back years of pain, even as the June quarter (Q1 FY23) results were somewhat convincing, the Street remains cautious with these names, given that their financials are still far from where it was, ahead of troubles knocking them down (see table).

We analyse each bank to see what went wrong and assess if they are out of the woods.

Bandhan Bank

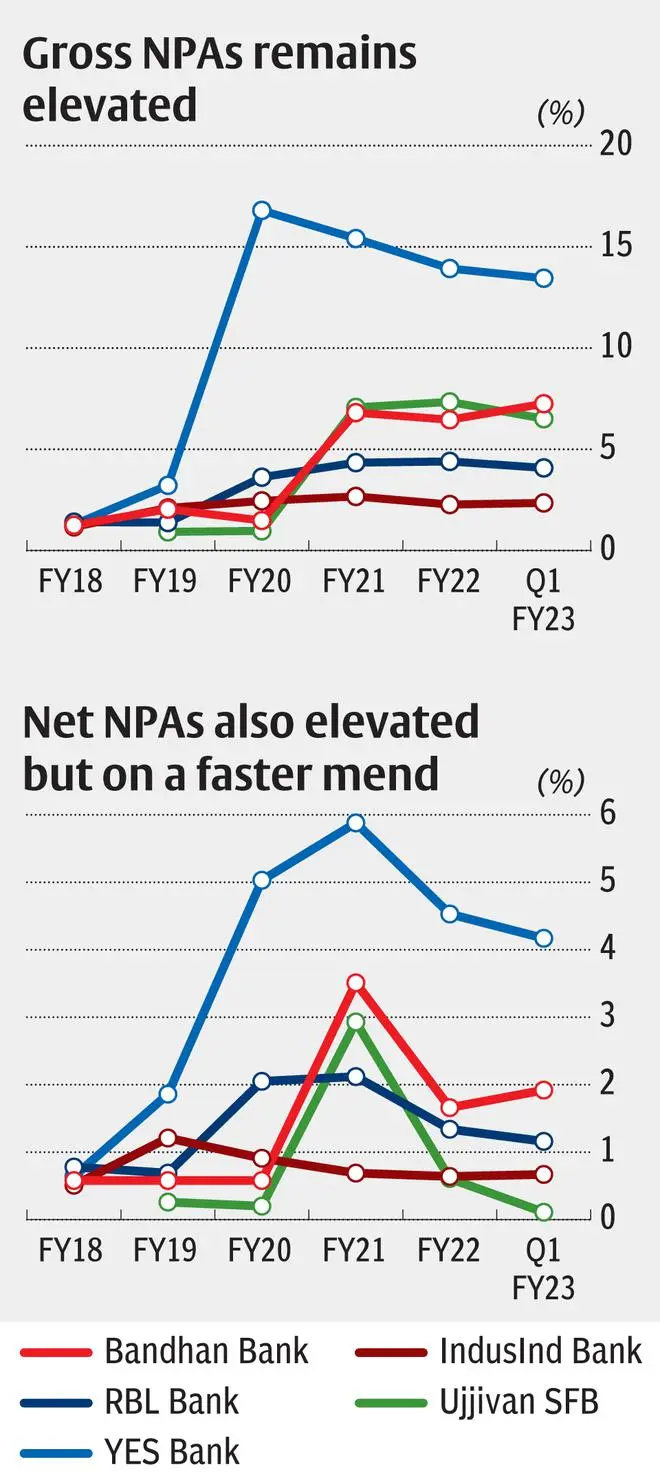

It was on January 10, 2019, when the bank took a hit on its books thanks to its ₹385-crore exposure to IL&FS that asset-quality cracks first surfaced. Chandrashekar Ghosh, MD and CEO of the bank, called it (the exposure to IL&FS) an experiment he wouldn’t repeat and made amends for it by acquiring Gruh Finance in a few months. From 2.4 per cent gross NPA in Q3 FY19, the number improved to 1.48 per cent in FY20 despite the floods in Assam that fiscal. But the pandemic disrupted the show again with gross NPA climbing to a five-year high of 6.81 per cent in FY21. In Q1 FY23, while the number eased by 93 basis points (bps) year-on-year, at 7.25 per cent gross NPA it doesn’t instil confidence.

