Price erosion in the US markets has been hurting Indian pharma companies over the last few years. On the one hand, large distributors, insurers, and retailers in the US forged partnerships and thus buyers consolidated into three blocks from more than six earlier. This strengthened buying power, leading to sharp erosion.

On the other hand, the US FDA incentivised generic filing, which brought in more competition, further weakening sellers of generics. Generics, facing 5-8 per cent erosion earlier, are now staring at 15-20 per cent erosion every year. This implies that for a base portfolio of 100 products, 15-20 new launches are needed every year to report marginal positive growth from generics.

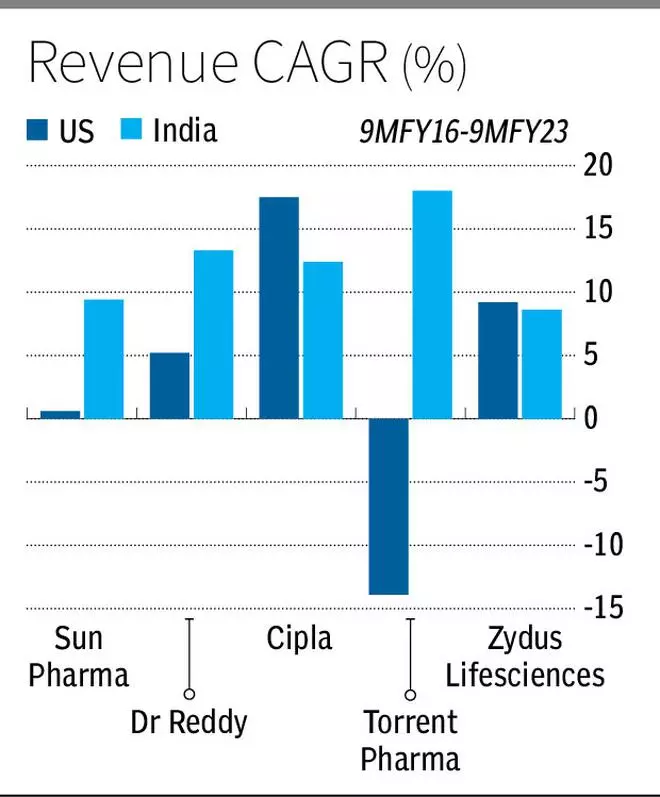

With the top Indian companies having exposure of 12 to 42 per cent in this geography, price erosion in generics has impacted them deeply. Against average Indian revenue CAGR growth of 12.3 per cent for the top 5 companies, the US reported 3.7 per cent CAGR in 9MFY16-9MFY23. To mitigate this, Indian pharma players have been trying out various routes to add value and improve profitability from the US markets. Here’s how they have been navigating tricky roads:

Para IV application under ANDA

Abbreviated New Drug Application or ANDA is the foremost pathway for Indian generics. ‘Abbreviated’ in this case refers to the efficacy and safety research of the innovator reused by the generic while filing, thereby saving time. Based on innovator’s patent status, this pathway has four routes or Paragraphs to file. Para I, II and III are used when no patent challenge is involved and no exclusivity is targeted. In these routes, assuming ten other filers gather in the first six months for the product, erosion can reach 95 per cent and EBITDA margins meander in 15-20 per cent range at best.

A Para IV certification, on the other hand, can grant a 180-day exclusivity to the generic filer, a period wherein the innovator and the generic are allowed to operate in the market — allowing for lumpsum revenues and a higher 20-30 per cent EBITDA margins. Hence, this route is more value-adding. Under a Para IV application, the generic filer asserts that innovator patents are either unenforceable or are not infringed or are invalid. The generic filer notifies the innovator of the Para IV filing within 20 days, after which there will be an automatic 30-month stay holding back FDA approval, so as to conclude the legal proceedings. Within the 30-day period, if the generic company wins the ruling, they will be able to market the product immediately (before the patent expiry) and exclusively for a period of 180 days, starting from the day of commercialisation.

The generic filer may also enter into a settlement agreement with the innovator for a delayed launch. If there is no outcome after the 30-month period, the generic filer can potentially consider an at-risk launch, that is launching the product (with 180-day exclusivity) risking patent infringement in case the innovator wins the legal course. For example, Dr. Reddy’s launched Suboxone ‘at risk’ in November 2018 while in a Para IV litigation with the innovator. Even as a temporary restraining order was filed, it was later lifted. Dr. Reddy’s settled for $72 million from the innovator for the lost sales after it showed that it was non-infringing on innovators’ patent strengthening its balance sheet from the one-time ‘other income’.

One prominent example of settlement in a Para IV is the Revlimid launch. While the patent is supposed to expire in April 2027, several filers have launched in 2022 after settling with the innovator Celgene. Natco and its partner Teva have also secured a 180-day exclusivity for four strengths of the drug, being the first applicant to challenge the patents. Natco’s Q1FY23 revenues jumped by $40 million (44 per cent QoQ) with only a fraction of revenue share (around 33 per cent). The others have settled for a volume-limited launch until 2026 wherein they are restricting themselves to pre-defined volumes. Dr. Reddy’s North America revenues improved by $120 million sequentially (52 per cent) in Q2FY23, driven primarily by gRevlimid.

Competitive generic therapy

Competitive generic therapy (CGT) came into the picture in 2017 to incentivise generic filing in drugs with inadequate generic competition. Under CGT, a 180-day exclusivity is provided for successful ANDA submission of the first applicant, even when no patent protection exists. Applicants can request for CGT classification of the drug prior to or during an ANDA submission, which is evaluated based on lack of actively selling generics. The applicant can also expect an expedited review timeline and an 180-day exclusivity on launch.

