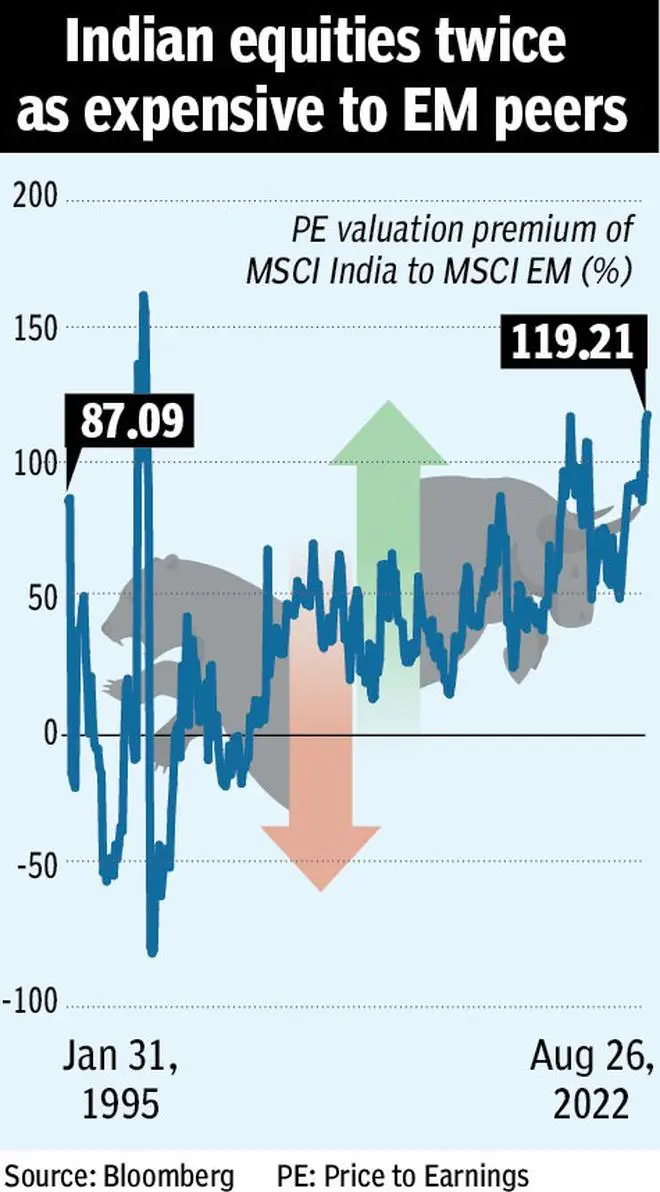

For about two years now, Indian equities have taken a very different route compared to the Emerging Markets (EM) pack.

The MSCI India Index has gained 50 per cent in this period, while the MSCI EM index has slipped 22 per cent. This has led to the valuation of the Indian stock basket more than doubling now, compared to EM peers.

The MSCI India now trades at a PE (price-to- earnings) of 24.5 times the trailing earnings while the MSCI EM is at 11.2 times.

This isn’t good news, especially for those celebrating the rebound in stocks since mid-June this year.

Data since 1995 shows that whenever Indian stocks trade at a valuation premium of 100 per cent or more over EM rivals, markets tend to correct thereafter.

The MSCI India Index measures the performance of a total 109 stocks (large- and mid-cap segments) of the Indian market.

With nearly 1,380 constituents, the MSCI EM index does the same but across 24 emerging market countries including China, Taiwan, India (around 14 per cent weight), South Korea and Brazil.

History not in favour

Since January 1995, in just over a dozen months has the price to earnings (PE) of the MSCI India index been 100 per cent or more than that of the MSCI EM index.

These months broadly fall in four specific year blocks: 1998, 2018, 2019 and 2022.

In May 1998, MSCI India was trading at a PE of 14 times, 2.4 times that of MSCI EM (PE 5.8 times). Then, the Pokhran tests were carried out, and Indian markets fell over 20 per cent between May 1998 to October 1998 on fear of a negative impact on the economy due to the US sanctions.

But as emerging markets also fell by a similar extent during the period, India’s valuation premium remained intact. In August 2018, Indian stocks again became twice as expensive as the EM pack. Following this, by end December that year, domestic equities corrected by around 9 per cent. Crude price rise, rupee in a free fall, and US-China trade sanctions had soured the sentiment in India.

Given that global investors view India as part of the EM group, during this correction too (as in 1998), the EM emerging markets basket fell by a similar margin.

Hence, again, the Indian valuation premium sustained despite the correction.

By the start of 2019, the MSCI India PE valuation premium over EM peers again crossed the 100 per cent mark. While Indian equities did not fall then, they did not rise either and remained flat. By July 2019, the domestic market was at the same level at the start of the year. The EM basket also behaved in a similar manner. But in the same year, the MSCI India valuation premium surpassed the 100 per cent mark over EM again in September. Then a real price correction happened and that lasted till the nadir of the Covid crash (March 2020). Indian markets lost 23 per cent during this period, greater than the 15 per cent decline in the EM group.

This time it’s different?

A sharp rebound in India equities over the last two years has pushed its valuation premium to near levels last seen in 2019. “As the US bond yields have started to rise and recessions risks are rising too, some correction in the Indian equity market cannot be ruled out, in our view,” said Jitendra Gohil, Head of India Equity Research, Credit Suisse Wealth Management, India.

However, any sharp correction can be a good buying opportunity given India’s superior fundamentals and better growth potential compared to its peers, he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.