In the stock market paradigm, profitability is the sovereign criterion of the enterprise. Without profits, companies find it difficult to thrive and grow. Some investors think that the biggest companies make the biggest profits. But, that is not always true. For instance, Reliance Industries is the biggest listed company in terms of m-cap, but it is LIC (₹15,854 crore) which is the most profitable firm based on the latest quarterly profit. Here are 5 infographics that will give you a fresh perspective on the profit picture of India Inc.

The 20 most profitable listed companies are led by LIC, SBI, Reliance Industries, HDFC Bank and TCS. They have cumulatively made over ₹1.37 lakh crore in the July-September quarter of 2022. Interestingly, these companies alone account for more than 50 per cent of the total profit clocked by over 1,100 firms.

Profits are as much a reality as losses. Here are details about the companies that have made the biggest losses as per September-2022 quarter numbers. The 20 least profitable members of India Inc. are led by Vodafone Idea, HPCL, RComm., MRPL, Interglobe Aviation, who have cumulatively amassed over ₹24,750 crore losses in this quarter.

We looked at the September 2022 quarter earnings of the BSE AllCap index to gauge the profitability of companies. Take a look at the profit-loss ratio. Notice how, barring one quarter i.e. June 2020, over 80 per cent of firms remained consistently profitable over the past two years.

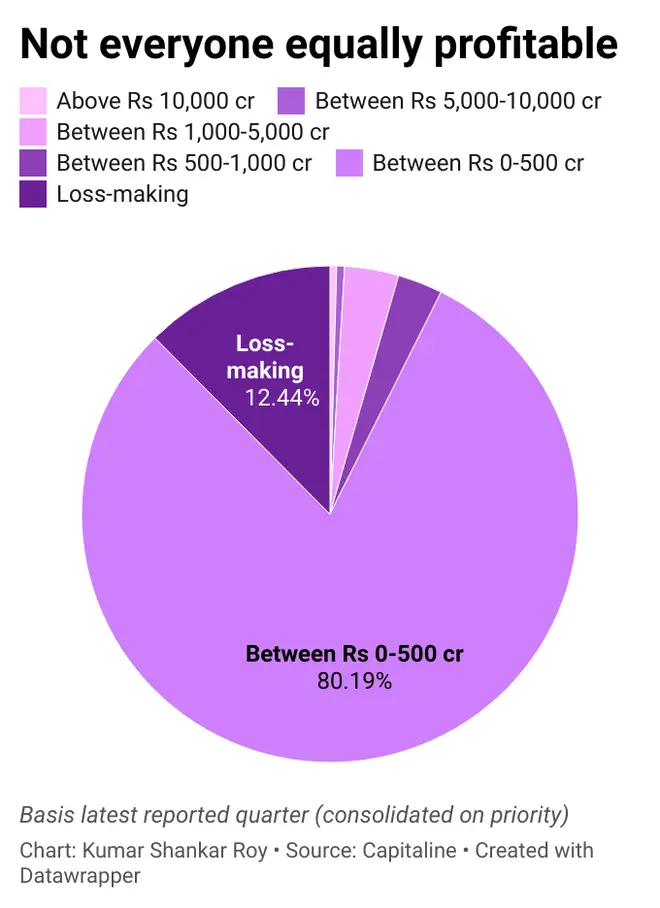

While the Indian market has grown by leaps and bounds, quarterly profits have not reach a huge scale. For instance, there are only 3 dozen firms (about 3 per cent of the total) that make ₹500-1,000 crore profit in 3 months. Take a look below at how profits (as per latest quarter) are distributed in different bands.

Over 80 per cent of companies fall in the ₹0-500 crore quarterly profit bracket. There are only handful of firms (less than 0.5 per cent) that posted over ₹10,000 crore quarterly profit.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.