Just when the industry was hoping that it would be handed out some goodies, licensing requirements may be simplified which would facilitate faster and a more meaningful penetration of life insurance in the country, what came out in the Budget was a complete disappointment. If any, it was a double blow for the sector. One end the Budget is pushing people towards a tax regime without any sops for choosing the nature of savings products, and on the other end, proceeds received on traditional plans such as participating and non-participating products, if the aggregate premium contribution exceeds ₹5 lakh, would fall in the tax net.

The timing couldn’t have been worse as the industry is just about readying for the next phase of growth and its financial parameters are at a near multi-year best. Valuations of listed life insurance companies have also corrected significantly, making them attractive like never before. But will fundamentals cushion these stocks?

Budget implications

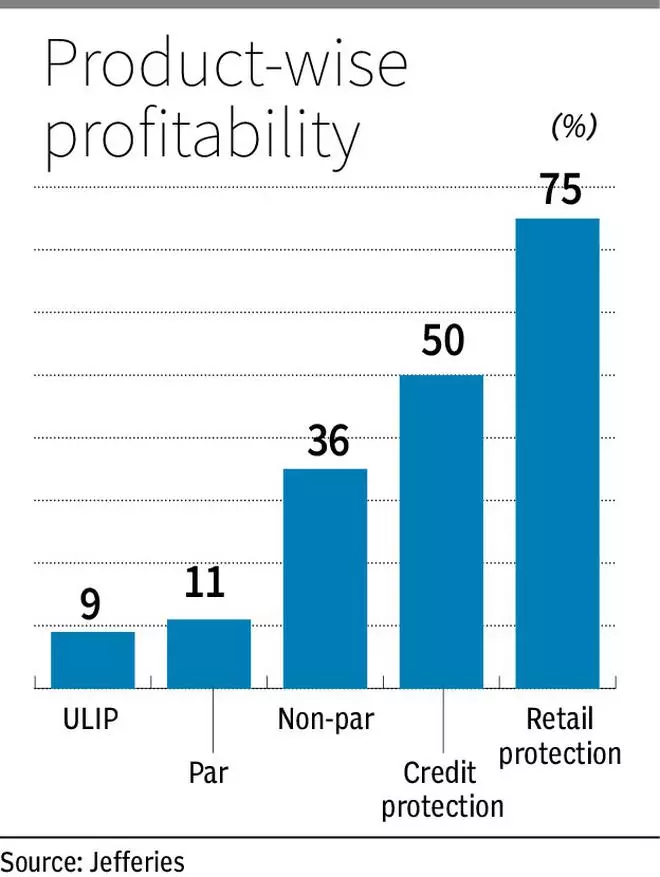

Value of new business margins is at an all-time high for listed life insurance players. Chart 1 depicts that profitability is the highest for protection policies and lowest for ULIPs or unit linked insurance policies. But take a look at what is driving growth for the life insurers and you would be surprised that retail protection as a component of annualised premium equivalent (APE) is merely 11-17 per cent. Instead, growth is largely coming from traditional products which offer higher level of savings return vis-à-vis life cover. They are also characterised as high-value products, targeted at the upper middle class and the creamy high net worth individuals (HNIs).

To sum up, barring a very transient phase between April and July 2020 when demand for protection plans shot up owing to the pandemic, protection plans are barely the growth driver for the life insurance sector. In essence, the move may reverse or at least alter this trend.

The government’s intention has been to make insurance a mass market product and not just for the elite or propagate it as a tax planning tool. The announcements made this Budget could help realise this goal. Sample this: in countries such as China, the US, the UK and Germany, which are the developed markets for life insurance, the penetration of protection plans is more than 80 per cent. In India, it is barely 15 per cent. Yet, life insurers use the point on under-penetration as a selling proposition when, in reality, they often chase the low hanging fruit on fat margins yielding products.

Therefore, in the next 3-12 months, companies will be forced to re-calibrate their operations and marketing strategies to adapt to the new ways of working. But here’s the good news. In the long run, they may well benefit, given that protection plans offer the best margins and will instil sustainability and predictability in this business.

Impact on financials

The new norms will come into effect prospective from April 1, 2023. Also, it will impact the non-ULIPs savings segment — namely, the par and non-par products. Therefore, in the order of impact, LIC, HDFC Life and Max Life may bear the maximum brunt while SBI Life and ICICI Prudential Life (I-Pru Life) may be relatively less affected.

