For more than a year now, the benchmark indices have been largely volatile, with a tug of war playing out between the bulls and the bears. The trend of buying anything and making money seen in 2020 to early 2022 is long gone now, bringing to light the importance of judicious stock-picking to make gains in the market.

A systematic approach is especially helpful in the small-cap segment where corrections in the last year may provide some pockets of opportunities now.

The Association of Mutual Funds in India (AMFI) classifies small-caps as companies falling below the top 250 listed companies in the Indian stock exchanges in terms of market capitalisation. This means that the small-cap universe contains thousands of stocks, making the odds of finding the next Page Industries very challenging. However, screening through certain quantitative and qualitative metrics — and finding out potential investment candidates using a bottom-up approach — makes the process systematic. We have attempted this here.

To begin with, using Capitaline database, we have filtered out the small-cap companies (barring those in the financials space) with at least ₹250 crore of revenue in FY22. Such revenue-based filter has been applied so that we can look at those companies that have shown some sort of ability to scale up, in the past. Also, a company of a certain size might pose less risk comparatively. Based on this filter, we have a universe of about 692 listed small-cap companies available for screening purposes.

Here are the five filters we have used:

1. Eye on leverage

Leverage is a double-edged sword. In a world of high inflation and increasing interest rates, it can make business plans go awry. If you have any doubts, just think of Adani! Thus, while scouting for opportunities in the small-cap space, it is imperative in the current context to focus on companies with sound balance sheets and cash flows.

Small-cap companies tend to have higher mortality rates as against large-cap and mid-cap players. They don’t enjoy the benefits that economies of scale give large companies. Further, they may not have access to debt at reasonable interest rate. Hence, it’s better to see potential investment opportunities in companies not burdened with excess debt in the wake of interest payments.

Here, a starting point can be the Interest coverage ratio (ICR) i.e. earnings before interest and tax divided by the interest expense. The higher the ratio, the better-placed the company is, in servicing its interest and debt obligations and tiding over the current interest rate environment.

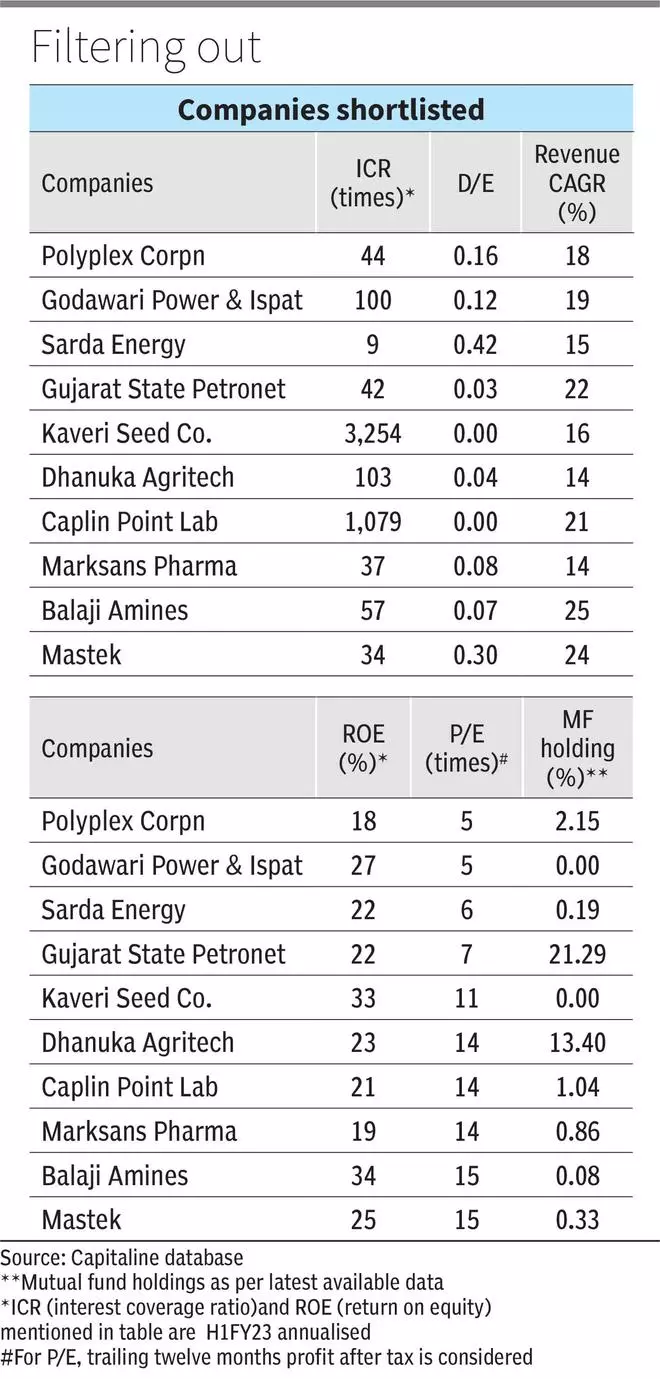

In the list of 692, we have eliminated those with interest coverage ratio (ICR) less than 3, leaving us with 306 companies that seem pretty comfortable paying their interest expenses. Kaveri Seeds. and Caplin Point Labs have high ICR, for instance.

