In the past week, the benchmark indices Sensex and Nifty gained around 2 per cent and 2.2 per cent, respectively, reaching all time highs. This upward trajectory was primarily fueled by positive sentiment and also news on the Reserve Bank of India’s record dividend payout to the government.. All sectoral indices ended green during the week while the best performing were BSE Capital (5.9 per cent), BSE PSU (4.6 per cent), BSE Metal (3.1 per cent) and BSE Realty (2.7 per cent).

While the buoyancy in markets resulted in many stocks doing well, here are three stocks that were the top gainers driven by fundamental news within the BSE 500 index last week.

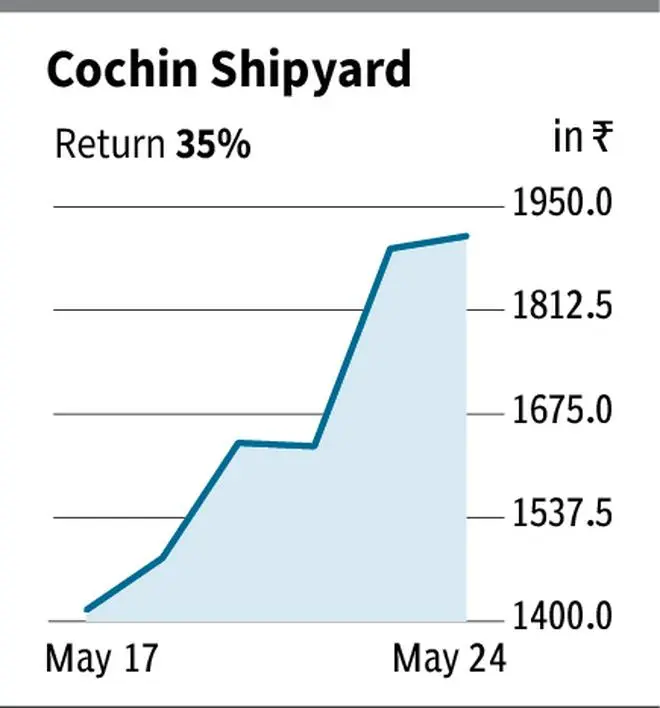

Cochin Shipyard Ltd

The stock of Cochin Shipyard surged 35 per cent over the past week, driven by strong fourth-quarter earnings.

Conferred with Miniratna status, the company is engaged in the construction of vessels and repairs and refits of all types of vessels including upgradation of ships, periodical lay-up repairs, and life extension of ships.

On a consolidated basis, Cochin Shipyard’s revenue from operations more than doubled in Q4FY24, reaching ₹1,286 crore compared to the same period last year. Concurrently, net profit soared to ₹259 crore from ₹39 crore, reflecting a significant multi-fold increase. Considering FY24, the company achieved a 62 per cent YoY revenue growth, with profit after tax (PAT) more than doubling to ₹783 crore from ₹305 crore in FY23.

Earlier this month, Cochin Shipyard announced in a filing to the exchange that it secured a large order, valued between ₹500-1000 crore, from a European client for the design and construction of a Hybrid Service Operation Vessel, with an option for two additional vessels.

Currently, the stock trades at a trailing price-to-earnings (P/E) ratio of 64.