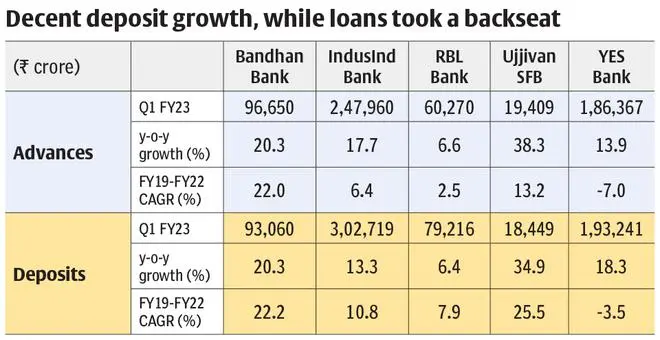

Its stressed pool of MFI loans at ₹12,100 crore (21 per cent of the book) is highest among peers and with slippages elevated from this pool, it doesn’t lend support to the overall asset quality. The good part though is the diversification plan playing out. Bandhan Bank’s share of non-MFI loans stood at nearly 40 per cent in Q1, up from 33.8 per cent a year ago. Loan growth too was brisk in the non-MFI segment at 42 per cent vis-à-vis MFI book growing at 9.2 per cent year-on-year in Q1 FY23. New lending norms for MFI loans and floods in Assam pushed back Bandhan from depending much on MFI loans during the quarter. It’s targeting 20 per cent loan growth in FY23 and the tide has turned favourable for MFI loans, according to the management.

Ghosh has guided for non-MFI loans to make up for 50 per cent of the total book by FY24 (versus earlier target of FY23).

Stock view: The mood around the bank remains bearish for reasons stated above. With collection efficiency still under stress (94 per cent in Q1 owing to floods in Assam), how Bandhan manages to grow its book in FY23 will play a critical role in shaping its financials. The pandemic has made it difficult for investors to predict the course of the bank’s balance sheet and Bandhan Bank is in a Catch-22 situation. If it aggressively pushes the non-MFI portfolio for growth, it could hurt the bank’s profitability and return profile, which have taken a hit since FY20. But if it dips into its comfort zone (MFI loans) to grow its book, at the cost of diversifying its book, the Street may not take it kindly.

Trading at 2.1x FY23 book, its valuations have eased since FY20. But the stock remains an expensive bet given the challenges.

IndusInd Bank

In FY18, it was trading neck to neck with HDFC Bank at over 4x price to book (one-year forward). The loan exposure of about ₹3,000 crore to IL&FS, revealed in September 2019, spoiled the party; it was the tipping point for more pain to follow. The bank’s gross NPA rose from 1.17 per cent in FY18 to 2.45 per cent by FY20.

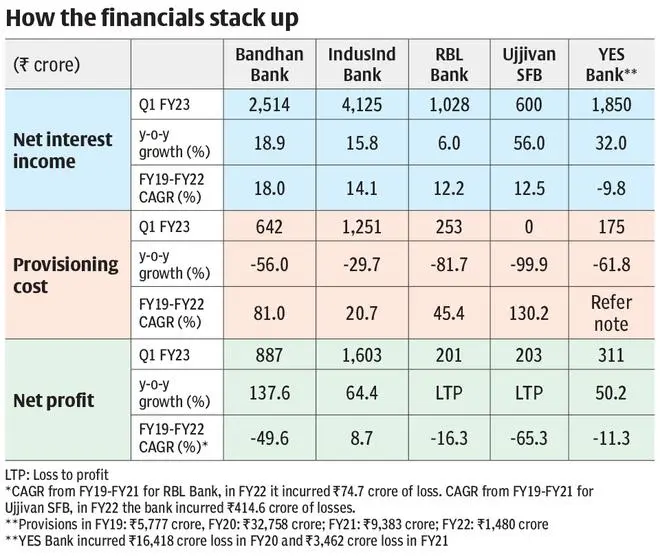

When Sumanth Kathpalia took charge as the bank’s MD and CEO on March 24, 2020, the YES Bank debacle was fresh in the minds of investors and depositors. IndusInd Bank was pushed to its lowest point and had to combat a run on deposits, unprecedented asset quality issues and slowdown in growth, due to an overall slump in the economy. To top it, there were constant speculations on whether the Hindujas (IndusInd Bank’s promoters) will still remain committed to their investment. Last year when the bank was hit with allegations of evergreening in the MFI portfolio, it came as a shocker. Yet, what sets IndusInd Bank apart from some of its peers is that FY22 was a comeback year where it managed to curb the credit cost at 2.9 per cent versus over 3.7 per cent in FY21 ; in Q1 FY23, it further eased to 2.1 per cent. Currently, the Street views the bank’s asset quality numbers with more confidence compared to two years ago, as the quality of its corporate book has significantly improved.