For companies such as GTPL Hathway and Quick Heal, ICR couldn’t be calculated as they don’t have any interest payment to be made. This could be a positive, in such net cash companies . On the other hand, keeping ICR as a filter helps weed out unprofitable companies at the operating level — Bombay Rayon and Varroc Engineering being examples.

Using the debt to equity ratio (ratio of total debt to net worth) as the next filter, seven of the 306 companies that showed promise on ICR have been weeded out due to D/E more than 1. Companies with D/E less than 1 are considered safe. Companies having high D/E include Chennai Petroleum Corp Ltd, NACL Industries and Shah Alloys while about nine companies, including TD Power Systems, India Motor Parts and Sakuma Exports, don’t have any debt on their balance sheets.

2. Revenue and profit growth matter

The motto of Reliance Industries – ‘Growth is Life’ — is a good maxim to follow in picking stocks. Companies such as Eicher Motors and Page Industries saw years of exponential growth which helped them become large-cap stocks. However, after growing into such size, they now might not be able to deliver the same growth as they did earlier. Hence, growth is the area where the small-cap universe gets more attractive and interesting as investment opportunity. Investors are better off avoiding small-caps without ability to grow.

Here, we have used a minimum of 10 per cent growth in revenue and PAT (profit after tax) during 2018-2023 (H1 annualised) as screening criteria. Out of 297 companies, 123 have passed this screener. Companies such as Nazara Technologies and Fine Organics have seen staggering growth in their revenue and PAT during the time, ranging 30-40 per cent and 50-130 per cent respectively, while Sakuma Exports and Dhampur Sugar have seen their revenues and profits declining.

This criteria also removes companies with good growth in their revenues but not able to do the same with their bottom line – examples being KIMS and TD Power Systems, which had reasonable growth in their revenues but couldn’t make the cut due to losses in earlier periods.

3. Cash is king

‘Cash is king’ can truly work while scouting for investment opportunities in small-cap equities. If a company is able to scale its business along with generating sufficient cash, it can withstand a downcycle with resilience. Net profit is based on accrual accounting principles and hence it is necessary to check if a firm is able to generate cash from its business along with having net profits on its books.

Operating cash flow (OCF) is an important benchmark to check whether a company is able to generate sufficient cash from its core operations, consistently — failing which it may have to rely more on external financing for its business expansion. Investors should exercise caution before considering such companies.

Here, the screening criteria is that a company should have OCF during each of the last five years (FY2018-22). We have restricted OCF analysis till FY22 and not taken 1HFY23 due to inconsistency in data availablility. Out of 123 earlier screened companies, 81 have been able to do so, including Companies such as Balaji Amines and Mastek. There have been companies such as RCF (fertilisers), Neogen Chemicals (chemicals) and Gravita India (metals) which have staggering growth in their revenue and PAT but haven’t been able to generate positive OCF consistently.

. Investors can keep a track of OCF trends of companies — whether OCF has been rising and whether it is moving in tandem with revenue and PAT on a longer time frame.

4. Profitability

Ability to scale while keeping a check on costs and also generating good margins might make a case for a potential investment opportunity. EBITDA margin (earnings before interest, tax and depreciation as a percentage of sales) is an important indicator of a firm’s ability to generate profit from its core operations. Also important is return on equity (ROE). A good ROE number for a listed player on a consistent basis indicates that the company utilises capital efficiently.

Hence here we have further taken those with EBITDA margins and ROE more than 15 per cent for the last three periods i.e. H1FY23 (annualised), FY22 and FY21. Applying the filters, about 25 companies have been screened out of 81 companies.

Balaji Amines (Chemicals), Godawari Power and Ispat Ltd(Steel) and Caplin Point Lab (Pharmaceuticals) have been able to generate some of the best EBITDA margins and ROE on a consistent basis. IFB Agro Industries, Greenlam Industries, Gallantt Ispat and Confidence Petroleum have not been able to pass the 15 per cent threshold for EBITDA margins and ROE for any of the three periods. Further, seven companies have consistently generated good EBITDA margins but have not been able to do the same at ROE level, including Ramco Industries (Cement) and healthcare firms Shalby and Poly Medicure.

5. Valuation

We have come out with the list of about 25 companies using various fundamental filters. However, the screening might not just end here. A stock can be considered as a potential investment only if a company with quality fundamentals is available at reasonable valuations. Here, valuation metrics such as price to earnings (P/E) ratio come into play.