The impact will be felt on value of new business (VNB). However, these products, on a combined basis, account for 30-65 per cent of VNB. Likewise, aggregate premiums exceeding the ₹5-lakh mark are sized nearly a fourth of total premiums for the industry. The ₹10-50 lakh premium bulge accounts for 10-15 per cent of the total premiums. Hence, on a net basis, overall top-line impact could be 10-16 per cent in FY24.

Two aspects need to be factored here.

Firstly, much as companies claim that their premium growth is gradually de-linking from tax-related incentives, the months of January-February-March account for 30-35 per cent of total APE. Secondly, this is also the ripe period for companies to push their high-ticket products, including single-premium plans.

With both getting curbed at the same time, it would be interesting to see how quickly companies reorient their businesses. For instance, upper middle class and HNI customers account for 40-50 per cent of total customer base. SBI Life, catering predominantly to customers of State Bank of India, which has a cross-section of customers, could be less impacted, though not insulated, from the developments.

With revenues coming under pressure, VNB margins could also take a 100-150 basis points hit while at an overall level, the costs incurred to re-tune the distribution networks and employees would also weigh on the near-term profitability of life insurers.

Yet, this isn’t as much a concern, given that in the long term, if the share of retail protection increases, VNB margins may also increase from the current levels.

What to do with the life insurance stocks?

Let’s do a quick rewind to find out how and why insurance stocks became popular in India.

The first listing of a life insurance company happened in September 2016, when I-Pru Life debuted on the bourses. It didn’t have a great listing for a prolonged period, it didn’t catch investors’ fancy. But it paved the way for the listing of HDFC Life and SBI Life. These were blockbuster IPOs and there were two critical reasons why investors got interested in these stocks.

Firstly, the banking sector wasn’t having a good run. The sector was nearing the peak of asset quality crisis and one wasn’t sure whether the worst days were nearing an end or not. Life insurance stocks offered a window where investors didn’t have to be concerned of such risks. Secondly, they bought into the tale of under-penetration propagated by the industry. Therefore, life insurance stocks were seen as steady ships.

Where do we stand today?

For starters, the earnings quality and the trajectory of banks is a lot more stable than what it was about four years ago. This is reflecting in their valuations as well, which have appreciated by 30-60 per cent since FY17. On the other hand, stocks of life insurance companies haven’t done so well, particularly in the last year. There are stock-specific issues and macro issues weighing on them. For instance, in case of HDFC Life and I-Pru Life, it isn’t clear yet whether their bank-led parent entities can continue to hold the present stakes as promoters. This is a technical overhang on the stocks.

Fundamentally, investors are beginning to call out that the under-penetration theme isn’t playing out for the sector as promised. For most of FY22, investors were told that insurers are selling what their customers want and if they want more of savings option in a low interest rate regime, then so be it. But this strategy isn’t long-term positive and with this Budget, it would be severely challenged.

What’s also inetersting is that global life insurers such as Aviva, AIG, Axa trade at 1-2x one-year forward embedded value and this is despite having a significantly higher level of protection penetration. On the contrary, Indian life insurers, barring LIC, trade at significant premium. Therefore, with a potential reset in earnings, margins and business strategies, investors may want to wait to see how FY24-25 pans out for the sector. If there is a visible shift in favour of protection, then we could see a round of re-rating in valuation. But until then, investors may be better off being on the sidelines.

Meanwhile, with banks on a better footing, the relative advantage that insurance companies had is also narrowing, making the investment case not so favourable for the insurers.

In fact, on a competitive basis, general insurers such as ICICI Lombard or Star Health Insurance appear more attractive than life insurers. With fewer regulatory changes, they seem more insulated in the near term. However, the introduction of composite licences, which may permit life insurers to promote other lines of businesses currently specialised by non-life players could be a fundamental threat for the latter.

Yet, if an investor is keen to broadbase the options in the financial services sector and is looking at life insurance stocks, I-Pru Life and HDFC Life may top the pecking order. At bl.Portfolio, we have a ‘hold’ recommendation on Max Financial Services, the holding company of Max Life. We continue to maintain a not so bullish view on the stock. As for SBI Life, which has outperformed peers in the past year, valuations appear steep under the current circumstances. LIC, purely based on valuation and considering the quantitative improvement in earnings, remains an attractive pick in the sector.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.