But the missing part for IndusInd Bank is growth. In FY22, its loan book grew at 12.4 per cent year-on-year, while it picked pace in Q1 FY23 at 20.3 per cent. That said, while Q1 numbers were the best in recent quarters, it remains a laggard when benchmarked against the bank’s pre-FY20 performance. Likewise, there’s more ground to clear with respect to asset quality. Gross NPA of 2.27 per cent remains elevated, though, on a net basis, at 0.64 per cent in Q1 FY23, it’s inching closer to pre-stress levels of 0.5 per cent. Loan growth and asset quality improvement will play a critical role in lifting the bank’s financials here on. The bank’s per share earnings at ₹59.5 hasn’t significantly taken off in the last five years.

Stock view: Whilethere is room for improvement, what’s convincing about IndusInd Bank is its ability to walk the talk, despite going through its fair share of internal troubles, including high manpower attrition. Therefore, even as a convincing turnaround is awaited, at 1.3x F23 estimated price to book, IndusInd Bank’s valuations appear attractive. The bank has guided for 15-18 per cent loan growth in the next two years. In Q1 FY23, loan growth came at 17.7 per cent — within the targeted range. Set to foray into the home loan space, how the rising interest rates affect the bank’s pricing ability will play a major role in shaping its financials.

RBL Bank

From being perceived as the next HDFC Bank in the making to now in the no-go zone, things flipped quickly for RBL Bank. In June 2019, it came to the fore that there could be lots of bugs in its corporate book. Within a year, the bugs turned into monsters, with the gross NPA more than doubling from 1.38 per cent in FY19 to 3.62 per cent in FY20. By FY22, it peaked at 4.4 per cent and eased marginally to 4.08 per cent in Q1 FY23. For a bank which took pride in having one of the strongest unsecured retail book, the pandemic revealed cracks on that front too. MFI loans and credit cards, both high-risk, high-return portfolios, accounted for nearly 30 per cent of the bank’s total book and slippages from these loans (₹3,610 crore) accounted for over half of the total slippages at ₹6,530 crore. On its part, the bank has been guiding for an improvement in asset quality since Q3 FY21. But the reality has been quite distant, and explains why the Street punished the RBL Bank stock. From its June 2019 high of ₹690 a share, it has corrected 87 per cent to now trade at ₹91.65 a share. Meanwhile, the bank ran into succession-related crisis in December 2021, when its then MD and CEO Vishwavir Ahuja stepped down. While the second-in-command Rajeev Ahuja was quick to fill in and the RBI also appointed an additional director, Vishwavir Ahuja’s untimely exit thickened the clouds of doubts around the bank’s loan-book quality and its future. The appointment of the resolution specialist R. Subramaniakumar (RS Kumar) last month as the bank’s MD and CEO added to the speculation, given his resolution background and his recent success with Dewan Housing. However, after the initial push-back, the stock has gained about five per cent since RS Kumar took charge.

Is this a sign of normalisation? Q1 FY23 results of the bank suggest so. Indicators such as provisioning costs, gross and net NPA ratios and share of stressed assets (down from 7.2 per cent in Q4 FY22 to 6.6 per cent in Q1 FY23) point at a gradual normalisation of the bank’s financials.

Stock view: Trading at 0.5x FY23 price to book, RBL Bank is near its all-time low in terms of valuations, which may tempt investors to look at the stock favourably. But in comparison to IndusInd Bank, it may be too early to call out a recovery in RBL Bank. For one, the overall loan growth remains rather muted (see table) and the bank is in the process of diversifying its retail presence to segments such as housing, vehicle loans and gold loans. These are highly competitive markets and in an increasing interest rate trend, how well RBL can balance between growth, risk management and profitability needs to be seen. Until the bank can convincingly demonstrate growth and a faster improvement in asset quality, the stock is strictly for the brave-hearts.