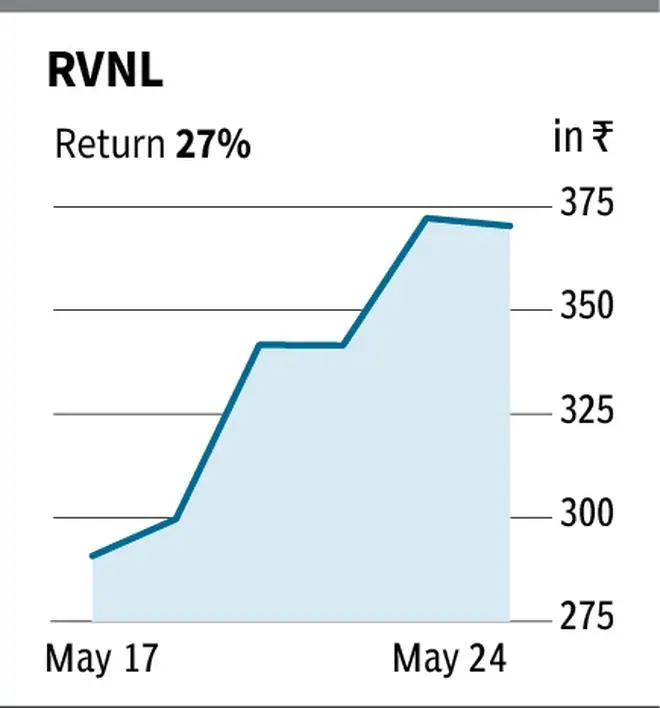

RVNL

The stock of RVNL surged over 27 per cent last week, driven by the company emerging as the lowest bidder for a metro rail project.

Rail Vikas Nigam Ltd (RVNL) is a public sector undertaking (PSU) specializing in the development of rail infrastructure.

In recent filings, RVNL announced its position as the lowest bidder for a project commissioned by Maharashtra Metro Rail Corporation Limited (Nagpur Metro). The project involves the construction of six elevated metro stations, valued at approximately ₹187 crore, and is to be completed over 30 months. Additionally, it received letters of acceptance earlier this month from Southern Railway and South-Eastern Railway for other projects.

Regarding the financial performance, the company reported a solid performance in the fourth quarter of FY24. Consolidated revenue from operations increased by 17 per cent to ₹6,714 crore, compared to ₹5,720 crore in the same quarter of the previous year while the PAT rose by 33 per cent to ₹478 crore. In FY24, the company achieved a revenue and PAT growth of 8/17 per cent respectively.

The stock is currently trading at a trailing P/E ratio of 49 times.

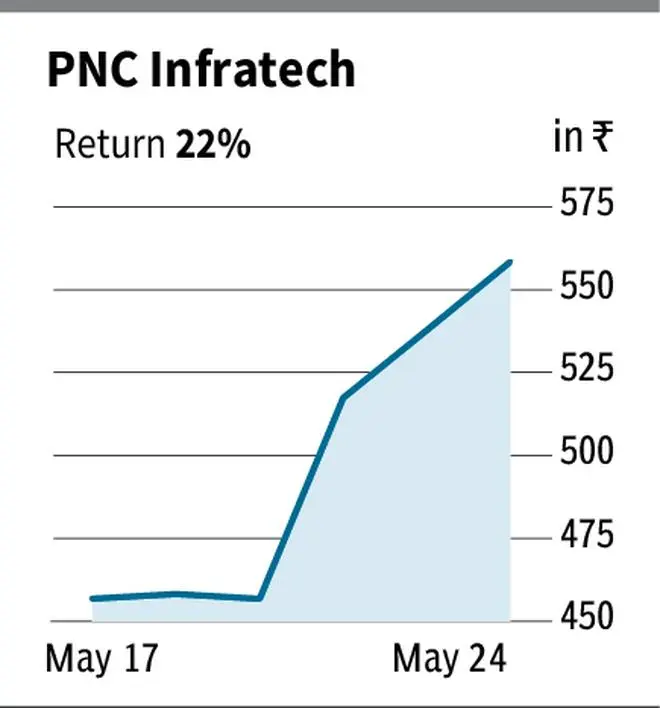

PNC Infratech Limited

The shares of PNC Infratech jumped by 22 per cent in the past week, led by the company emerging as the lowest bidder for projects worth nearly ₹5,000 crore.

PNC Infratech specializes in engineering, procurement, and construction (EPC) services, including highways, airport runways, bridges, flyovers, and power transmission projects.

In a stock exchange filing last week, the company announced that it has been named the lowest bidder for two EPC projects by the Maharashtra State Road Development Corporation. These projects, valued at over ₹4,994 crore, are to be completed within 30 months.

Furthermore, around market closing hours on Friday, PNC Infratech reported a 13 per cent growth in consolidated revenue in Q4FY24, reaching ₹2,600 crore while the PAT saw a significant increase of 171 per cent, rising to ₹396 crore from ₹146 crore in Q4 FY23. For the FY24, PNC Infratech achieved a YoY revenue/PAT growth of 9/38 per cent, respectively.

Currently, the stock is trading at a trailing P/E ratio of 16 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.