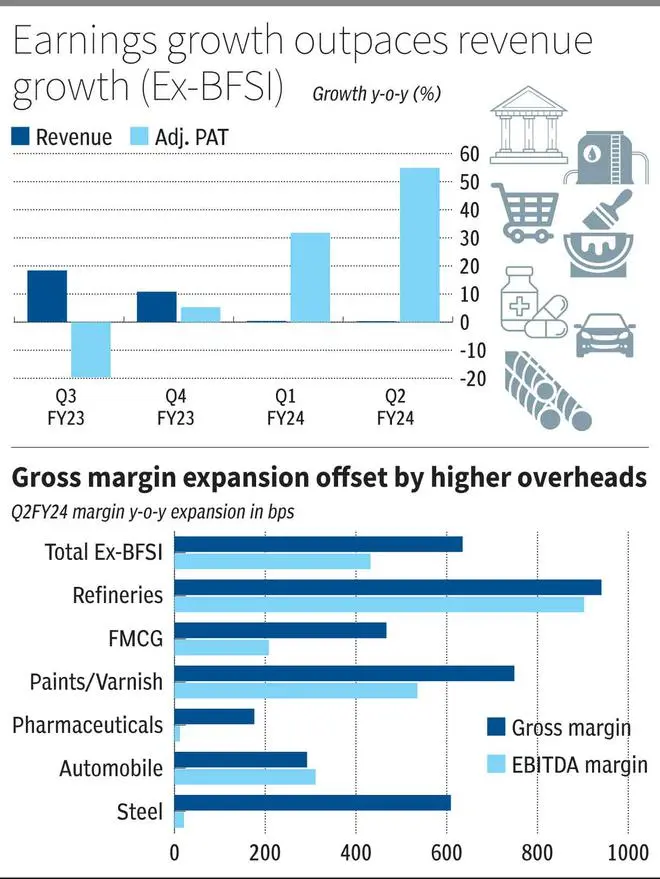

For the 787 companies that had reported second quarter results till last Thursday, revenue growth was flat at 0.3 per cent y-o-y (excluding BFSI), with high PAT growth (55 per cent y-o-y). Higher margins delivered robust PAT growth. The first quarter had showed the first signs of commodity cool-off, which delivered fully this quarter.

However, weak volume growth was evident from margins. EBITDA margin grew 432 bps y-o-y in Q2 considerably trailing gross margin expansion of 635 bps. Without volume expansion, normal inflation in overheads has impacted.

Sectoral show

Much of the manufacturing sectors gained from margin expansion. With a 46 per cent y-o-y growth in PAT, the auto sector continues to take the lead with bumper festival season still underway. Cooling off in commodities including steel and alloys, too, helped.

With cost declining in edible oils, chemicals, copra and logistics, FMCG and paint companies reported significant margin expansion this quarter (460/750 bps y-o-y gross margin expansion). However, tepid volume growth was reported.

Cement and steel sector are in the midst of expansion, in anticipation of strong infra push. Commodity and energy costs have deflated padding their margins, even as cement price held firm and steel prices declined this quarter.

However, the picture isn’t rosy for some others such as pharma and IT.

In the pharmaceutical sector, strong domestic growth over the past five years has given way to a recent quarter of weakness due to pricing restrictions and slower base business growth. The Indian market growth (IPM), typically in double digits, slowed to seven per cent this quarter.

In the IT sector, deal wins are making progress, but companies are now focussing on cost optimisation. However, digital, discretionary, and other high-margin businesses are contracting and are expected to remain weak.

Mixed outlook

Banks and automobiles continue to be top picks for investments. But credit growth, which has trended above 20 per cent in FY23, has slowed to mid-teens starting with retail credit. The spreads (between lending and deposits) will decline going forward as last leg deposit repricing gets done in H2FY24. In the auto industry, the tougher comparisons stemming from the higher base during and after the Covid-19 period will pose a challenge. FMCG and consumer facing sectors will face increased competition from price pass throughs.

Overall, earnings growth may likely continue in H2FY24 at a similar pace, riding on unwinding of commodity cost inflation across markets. A pick-up in volume growth can also help. But with trouble in West Asia and spike in crude oil prices, a hard bet on continued commodity deflation maybe premature. Coal and energy prices for steel and cement companies have increased towards end of the quarter.

Farm commodities also need to be monitored considering the damp kharif estimates. On the demand front, volume growth is still in anticipatory mode for high frequency sectors (FMCG, paints and pharma). Besides, with muted growth expectations in developed world, export economy will face headwinds. On the other hand, energy, power and refineries can expect continued growth on higher energy costs making a comeback and lower processing capacity globally.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.