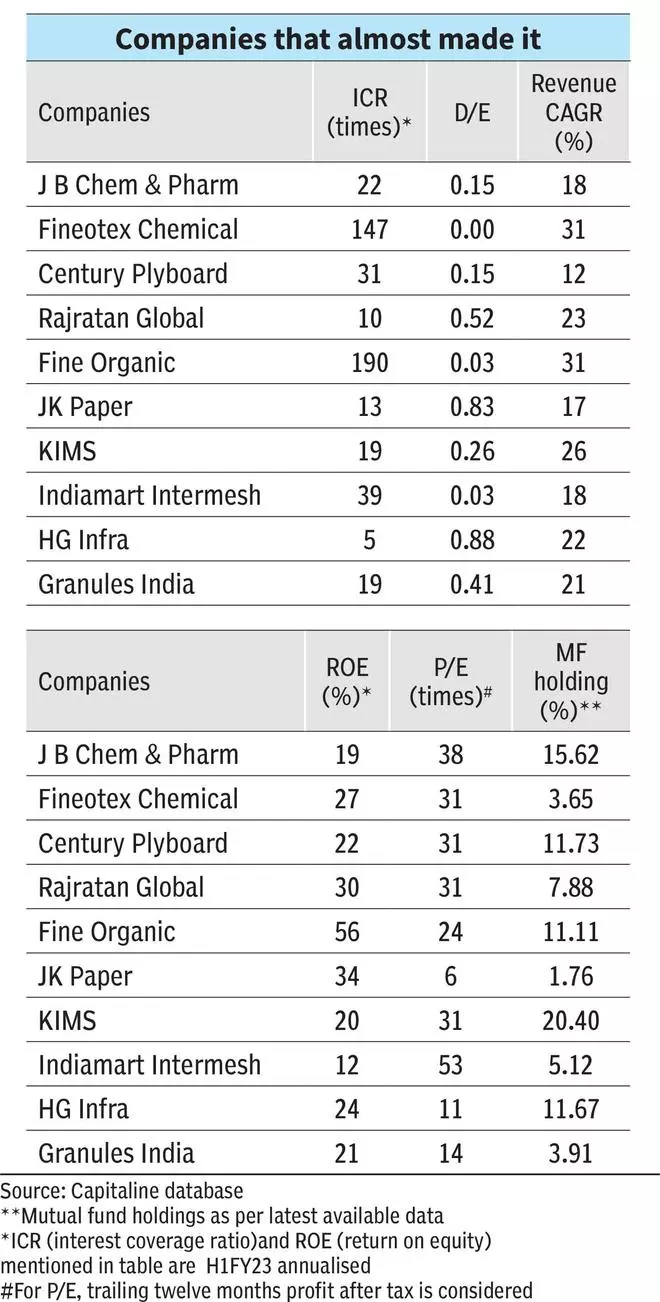

In the list of 25, companies such as J B Chemicals & Pharma, Rajratan Global and Century Plyboards are trading at the highest valuations among the lot with P/E ranging 30-35 times. Filtering companies based on the P/E lower than 15 times, we are left with 10 out of 25. Here, trailing twelve months PAT is taken as earnings for valuation purpose. Companies having lowest valuations include packaging firms Uflex and Polyplex Corp and others like Godawari Power and Ispat Ltd with P/E ranging 2-5 times.

However. all companies with low valuations may still not be the best investments to make as other qualitative checks are also essential.

Further, along with the final list of shortlist companies, we have also mentioned companies which through are fundamentally sound but couldn’t make it to the shortlist due to minor miss in a particular filter. Keeping a track of those companies might also be helpful.

Qualitative checks

The investing decision shouldn’t be based on just financial screening. Investors need to look at some other qualitative checks on the screened small-caps.

Corporate governance is a key factor. For instance, the Income-Tax department launched searches on various premises of Uflex recently. The stock is down 15 per cent since then. While the outcome is uncertain, when it comes to small-caps, it is better to approach with caution. Likewise, one can further check disclosures regarding related party transactions and compare the remuneration of key management personnel with industry level. Sometimes, simple internet checks and tracking news of the said companies can help.

One needs to assess promoter pledging. Promoters pledge shares with a financial institution to raise funds. This may not always be a concern. However, one needs to take a closer look at firms where the promoter is pledging a high stake. For instance, take the recent instance of high volatility witnessed in few Adani Group company shares that had higher percentage of shares pledged. Thus, when sentiment turns awry, pledged shares can become an issue. If promoter is unable to pay the dues, then the FI might sell the shares, resulting in further pressure in the stock price.

Also, small-cap stocks generally tend to have low liquidity in daily trading. In such instances, a few days of heavy trading can cause a lot of volatility, resulting in the stocks trading at extreme ends — or over-valuation and under-valuation. Investors must take cognizance of this.

Investors should also assess whether the stake held by mutual funds is high. For instance, mutual funds’ stake in Gujarat State Petronet Ltd (GSPL) and Dhanuka Agritech are as high as 21 per cent and 13 per cent respectively. Though the MF holdings provide a certain level of comfort, they also show that the stock is not undiscovered.

Lastly, one should keep a sharp eye on aspects such as industry growth prospects, regulatory environment, the company’s moat, market share, and the like, before zeroing in on the investment.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.