Ujjivan SFB

When a business model goes through an unexpected crisis, it can change the dynamics within the senior management. Ujjivan SFB is a perfect example. Samit Ghosh, Ujjivan Financial Services (holding company of the bank), roped in Nitin Chugh, former technology head at HDFC Bank, to lead Ujjivan SFB. Listed in December 2019, the stock became the market’s darling, trading at over 3x its one-year forward book value, despite the risk of concentrated portfolio. The bank drew over 75 per cent of its loan assets from MFI business. Hit by the pandemic, these loans became extremely vulnerable to asset-quality pangs and gross NPA, which was at less than a per cent till FY20, shot up to 7.07 per cent in FY21. The looming asset quality issues and certain operational differences between Chugh and Ghosh led to a fallout between the two, which ended with the former’s unexpected exit from the bank. This resulted in the bank’s stock price plunging to a low of ₹18.45 apiece. With the RBI not allowing the then interim chief Carol Furtado to assume a full-time role, it went back to one of its old hands for support. Ittira Davis, who was the chairman of the bank’s board till March 2021, stepped in to take charge as MD and CEO in January 2022 for a year. His promise to the Street was to arrest the NPA accretion and demonstrate a turnaround by March FY22 quarter. While he kept up with his promise in Q4 FY22, June FY23 results were far more encouraging. With net NPA cooling off to 0.11 per cent and fresh slippages contained at five per cent of the total book as against nearly 10 per cent in FY22, the bank posted a net profit of ₹203 crore, which is the best in eight quarters. Davis has indeed walked the talk.

Stock view: At 1.1x FY23 price to book, Ujjivan SFB seems attractive. A convincing turnaround in sight and the bank’s commitment to expanding its base beyond MFI loans auger well. In fact, in Q1 FY23, the share of MFI loans to total book stood at 68 per cent, down from 76 per cent in Q1 FY21. Areas of non-MFI loans include housing and micro enterprise loans. While the share of MFI loans at Ujjivan is higher than Bandhan’s, what instils confidence is that the former is building the book organically, unlike Bandhan which took the acquisition route. But the process of diversification could jack up the costs, throw up intermittent asset quality issues till the new book matures and disturbs the overall return profile of the bank, which has taken a beating since FY20. Also, the likelihood of a merger with its parent company could also weigh in on Ujjivan SFB’s stock price. That said, current valuations capture these downside risks.

YES Bank

From availing ₹50,000-crore credit facility from the RBI when it placed under the reconstruction scheme in March 2020 to exiting the scheme eight months ahead of the March 2023 due date, YES Bank is a successful example as a comeback case among the distress banks so far in India. After providing for ₹49,400 crore towards bad loans and writing off ₹20,000 crore of loans from FY20 -FY22, the bank is on its way to reducing its gross NPA to 1.5-2 per cent, thanks to the ongoing Swiss Challenge auction for stressed assets. The bank has identified ₹48,000 crore of toxic assets, which it would load off to the successful bidder, and has entered into an agreement with the US-based JC Flowers Asset Reconstruction Company (ARC) to pick up a 20-per cent stake in it if the auction to the ARC concludes successfully. What more, from not garnering interest among investors in 2019 and 2020 to pump in capital, the bank is at a point where two large private equity firms are set to take 10-per cent stake each in YES Bank’s upcoming $1 billion (₹7,500 crore) fund-raise. With this, it’s YES Bank version 3.0. But as a retail investor, is the YES Bank story promising enough to grab a piece of the cake?

Stock view: Tradinga little overits book value, YES Bank is no more a cheap stock. In fact, in the last one month, its stock price has increased 14 per cent. While the bank has made significant progress in granularising its book, doing away with legacy corporate exposures and altering the construct of its loan profile in favour of retail and SME assets (combined share at 60 per cent of total book as of FY22), much of this progress is yet to translate to earnings.

When most private banks operate at four per cent plus net interest margin, YES Bank was at 2.4 per cent in Q1 FY23. It may have returned a handsome net profit for the quarter, but that barely adds up to a meaningful return profile (see charts). Targeting 0.75 per cent return on assets (ROA) in FY23, YES Bank’s aim is to reposition itself as a retail lender. However, there is already a mismatch between the book composition, its profitability and the overall return profile of the bank. Retail-heavy private banks such as ICICI Bank and HDFC Bank enjoyed 1.5-1.8 per cent ROA in FY22. While it isn’t fair to compare YES Bank with these names yet, at the current valuations, the asking price seems a bit steep given the depressed return ratios. Also, there is limited liquidity in the counter owing to the embargo on trading the bank’s shares. All these factors combined, position YES Bank stock as a momentum play riding on positives such as the sharp reduction in bad loans and entry of new investors. Once these play out, further re-rating would solely depend on the bank’s ability to press the pedal on growth. In FY23, the bank aims to grow its loans at 15 per cent, which may not be sufficient to get the bank on par with peers in terms of return profile. That said, the probability of errors seems thin here on and that’s a huge positive for investors. The YES Bank stock is best-suited for those with propensity for risk and three-five year investment horizon.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.