There are close to 50 filers for Advil (Ibuprofen) in the US, each with different dosages and routes of administration, which implies a $2-5 million revenue run rate. Strides Pharma secured a CGT approval in such a competitive space for its Infant Advil drops in June 2022 along with a 180-day exclusivity and is only generic for the product. The company should ideally expect to make $7 million from the product in the first 180 days and around $2 million per quarter post exclusivity, compared to $40-million market size. For comparison, if this were a plain generic with 7-10 filers and no exclusivity, the product would have netted $2 million in the first year. Amphotericin for Sun Pharma, Vigabatrin for Dr. Reddy’s and Dihydroergotamine Mesylate for Cipla are some of the other examples in recent periods. In Q1FY23, Zydus announced that three of the eight launches in the quarter were approved under CGT pathway.

505 (b)(2) application

Half-way between a full-blown new chemical entity approval (505(j)) and a generic filing lies a 505(b)(2) approval. This route is used when a change is made with regard to the original in terms of dosage, strength, routes of administration, or approved therapy label in order to improve patient outcomes, convenience or ease of administration. The pathway incorporates the safety and efficacy data of the innovator and new clinical trials conducted by the filer to substantiate the changes done. Prescription to OTC switch, tablets to pellets/sprinkles, a new combination of drugs are some forms that use this pathway along with a ‘bridging’ clinical trial to substantiate the effectiveness.

The exclusivity under this pathway is dependent on the extent of clinical trials that will be required by the FDA. But even otherwise, the product approved as brand in US markets provides for a far longer revenue timeline before erosion.

Sun Pharma’s Yonsa (prostate cancer), a crucial product in its speciality portfolio, was approved as an NDA (New Drug Approval) under the 505(b)(2) pathway with clinical trials. The product has patent protection until 2034, but generics of the original can still enter the market. Against the $4-8 million that a generic filer should have expected, the 505(b)(2) pathway may have aided Sun Pharma net $15-20 million from the product per year. Considering the branded promotion, the erosion curve might be less steep and EBITDA margins closer to innovator level of 30-35 per cent. Cipla’s Lupron Depot injection and Dr. Reddy’s Bortezomib are some other launches that have used this route to improve profitability in their US exposure.

Biosimilars

Biosimilars are generics of biologics. Biologics, in turn, are not chemically synthesised but derived from natural sources, including micro-organisms, animals or humans and are larger compared to ‘small molecules’ (10-100 times larger).

Innovators are preferring biologics compared to small molecules owing to high value attributed to immunogenicity of biologics (evoking an immune response) and manufacturing complexity. Patent expiry may not imply a steep fall here, protecting innovators as well. This implies that Indian operators should eye this piece of pie to stay relevant in US markets, and they have been doing so.

A biosimilar addressing a $2,000 million innovator market in US (Biocon with biosimilars of Pegfilgrastim, Trastuzumab or Glargine, for instance) can expect to make $70-150 million per year, going by the peak market share of 10-20 per cent and a discount of 50-60 per cent from innovator price. While this may be perceived as lower than expected return for the time it takes to go to market, (3-4 year development timeline), and the associated investments required ($100 million in development costs), proponents’ focus on the elongated timelines with lower erosion, sticky market share and innovator level margins at 35 per cent. Also, US or European approval paves the way for emerging market play. Most major Indian generic players, including Sun Pharma, Cipla and Aurobindo Pharma, are eyeing a piece of biosimilar franchise by 2030.

Complex products

Companies are now moving beyond plain generics to products that are differentiated on manufacturing difficulty. Zydus Lifesciences’ portfolio has had a high concentration of such products. Mesalamine, a complex product, for instance, has upwards of 20 filers in different routes. However, Zydus’ delayed release tablet version of this drug now has sole presence as even the innovator has discontinued the product as per the FDA’s approved drug list.

With such low competition the generic should have raked in $40-60 million per annum compared to a mere $10-20 million that other dosage forms of the generic filers expect. Cipla’s Advair Diskus, a combination of inhalation powder and a device to administer, both of which score high on complexity, were expected to be out in a year (but impeded by plant clearance). Industry leader Sun Pharma is now operating at the high end of complexity with patent protection for its leading drug Ilumya, which took the innovator route for biologics. Approved for psoriasis, Ilumya has initiated trials for another indication as well. The peak sales estimates are in the range of $300-350 million for the one indication.

Erosion, a given

Innovator, generics, speciality, biosimilar — erosion is a given in pharmaceutical products. It is only the period of protection and slope of erosion that may differ. Innovators are protected by exclusivity for a period of 20 years, that may include 7-10 years for development.

Evergreening was practised where new patents were introduced at the end of protection, but FDA plugged it by restricting the 30-month stay to one per ANDA, on being challenged. After the exclusivity, erosion can range up to 95 per cent on day-1 of a generic launch, depending on the complexity of the product and the number of filers and is sometimes even discontinued in small molecules.

To deal with such a challenge, Pfizer, for instance, split Upjohn with legacy of patent drugs portfolio as the division needed a separate focus. With a short window of 8-10 years, innovators raise prices by 8-10 per cent every year to maximise profits. Even in Biologics with complex manufacturing, the slope of erosion will be evident if not punishing. For a lucrative product like Humira (biologic) with $17 billion in sales, 11 applications may have been approved so far targeting launch in 2023.

Thus, pharma companies always need to be on their toes, looking for ways to plug the gaps and protect their profitability.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.